Spot Bitcoin ETF Approval Has Not Yet Happened Yet, But Bitcoin Price Is Falling Sharply

Key Points:

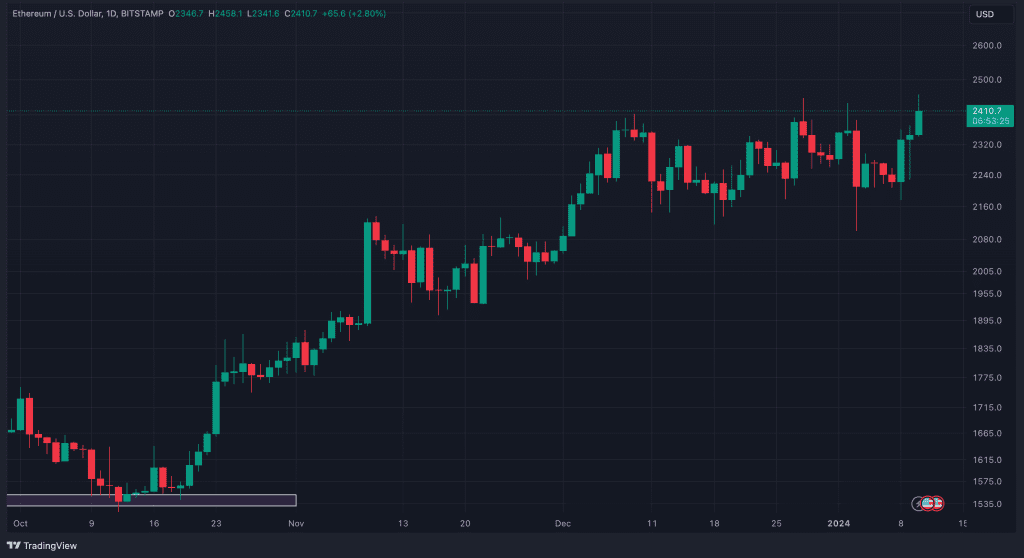

- While Bitcoin dips, Ether rises by 6.5% to $2,410, hitting a high since May 2022 at $2,456.

- Spot Bitcoin ETF approval anticipation with analysts predicts a positive decision today between 4-6 p.m. EST, despite earlier confusion.

In a turbulent turn of events, the cryptocurrency market experienced a rollercoaster ride as investors eagerly awaited the official spot Bitcoin ETF approval by the U.S. Securities and Exchange Commission (SEC).

Spot Bitcoin ETF Approval Hasn’t Happened Yet But Ether Price Is Increasing Stronger Than Bitcoin

On January 9, excitement initially soared when the official SEC X account “falsely” declared the spot Bitcoin ETF approval, causing Bitcoin’s price to surge to $47,900. However, the celebration was short-lived as uncertainty and confusion ensued, leading to a rapid drop to $45,400 within five minutes.

The aftermath of the false announcement manifested in Bitcoin’s more than 3% decline on Wednesday, settling at $45,309, according to CoinMarketCap. Conversely, Ether (ETH) defied the trend, experiencing a 6.5% increase to $2,410, reaching its highest level since May 2022 at $2,456.

Senior ETF Analyst at Bloomberg, Eric Balchunas, anticipating the official announcement, predicted a positive outcome for the spot Bitcoin ETF later in the day, with expectations set between 4-6 p.m. EST. Despite the market’s readiness for potential spot Bitcoin ETF approval, the earlier misinformation from the SEC’s X account may temper the response.

The SEC is set to decide on Wednesday regarding the spot Bitcoin ETF application from asset managers Ark Investments and 21Shares. Notably, numerous other applications from major players such as BlackRock, Fidelity, and VanEck are pending with the SEC, awaiting their verdict on this groundbreaking financial instrument.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |