Key Points:

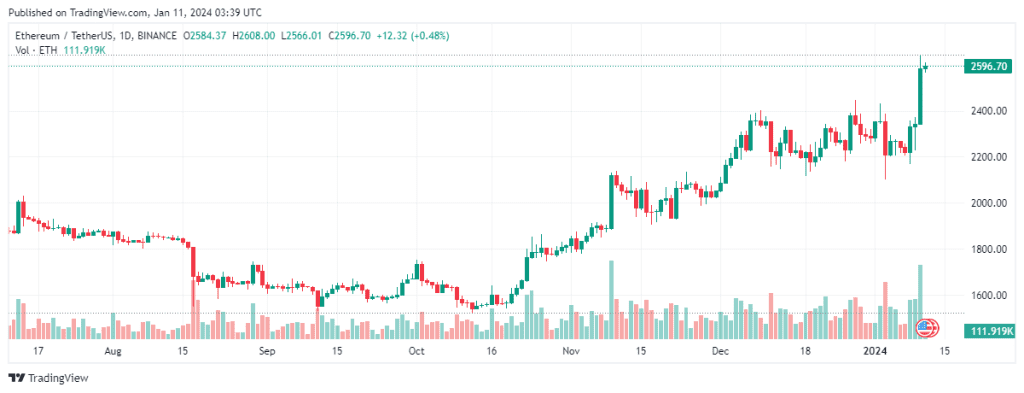

- Ethereum surges over 13.6% as investors anticipate a potential ETF launch.

- Other tokens, such as Lido’s LDO and RocketPool’s RPL, gained as much as 20% before retreating.

Wall Street Eyes Ethereum as it surges 13.6% amid anticipation of a potential Spot ETF launch. Bitcoin experiences volatility due to fake tweets. Other tokens also gain.

The surge in Ether (ETH) and native tokens of applications built on Ethereum comes as traders bet on the likelihood of a proposed ether exchange-traded fund (ETF) following the expected approval of a bitcoin ETF in the U.S.

In the past 24 hours, Ethereum has experienced a surge of over 13.6% and reached over $2,600 before trading at $2,596 as of this writing.

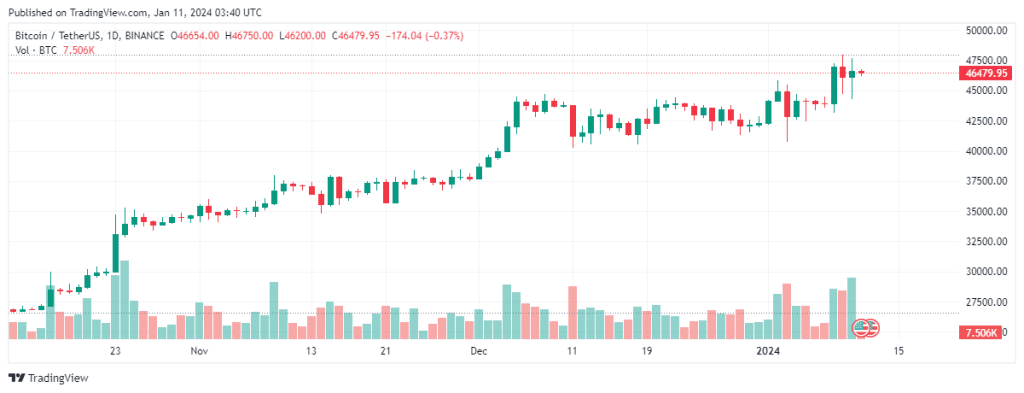

Meanwhile, Bitcoin experienced a 2% decrease due to a series of fake tweets from the temporarily hacked U.S. Securities and Exchange Commission’s X account, causing significant volatility in bitcoin trading.

BlackRock has previously filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) for its iShares Ethereum Trust, which is a spot ether exchange-traded fund (ETF).

Readmore: Ethereum Validator Exodus Soars to Record 16,000, Linked to Celsius Staking Reshuffle

Wall Street Eyes Ethereum, Spot ETF Buzz Sends ETH on Tear

Other tokens, such as Lido’s LDO and RocketPool’s RPL, gained as much as 20% before retreating. These protocols allow users to stake ether on their platforms and earn around 5% in annualized staking rewards.

In addition, tokens of layer 2 networks like Mantle’s MNT and Optimism’s OP also experienced gains of up to 10%.

These networks are built on top of Ethereum but operate as independent blockchains, enabling users to transact cheaply and much faster than the main blockchain. However, market observers caution that an ether ETF is still more of a probability than a possibility as of Wednesday.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |