Market Overview (Jan 8–Jan 14): SEC Approved Bitcoin ETF to Revolutionize Crypto

Key Points

- The SEC has approved several Bitcoin ETFs, marking a significant step for cryptocurrency in mainstream finance and opening the door for more institutional and retail investors.

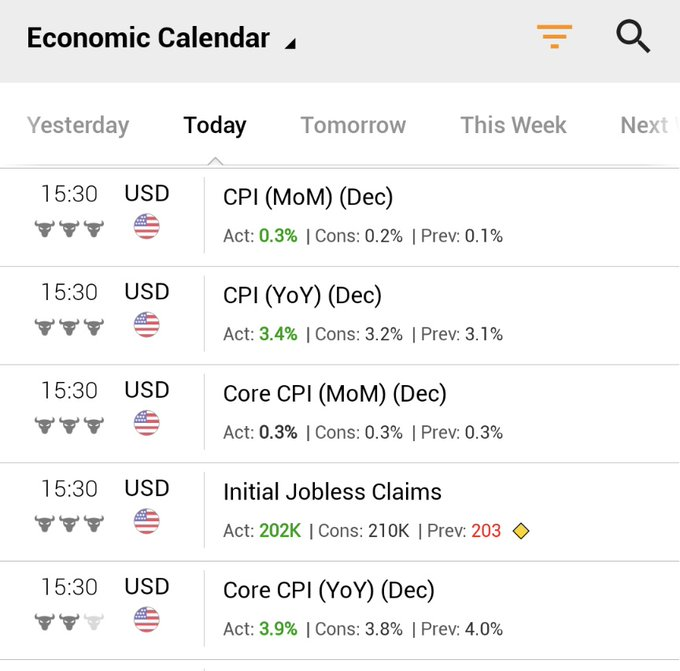

- The Consumer Price Index (CPI) has increased by 3.4%, surpassing the estimated 3.2%, indicating economic changes.

- The SEC’s approval of all Bitcoin ETFs and consideration of Ethereum ETFs signals a potential major shift in the cryptocurrency market.

Discover cryptocurrency’s significance with Bitcoin ETF approval, economic updates, and crypto market forecasts.

Last week’s highlights big news (Jan 8–Jan 14)

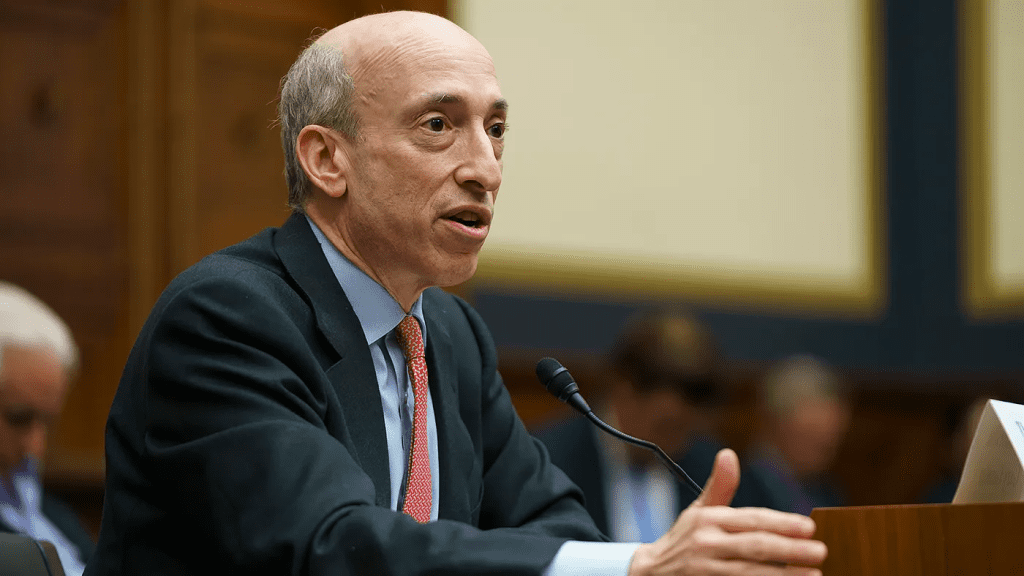

In a historic development, the Securities and Exchange Commission (SEC) has approved several Bitcoin exchange-traded funds (ETFs), marking a significant step forward in integrating cryptocurrency into mainstream finance.

The approved ETFs are those from industry heavyweights such as VanEck, Bitwise, Fidelity, Franklin, Valkyrie, Hashdex, Ark Invest, Grayscale, BlackRock, WisdomTree, and Invesco Galaxy. This decision by the SEC has opened up the floodgates for institutional and retail investors to gain exposure to Bitcoin in a regulated manner.

SEC Chairman Gary Gensler stated: “Although we approved the listing and trading of some Bitcoin ETF shares today, we did not approve or endorse Bitcoin.” This highlights the SEC’s stance on the asset itself, reinforcing that the approval of the ETFs does not equate to an endorsement of the cryptocurrency.

This development follows Standard Chartered Bank’s estimate that about 50–100 billion USD will be invested in Bitcoin Spot ETFs this year. This investment could potentially pave the way for Bitcoin to reach 200K USD by 2025.

In related news, Upbit Exchange has been officially granted a full license in Singapore, strengthening its position in the Asian market. Meanwhile, major crypto exchanges like Binance, Kraken, and Kucoin have been removed from the Indian App Store, raising questions about the future of cryptocurrency in India.

In an effort to expand its global reach, Coinbase has partnered with an African stablecoin exchange, Yellow Card. This partnership aims to increase product accessibility across 20 African countries, marking a significant step in bringing crypto services to underserved markets.

Finally, Ouroboros Research reports that on the first day of trading, the newly approved Bitcoin ETFs, excluding GBTC, already held 3200 BTC. This illustrates the strong demand for these products and suggests a promising future for Bitcoin ETFs.

Read More: Bitcoin Price Prediction For 2024, 2025, 2026 and 2030: Super Crypto Bull Run

Macroeconomics (Jan 8–Jan 14)

This month’s Consumer Price Index (CPI) has shown an increase of 3.4% from last month’s figure of 3.1%, surpassing the estimated 3.2%. Meanwhile, the Core CPI, which excludes volatile items such as food and energy, is at 3.9%, slightly higher than the estimate of 3.8% but down from last month’s 4.0%.

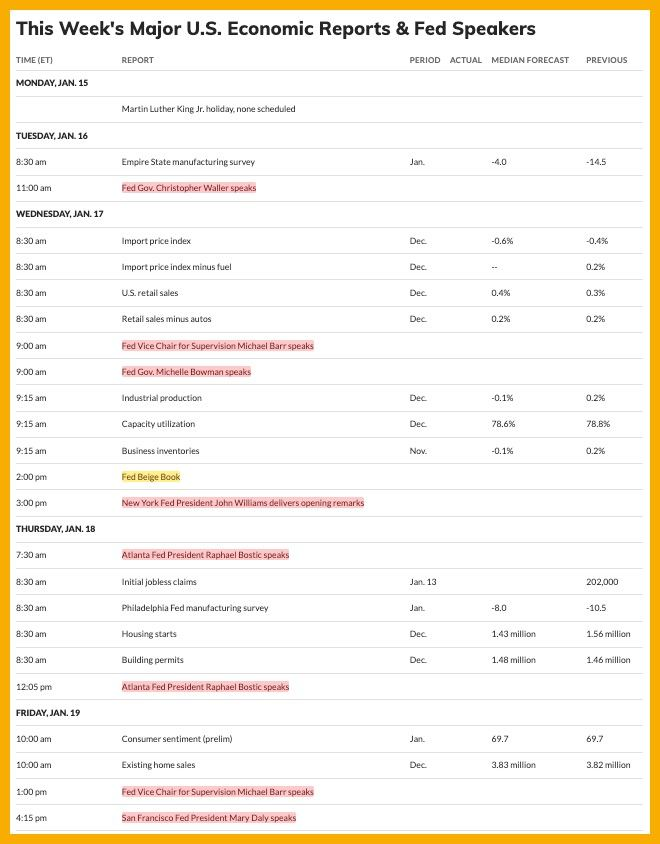

In policy, Federal Reserve Governor Michelle Bowman, known for her strong support of tight monetary policy, softened her stance recently. On January 9, she suggested that the cycle of interest rate hikes might have come to an end. However, she isn’t ready to start discussions about cutting the interest rate yet.

This week promises to be eventful, with several FED officials slated to make statements. These discussions could provide critical insights into future monetary policy and the state of the economy.

Additionally, the Federal Reserve will share its ‘Fed Beige Book’, a report providing statistical information about the current economic situation. This can offer valuable insights into economic trends and potential shifts in monetary policy.

Read More: Ethereum Price Prediction For 2024, 2025, 2026 and 2030: Super Crypto Bull Run

Prediction Market Crypto (Jan 8–Jan 14)

In the history of ETFs, we’ve witnessed the impact of exchange-traded funds (ETFs) on various commodities. One of the most notable examples is the Gold ETF Spot, approved on November 18, 2004.

The approval significantly changed the way investors interacted with gold. Prior to entering its super-growth phase, gold prices remained relatively stable throughout 2005.

This historical precedent could hint at what’s to come for Bitcoin. After its recent ETF approval and halving, the cryptocurrency market braces for potentially dramatic changes. The Securities and Exchange Commission (SEC) has approved all Bitcoin ETFs and is now considering the approval of Ethereum ETFs.

Investors should monitor several projects as Ethereum ETFs potentially follow Bitcoin’s path. These include $ARB, $OP, $LDO, $RSTK, $SSV, $FXS, $PENDLE, $LBR, $OGV, $SNX, $ENS, $PEPE, $MKR, and $BLUR. These projects and the possible approval of Ethereum ETFs could signify a major shift in the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |