Key Points:

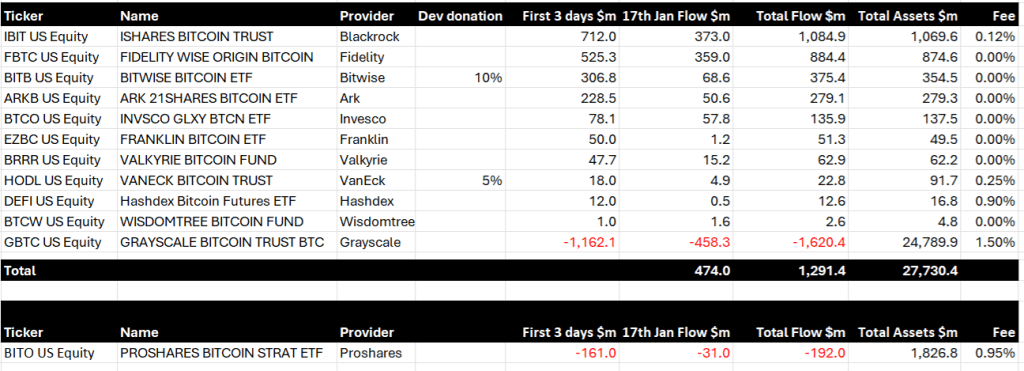

- GBTC records a massive $458M net outflow in one day, totaling $1.62B.

- Spot BTC ETFs see a surge with $474M net inflow on the fourth day, totaling $1.29B.

BitMEX Research witnessed dramatic financial movements as the Grayscale Bitcoin Trust (GBTC losses) faced a substantial net outflow of US$458 million on the fourth day alone.

This staggering figure contributed to a cumulative net outflow of a whopping US$1.62 billion.

The spot Bitcoin Exchange-Traded Fund (ETF) group experienced a remarkable surge in net inflows, with $474 million pouring in on the fourth day alone. Over the span of four days, the net inflows for the spot BTC ETFs reached an impressive total of $1.29 billion.

The divergence between GBTC and spot BTC ETFs highlights a dynamic shift in investor sentiment and preferences within the cryptocurrency market. Investors seem to be reevaluating their strategies, favoring the flexibility and advantages offered by spot BTC ETFs over traditional investment vehicles like GBTC.

GBTC Losses, ETF Gains!

BitMEX Research’s findings suggest a broader trend of capital reallocation within the cryptocurrency investment space. The significant outflows from GBTC and the concurrent inflows into spot BTC ETFs indicate a potential repositioning of assets as investors navigate the evolving landscape of digital assets.

The observed net outflow from GBTC raises questions about the trust’s continued appeal, while the substantial inflows into spot BTC ETFs underscore a growing confidence in this alternative investment avenue. As the cryptocurrency market continues to mature, such shifts in capital flows provide valuable insights into investor behavior and the evolving dynamics of the digital asset ecosystem.

The BitMEX Research report serves as a crucial resource for market participants, offering a comprehensive understanding of the recent trends shaping the cryptocurrency investment landscape. As investors seek to optimize their portfolios in the ever-changing crypto market, staying informed about these shifts becomes increasingly vital.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |