Key Points:

- BlackRock’s Bitcoin ETF surpassed $1 billion in investor inflows, leading among the new cryptocurrency-holding ETFs.

- A considerable portion of these inflows comes from investors leaving Grayscale Investment’s GBTC fund, which saw about $1.6 billion in outflows.

According to BBG, BlackRock’s Bitcoin ETF surpassed $1B in inflows, the first among new crypto ETFs. Many investors are leaving Grayscale’s GBTC fund.

BlackRock Inc.’s Bitcoin exchange-traded fund (ETF) passed $1 billion in investor inflows, becoming the first among nine new direct cryptocurrency-holding ETFs to reach this milestone since trading began last week.

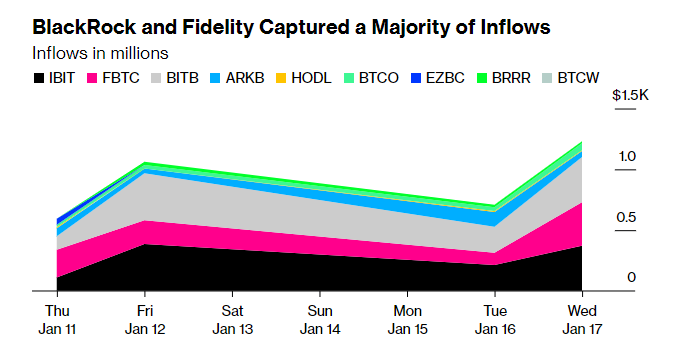

The fund received $371 million in deposits on Wednesday, pushing it past this notable mark. BlackRock and Fidelity Investments, another significant player, have led early consolidation in this new asset category, jointly receiving 68% of all inflows across the new ETFs on the market, totaling nearly $2 billion.

Readmore: BlackRock Officially Files Spot Ethereum ETF With Nasdaq, ETH Exceeds $2,100 Mark

BlackRock’s Bitcoin ETF Surpasses $1 Billion Mark, Fidelity Follows Close Behind

A significant portion of these inflows is coming from investors leaving Grayscale Investment’s GBTC fund, following the U.S. Securities and Exchange Commission’s approval of the ETFs.

Grayscale’s Bitcoin Trust had over $28 billion in assets under management when it converted to an ETF but has since seen about $1.6 billion in outflows.

Despite having management fees higher than some competitors, BlackRock and Fidelity may capture more market share due to their extensive institutional and retail distribution networks.

BlackRock is not only attracting “day one” retail investors but is also focused on winning over investors new to this asset class.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |