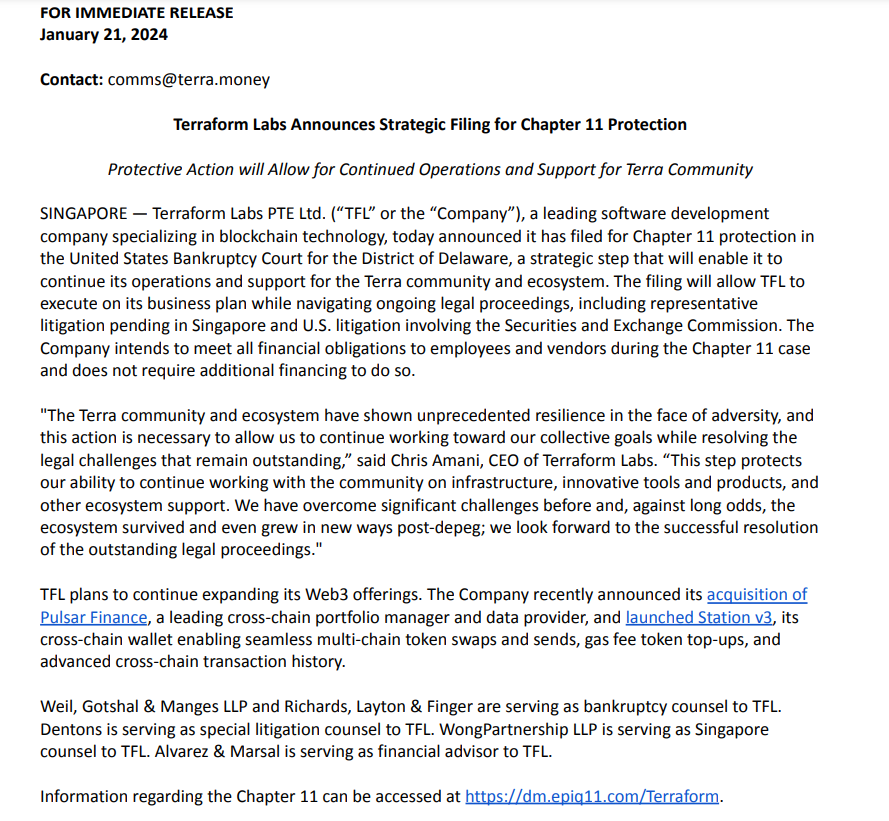

Key Points:

- Files for Chapter 11 amidst SEC proceedings, assets and liabilities $100-500 million.

- Remains fully operational, commits to meeting financial obligations sans additional financing.

Terraform Labs bankruptcy has officially filed for Chapter 11 bankruptcy protection amidst ongoing litigation and U.S. proceedings involving the SEC.

Despite this legal development, the company asserts its commitment to remaining fully operational.

Terraform Labs, commonly known as TFL, aims to navigate the legal challenges while ensuring stability in its operations. The company, known for its contributions to the Web3 space, emphasizes its dedication to meeting all financial obligations to employees and vendors during the Chapter 11 bankruptcy case. Notably, TFL assures stakeholders that it does not require additional financing to fulfill these commitments.

Amidst the legal proceedings, Terraform Labs remains resolute in its ambitious plans for expansion. The company is set to continue developing its Web3 products, affirming its commitment to innovation in the decentralized space. Additionally, TFL is steadfast in completing the acquisition of Pulsar Finance, a move that aligns with its strategic growth objectives.

Terraform Labs’ Strategic Moves Beyond Chapter 11 Challenges!

Furthermore, TFL enthusiasts can anticipate the launch of the much-anticipated cross-chain wallet, Station v3. This innovative wallet is expected to enhance user experiences in managing various digital assets across different blockchain networks. Additionally, Terraform Labs plans to introduce an Enterprise Protocol cross-chain staking upgrade, further bolstering its presence in the evolving blockchain landscape.

The filing for Chapter 11 bankruptcy protection comes with reported assets and liabilities ranging from $100 million to $500 million, reflecting a comprehensive evaluation of the company’s financial standing.

Terraform Labs’ proactive approach in addressing legal challenges, coupled with its commitment to operational stability and strategic growth initiatives, positions the company to navigate the complexities of the current regulatory landscape. This development signifies a pivotal moment for TFL, as it strives to maintain its leadership in the Web3 ecosystem and emerge stronger from the legal proceedings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |