Key Points:

- Crypto exchange OKX faced an OKB price incident on January 23 due to a market decline.

- OKX assures full compensation for user losses resulting from abnormal liquidation, with a detailed plan to be announced within 72 hours.

OKX, a prominent cryptocurrency exchange, experienced an OKB price incident as a result of a significant decline in overall market prices on January 23.

Read more: OKX Review: Really Outstanding Cryptocurrency Exchange

OKX Faces OKB Price Incident: Liquidations and Compensation Assurance

The downward trend triggered the liquidation of multiple large leverage positions, leading to a cascading effect on staked lending, margin trading, and cross-currency transactions. In response, OKX has assured users of full compensation for additional losses stemming from abnormal liquidation, with a detailed compensation plan to be disclosed within 72 hours.

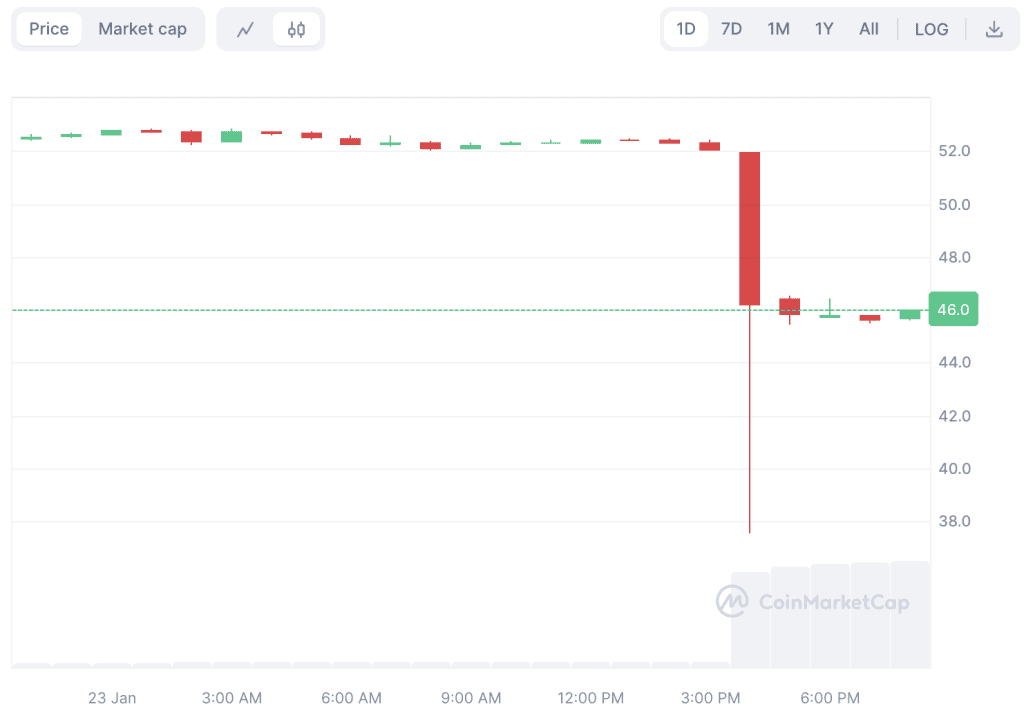

The OKB price incident, marked by the token prices fluctuating alongside the market downturn, saw the cryptocurrency hit $48.36 at 17:07:26 (HKT). This triggered liquidations, causing a rapid drop to $25.1. Despite the turmoil, the currency price has since stabilized and returned to normal levels.

Spot On Chain, a blockchain analytics platform, brought attention to a potentially suspicious event preceding the market turmoil. Approximately a week before the OKB price incident, 176,154 OKB (equivalent to over $8 million) was deposited to OKX from 10 previously dormant crypto addresses. Spot On Chain noted the timing as “suspicious,” suggesting a connection between the deposits and the subsequent price drop, although the exact link remains uncertain.

Launched in 2018, OKB, the native token for OKX, serves as a utility asset within the exchange’s ecosystem, offering holders trading fee discounts and VIP privileges. As of the latest update, OKB is trading at $45.7, according to CoinMarketCap data.

OKX is actively addressing the situation, emphasizing a commitment to user compensation and announcing plans to optimize various aspects of its platform, including spot leverage gradient levels, pledged lending risk control rules, and liquidation mechanisms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |