Grayscale Bitcoin Trust Holdings Fell 15% In The Past 7 Days

Key Points:

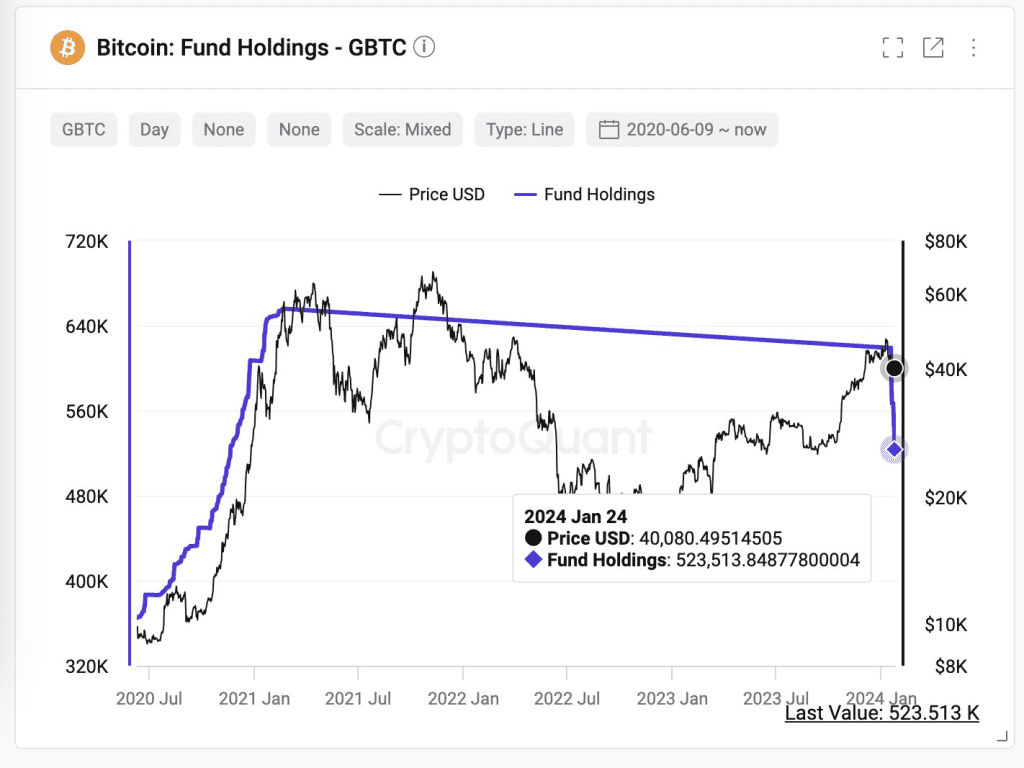

- CryptoQuant CEO predicts Grayscale Bitcoin Trust holdings could hit zero by mid-March, with a 15% decrease in the past week.

- BitMEX Research notes a hopeful sign as daily GBTC outflows slow to $429 million on Jan. 24, the smallest since the ETF launch on Jan. 11.

In a recent analysis posted on X, Ki Young Ju, CEO of CryptoQuant, highlighted a 15% decrease in Grayscale Bitcoin Trust (GBTC) holdings over the past seven days.

Read more: Grayscale Spot ETF: Basic Knowledge and Positive Future Outlook

Grayscale Bitcoin Trust Holdings Decline Sparks Concerns of Zero Balance by March

Expressing concern, Ju speculated that if this trend continues, Grayscale Bitcoin Trust holdings could hit zero by mid-March this year, raising questions about Grayscale‘s strategy regarding the reduction in GBTC holdings.

Contrary to the downward trend, there’s a glimmer of hope as outflows from Grayscale Bitcoin Trust holdings slowed for the second consecutive day. BitMEX Research reported a $429 million outflow on Jan. 24, the smallest since the launch of Grayscale’s spot Bitcoin ETF on Jan. 11, and a 33% decrease from the start of the week on Jan. 22.

The digital asset market witnessed a significant capital shift, with GBTC experiencing notable outflows of $429 million on day 9. Despite the decrease, the total outflows from GBTC have reached a staggering $4.4 billion, indicating an alarming trend in the market, as pointed out by analyst Eric Balchunas.

Balchunas, however, cautioned against prematurely concluding that the GBTC‘s downward trend is over, emphasizing that a slowdown in daily outflows does not necessarily signal a halt to the “bleeding.” He previously estimated that GBTC could lose approximately 25% of its outstanding shares before the outflows subside.

Adding complexity to the analysis, blockchain tracking firm Arkham Intelligence warned of a potential misinterpretation of GBTC transaction data. Arkham clarified that the outflow data for Grayscale Bitcoin Trust holdings shown on its platform is divided between Coinbase Prime and new GBTC custody addresses, indicating that not all BTC moved from Grayscale’s Bitcoin Trust is necessarily being redeemed.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |