Key Points:

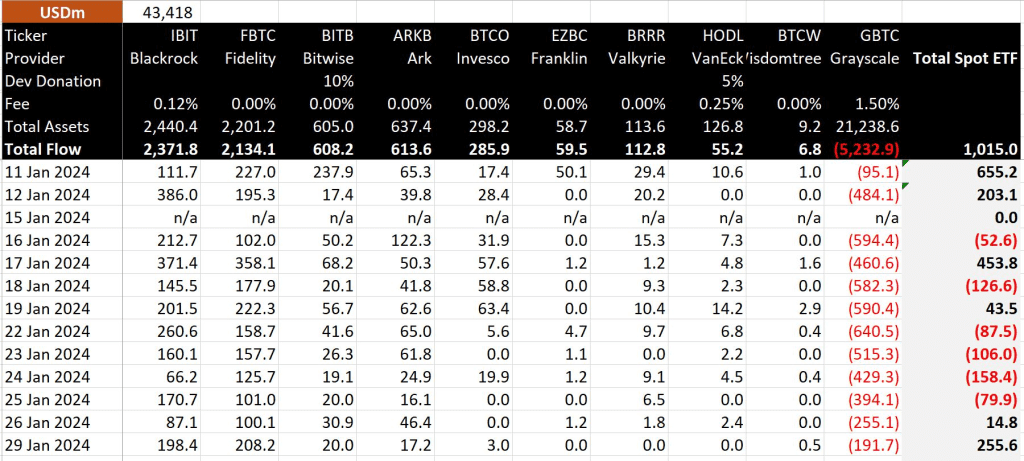

- BitMEX Research reports a substantial $255 million net inflow for U.S. Bitcoin spot ETFs.

- Positive indication of growing investor confidence in Bitcoin-related financial instruments.

- Highlights the accelerating integration of digital assets into mainstream investment portfolios.

BitMEX Research platform significant financial milestone for all U.S. Bitcoin ETFs has been unveiled.

On the 12th trading day since their inception, these investment vehicles witnessed a noteworthy net inflow of funds, totaling an impressive $255 million.

BitMEX Research, known for its comprehensive analysis and insights in the cryptocurrency space, highlighted the growing interest and confidence in U.S. Bitcoin spot ETFs. The substantial net inflow of funds within a relatively short period reflects a positive trend, indicating increased investor participation and trust in these financial instruments.

The $255 million influx further solidifies the position of Bitcoin spot ETFs in the mainstream financial landscape. Investors seem increasingly drawn to the potential benefits offered by these investment vehicles, including exposure to Bitcoin’s performance without directly owning the digital asset.

U.S. Bitcoin ETFs Surge with $255M Inflows

The report from BitMEX Research not only serves as a testament to the success of U.S. Bitcoin spot ETFs but also provides valuable insights for market observers and potential investors. The transparency and accuracy associated with BitMEX Research’s analyses contribute to its credibility within the cryptocurrency community.

As the cryptocurrency market continues to evolve and gain acceptance, the positive reception of U.S. Bitcoin spot ETFs signals a growing integration of digital assets into traditional investment portfolios. The $255 million net inflow serves as an indicator of the market’s receptiveness to Bitcoin-related financial products, setting the stage for further developments and opportunities in the evolving landscape of cryptocurrency investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |