Market Overview (Jan 29–Feb 5): Binance Labs Investment And FTX’s Surprising Leap

Key Points:

- Germany’s second-largest bank, DZ Bank, plans to pilot crypto trading, while crypto lending platform Celsius aims to repay $3 billion to victims.

- Binance Labs invested in Puffer Finance, an Ethereum restaking protocol, and the Federal Reserve is maintaining the interest rate at 5.25 – 5.5%.

- High Total Value Locked (TVL) in EigenLayer is benefiting Pendle, and Blur shows growth potential amid increasing NFT volume.

Catch up on last week’s crypto news. From Binance Labs investment to FTX’s refund pledge, and featuring key events, market predictions, and upcoming big unlocks in February.

Last week’s highlights big news (Jan 29–Feb 5)

Last week was particularly eventful in the crypto industry, with significant developments from various corners of the globe.

Germany’s second-largest bank, DZ Bank, announced plans to pilot crypto trading by the end of the year, marking another significant step for mainstream acceptance of cryptocurrencies.

In a surprising turn of events, FTX, the bankrupt crypto exchange, pledged to fully refund customers. The exchange discarded the initial plans of a reboot with FTX 2.0 after the FTT price dropped significantly.

The first Bitcoin ETF fund to diversify its storage is Valkyrie. It will store its Bitcoin through BitGo and Coinbase, leading players in the crypto custody space.

Celsius, a crypto lending platform, is set to repay $3 billion to victims through Paypal and Coinbase. The victims will recover about 26% of the lost crypto and acquire new shares in the crypto mining company Ionic Digital.

In the arena of blockchain technology, Polygon Labs announced a reduction of its workforce, letting go of 60 employees, which is approximately 19% of its total staff.

Genesis Lending reached a settlement with the SEC to end a civil lawsuit over alleged violations of securities rules through the Gemini Earn program.

In cybersecurity news, Singapore’s Cyber Security Agency and Police issued a warning about “crypto drainers,” a malware type that targets crypto wallets.

The Binance Inscriptions Marketplace is set to integrate an API from UniSat, a marketplace for ordinals and inscriptions. This integration allows users to access a deep liquidity market with over 60,000 BRC-20 tokens.

Spanish fintech firm Monei is testing the EURM stablecoin, backed by the euro, under the Central Bank of Spain’s supervision.

Lastly, Binance Labs, the startup investment and support branch of the crypto exchange Binance, announced an investment in Puffer Finance, a liquid Ethereum restaking protocol built on EigenLayer.

Readmore: Market Overview (Jan 22–Jan 28): Google Crypto Ads Approval And Avalanche’s Meme Coin Buy

Macroeconomics (Jan 29–Feb 5)

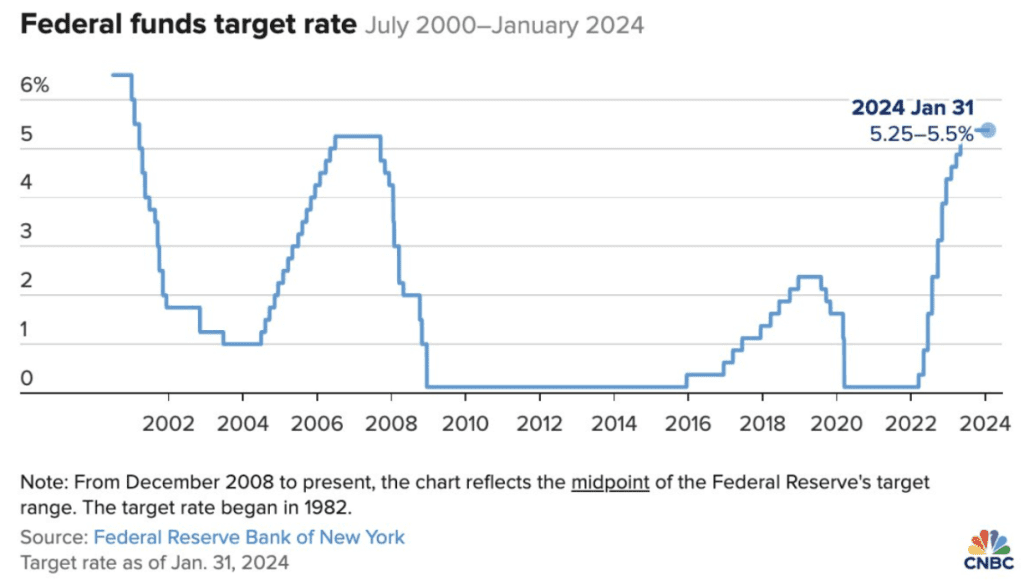

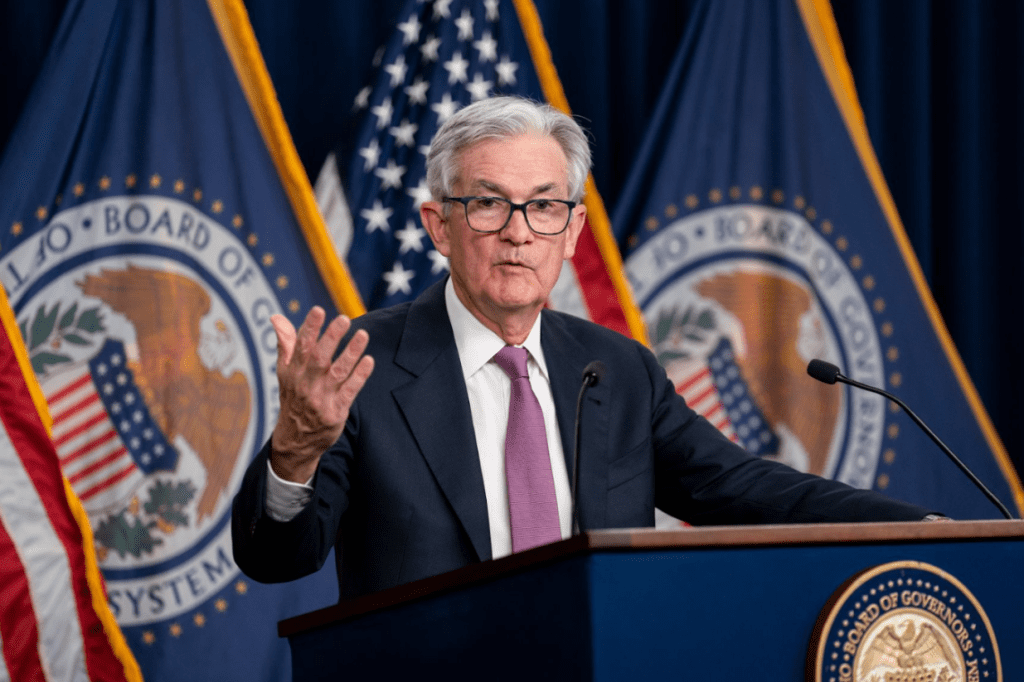

The Federal Reserve (FED) has announced to maintain the interest rate at 5.25 – 5.5%.

Summary of Chairman Powell’s press conference:

- 1. Economic Performance

- 2. Inflation Management

- 3. Interest Rate Enquiries

- 4. FED’s Bond Selling Strategy

The economy is performing well, with a low unemployment rate. While there are hopes for a soft landing, it is not guaranteed.

Powell expressed satisfaction and confidence with the management of inflation. However, he mentioned that more data is necessary for greater certainty.

On the subject of interest rates, Powell received numerous enquiries about a potential reduction.

Despite the various approaches and examples used by reporters, Powell only confirmed that rates would be lowered at some point this year, given that circumstances align with expectations.

However, he could not specify when and suggested that a reduction in March is highly unlikely.

The FED plans to discuss whether to continue selling bonds at the current rate during the March meeting. In the past year, they have sold more than 1.3 trillion USD worth of bonds.

The sale of bonds by the Treasury equates to money creation, while the FED selling bonds represents a tightening of the economy, or money collection.

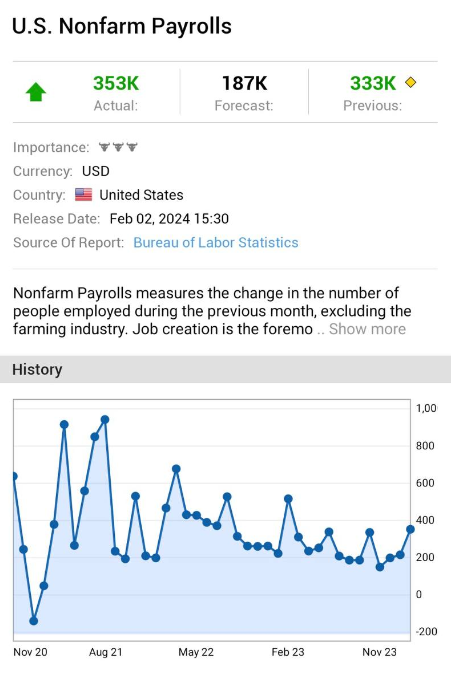

The US economy created 353,000 jobs in January, significantly surpassing the expectation of 187,000. The unemployment rate stands at 3.7%, lower than the expected 3.8%.

This marks 37 consecutive months of job creation in the US. Despite numerous companies laying off employees, the employment data remains strong. Nonetheless, many are anticipating a FED rate cut in March.

Readmore: Market Overview (Jan 15–Jan 21): Ethereum ETF Decision and Market Resilience

Upcoming Week’s Crypto Prediction Market

Some notable projects:

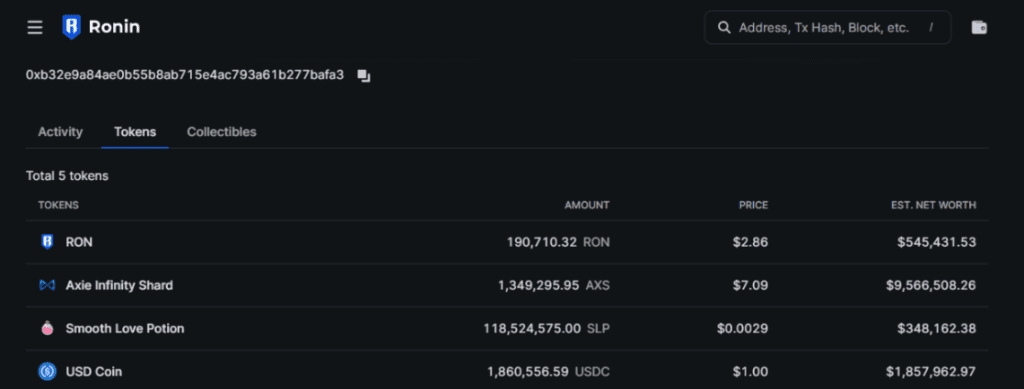

1. Ron

A recent Binance wallet address that previously held 700 Ron now holds 190k Ron. This suggests that Ron may be listed on Binance soon. Ron has repeatedly stated that blockchain games will lead the GameFi trend. You can view the wallet address here.

2. Pendle

Pendle is currently benefiting from the high Total Value Locked (TVL) of the EigenLayer project, which has officially surpassed 500M. To earn EigenLayer airdrop points quickly, one of the most effective methods is by joining the pool on Pendle.

3. Blur

Blur has potential for growth as the NFT volume is increasing and the market seems to be warming up. Additionally, if OpenSea merges with or is acquired by a traditional company, it could lead to further capital flow into this sector.

As a bonus, staking Blur will earn you Blast points. Blast’s upcoming mainnet on February 24 is attracting interest, despite it looking similar to a Ponzi scheme. It could result in a significant market explosion or a rug pull.

Upcoming big unlocks in February:

- $DYDX – $91M on February 1

- $SUI – $100M on February 3

- $NYM – $14M on February 3

- $GMT – $28M on February 9

- $CGPT – $9M on February 10

- $APT – $230M on February 12

- $SEI – $85M on February 15

- $MANTA – $51M on February 18

- $ROSE – $19M on February 18

- $ACE – $22M on February 18

- $IMX – $70M on February 23

- $ALT – $45M on February 25

- $AXL – $25M on February 27

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |