Key Points:

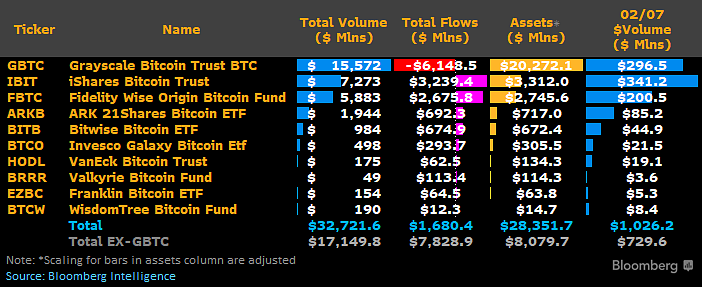

- Spot Bitcoin ETFs break records, surpassing $1 billion in daily trading volume. Signals growing mainstream interest in cryptocurrency investments.

- Surge in trading attributed to recent Bitcoin price movements, institutional interest, and broader acceptance. ETFs provide accessible entry into the crypto market.

- $1 billion trading volume underscores the evolving role of traditional financial instruments in the cryptocurrency ecosystem. Reflects the market’s increasing maturity and institutional adoption.

Spot Bitcoin ETFs experienced a historic milestone today, collectively trading over $1 billion in volume.

This unprecedented activity underscores the growing appetite for cryptocurrency investments and the increasing mainstream acceptance of Bitcoin.

Investors have shown a heightened interest in Spot Bitcoin ETFs, seeking exposure to the digital asset through the convenience and familiarity of traditional exchange-traded funds. The $1 billion trading volume signals a substantial influx of capital into these investment vehicles, highlighting the significant role they play in the broader cryptocurrency market.

Spot Bitcoin ETFs Surpass $1 Billion in Daily Trades

The surge in trading volume can be attributed to a combination of factors, including the recent price movements in the Bitcoin market, institutional interest, and a broader acceptance of cryptocurrencies as a legitimate asset class. Spot Bitcoin ETFs provide investors with a regulated and easily accessible avenue to participate in the crypto market without directly holding the digital asset.

This milestone comes at a time when the cryptocurrency market is witnessing increased institutional adoption and regulatory clarity. The approval and listing of Spot Bitcoin ETFs have paved the way for a more diverse set of investors to participate in the crypto space, contributing to the market’s maturation.

Spot Bitcoin ETFs Propel Cryptocurrency into New Territory

While the $1 billion trading volume is a testament to the current enthusiasm for Bitcoin ETFs, it also raises discussions about the evolving role of traditional financial instruments in the cryptocurrency ecosystem. The increased liquidity and trading activity could potentially attract more institutional players, further legitimizing Bitcoin as a viable investment option.

As the cryptocurrency market continues to evolve, the performance of Spot Bitcoin ETFs will remain closely watched, offering insights into the dynamics between traditional finance and the ever-expanding world of digital assets. Investors and market enthusiasts alike will be keenly observing how this milestone shapes the future trajectory of cryptocurrency adoption in mainstream financial markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |