Bitcoin Surges To $50K On Back Of ETF Boom, Bull Run Confirmed?

Key Points:

- Bitcoin’s price has surpassed $50,000 for the first time since 2021 due to slowed outflows from Bitcoin ETFs and interest from large investors.

- CoinShares reported net inflows of $1.1 billion last week, contributing to the rise in Bitcoin’s price.

Bitcoin Surges To $50K, first since 2021, attributed to large investor accumulation and renewed Wall Street interest.

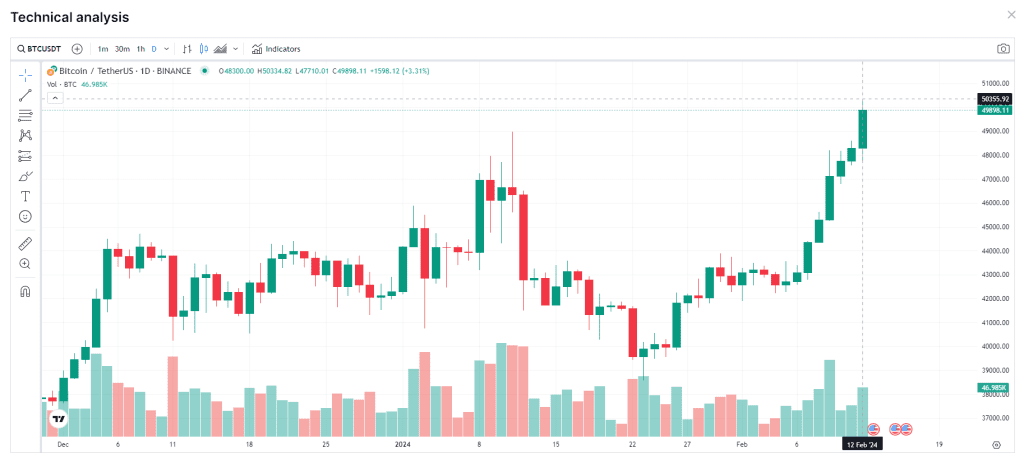

Bitcoin’s price has broken the $50,000 mark for the first time since 2021, entering a Fear of Missing Out (FOMO) stage. The surge follows slowed outflows from Bitcoin Exchange-Traded Funds (ETFs) that were approved in the US last month.

Bitcoin Surges To $50k! US ETF Inflows Fuel Historic Return

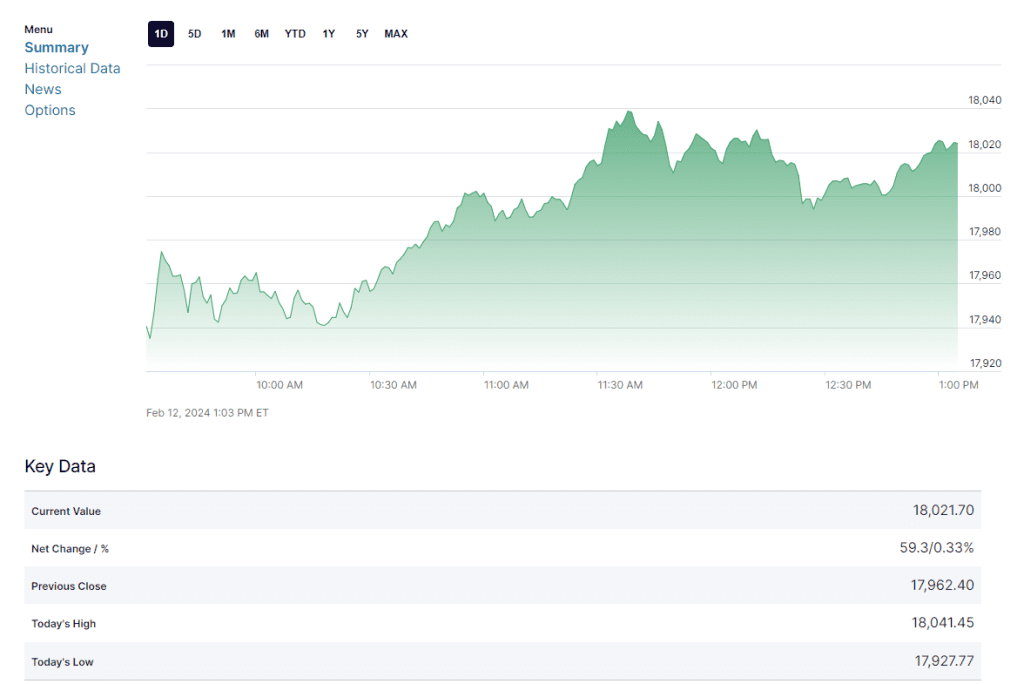

Analysts attribute BTC’s surge to large investors accumulating the cryptocurrency and a revived interest from Wall Street in the technology sector. The Nasdaq, which is technology-dense, has risen by 0.33% today; there was a previous significant correlation between BTC and stocks.

CoinShares reported net inflows of $1.1 billion last week and $2.8 billion since the funds launched. Despite initial attention on the billions leaving the high-fee Grayscale Bitcoin Trust (GBTC) and the price of Bitcoin falling to as low as $38,500, the recent weeks have seen slowing outflows from GBTC.

Readmore: MicroStrategy Bitcoin Investment Is Now At A $3.5 Billion Unrealized Profit

Bitcoin’s Slow Recovery and Positive Indications for Future

Meanwhile, substantial inflows have continued into the new ETFs. As of writing, the global cryptocurrency market capitalization is at $1.87 trillion.

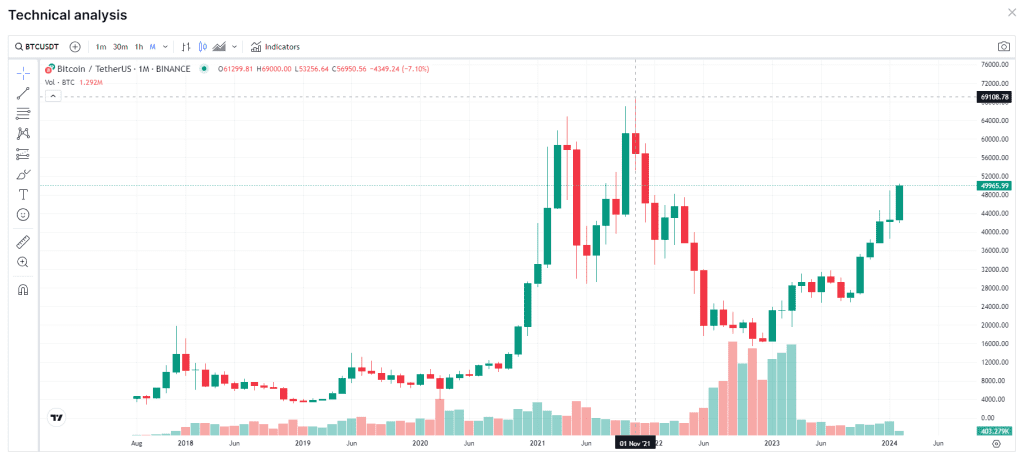

Bitcoin closed 2022 at just above $16,000, a significant drop from its all-time high of $69,106 back in 2021. However, despite a relatively slow recovery throughout much of 2023, the recent surge is a positive indicator for the cryptocurrency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |