Bitcoin Price Skyrockets Beyond $50k, Profits Soar for Investors!

Key Points:

- Spot ETF launch failed to breach $50,000; led to a 20% sell-off.

- Expert perspective from Antoni Trenchev, Nexo co-founder.

- Investors eye Bitcoin amid evolving regulatory landscape and macroeconomic factors.

Bitcoin price has reached the $50,000 milestone, marking its highest value in over two years.

The surge is attributed to anticipated interest rate cuts later in the year and the recent regulatory approval for U.S. exchange-traded funds (ETFs) designed to mirror its price.

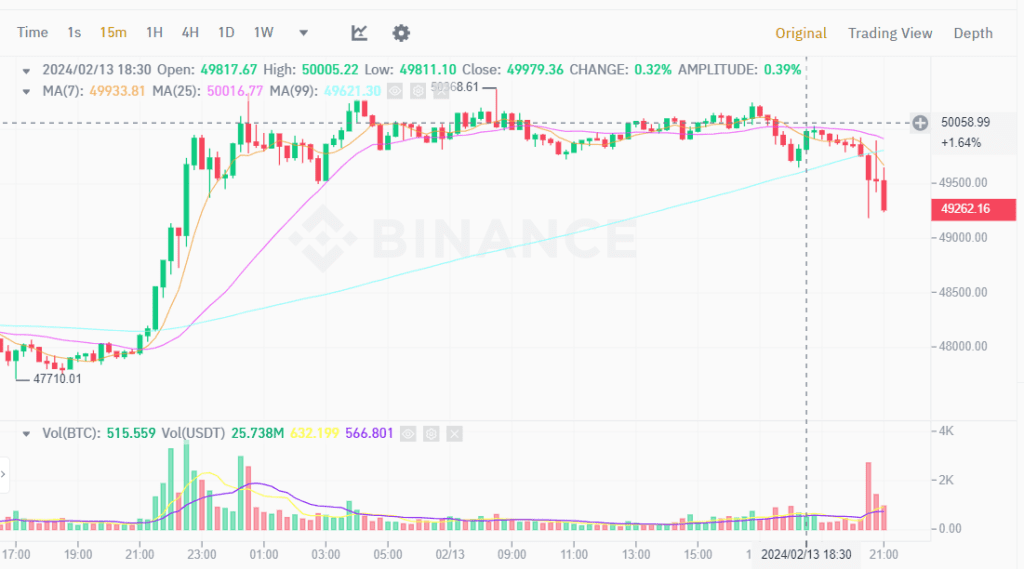

The world’s largest cryptocurrency has experienced a notable 16.3% increase since the beginning of the year. On Monday, it touched its highest point since December 27, 2021. As of 12:56 p.m. EST (1756 GMT), Bitcoin was trading at $49,899, reflecting a 4.96% gain for the day while consistently oscillating around the $50,000 level.

Bitcoin Rockets to $50K: 16.3% Surge in 2024!

The significance of this milestone is emphasized by Antoni Trenchev, co-founder of the crypto lending platform Nexo, who stated, “$50,000 is a significant milestone for Bitcoin price after the launch of spot ETFs last month not only failed to elicit a move above this key psychological level but led to a 20% sell-off.”

The market’s positive reaction to the approval of U.S. ETFs and the anticipation of upcoming interest rate cuts has propelled Bitcoin beyond the $50,000 threshold. Investors and enthusiasts are closely watching the cryptocurrency’s movements, given its historical volatility and the potential for substantial gains.

Bitcoin Price Peaks at $49,899, Investors Alert!

As the cryptocurrency landscape continues to evolve, with regulatory developments and macroeconomic factors playing a crucial role, Bitcoin price’s ascent to $50,000 underscores its resilience and attractiveness as a digital asset. Investors are navigating this dynamic environment, seeking opportunities to capitalize on the ongoing momentum and market sentiment surrounding Bitcoin.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |