Key Points:

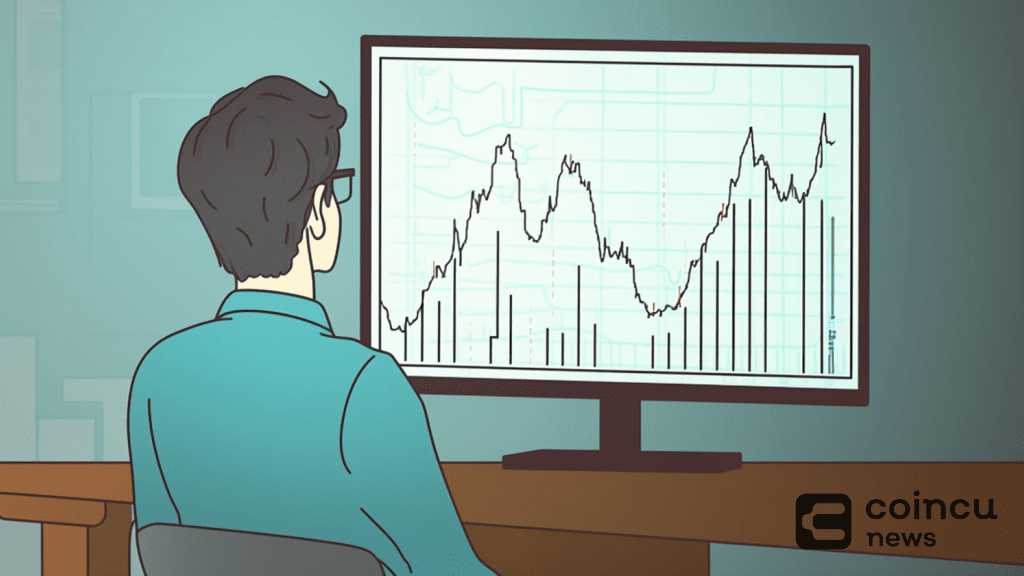

- The Crypto Fear and Greed Index hits 79, indicating extreme greed akin to the 2021 peak.

- Bitcoin has doubled in value over the past year, despite intermittent dips.

The Crypto Fear and Greed Index, a gauge of market sentiment for cryptocurrencies like Bitcoin, has surged to 79 out of 100, marking a phase of “extreme greed” among traders.

Crypto and Greed Index Hits 79: Market Greed Surges

This level echoes November 2021’s peak, when Bitcoin soared to its record of $69,000. Such exuberance often precedes market corrections, as excessive greed tends to signal overheated conditions.

Despite occasional dips, the Crypto Fear and Greed Index has hovered above the “greed” threshold since October 2021, only briefly hitting 50 in January after the green light for spot Bitcoin ETFs. Nonetheless, Bitcoin’s value has more than doubled over the past year, touching over $50,000 recently.

Compiled from various signals like Google Trends, surveys, and market indicators, the Crypto Fear and Greed Index reflects 25% market volatility, 25% market momentum, and 15% social media trends, among others. Emotions like fear and greed strongly sway investor actions, with fear prompting widespread selling and greed driving frenzied buying, potentially inflating asset prices artificially.

Investor Sentiment Swings: Bitcoin Hits $49,000 Amid Greed Frenzy

In June 2022, during the UST stablecoin collapse, the Crypto Fear and Greed Index plummeted to a low of 9, reflecting extreme fear. Similarly, during FTX’s bankruptcy in November 2022, it ranged from 23 to 30 points.

Following a recovery to a neutral 52 by mid-October 2023, the Crypto Fear and Greed Index surged into the “greed” zone in November and December, anticipating spot Bitcoin ETF approvals. On January 9, 2024, after over two years, the crypto market sentiment hit “extreme greed.”

Meanwhile, Bitcoin‘s price has soared to $49,000, its highest since November 2021, underscoring the fervent market activity despite cautious warnings of potential corrections.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |