Key Points:

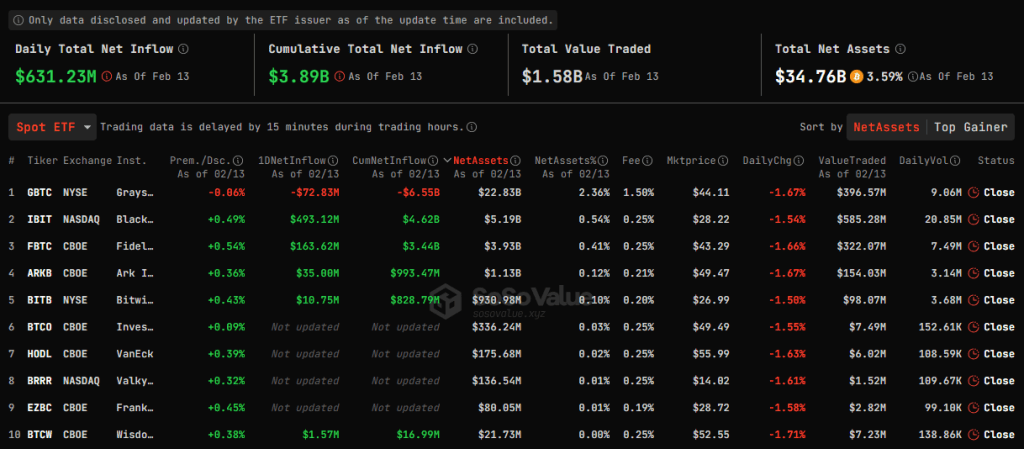

- Bitcoin ETFs saw a record net inflow of $631 million on February 13th, led by BlackRock’s ETF with a single-day inflow of $493 million.

- Despite outflows from Grayscale’s Bitcoin Trust, Bitcoin ETFs have accumulated over $11 billion, reducing selling pressure and signaling a bullish market.

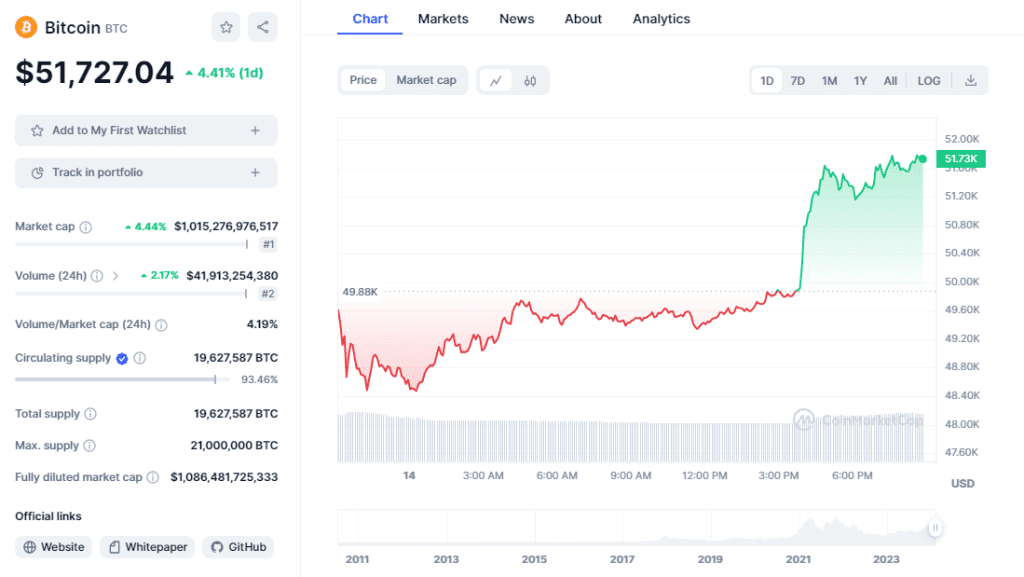

- Anticipating a surge to $64,000, Bitcoin’s price increased by 4% to exceed $51,700.

Bitcoin spot ETF inflows saw a record $631M on Feb 13, with a notable $493M to BlackRock’s IBIT. BTC price rose 4%, and may surge to $64,000 soon.

On February 13th, Bitcoin spot ETFs experienced a record-setting net inflow of $631 million, marking the thirteenth consecutive trading day of net inflows according to SoSoValue.

The Grayscale ETF GBTC contrastingly saw a net outflow of $72.83 million on the same day. Discounting Grayscale, the other nine ETFs received a combined net inflow of $704 million.

BlackRock Outperforms Bitcoin Spot ETF Inflows

Notably, the BlackRock ETF IBIT drew the highest single-day net inflow among the Bitcoin spot ETFs, amounting to $493 million, which represents 70% of the total daily inflow.

Despite outflows from Grayscale’s Bitcoin Trust (GBTC), the ETFs have amassed over $11 billion in Bitcoin. Analysts suggest that the easing outflows from GBTC are reducing selling pressure and encouraging a bullish market outlook.

As reported by Wu, Grayscale recently moved 294.6 BTC, equivalent to nearly US$15 million, to the Coinbase Prime Deposit address on February 14. Additionally, Grayscale shifted 2,582 BTC to a fresh address, which is believed to be their new custody address.

Readmore: Bitcoin Market Cap Hit $1 Trillion: Market Recovery Or Short-lived Rally?

Bitcoin Price Increases and Market Outlook Turns Bullish

The bitcoin price rose above $51,700, up 4% within 24 hours, some traders anticipate Bitcoin’s price to surge to $64,000 soon due to technical analysis and institutional buying demand.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |