Key Points:

- SEC Chair Gary Gensler voiced concerns about Bitcoin’s connection to illicit activities, despite the SEC’s approval of 11 Spot Bitcoin ETFs.

- Despite Gensler’s concerns, Bitcoin’s value has shown signs of recovery, rising by 6% in the last 24 hours to surpass $52,000.

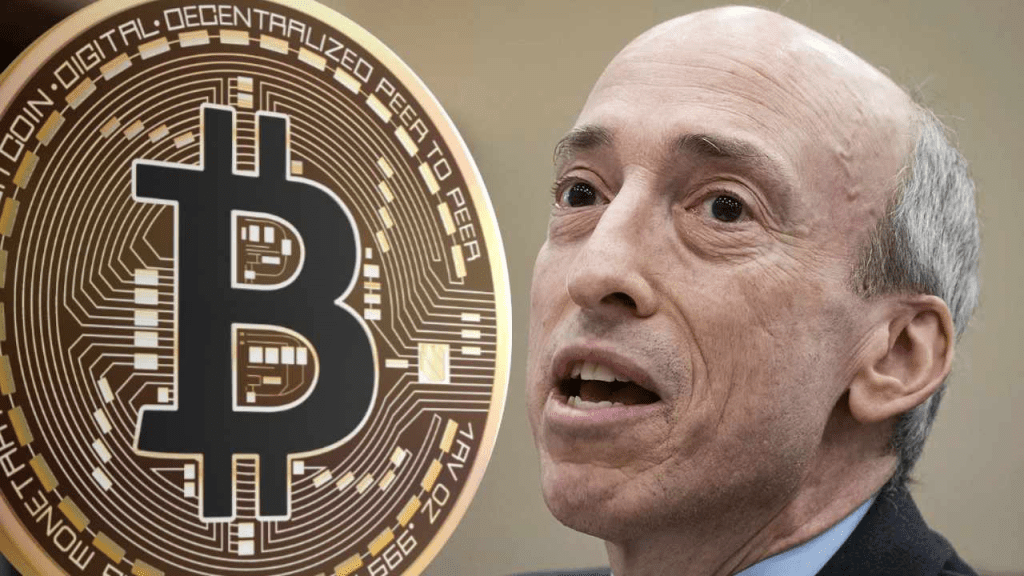

SEC Chair calls Bitcoin ransomware due to illicit activities, despite ETF approvals. Bitcoin value rises 6%, exceeds $52,000.

US Securities and Exchange Commission (SEC) Chair, Gary Gensler, in an interview with CNBC, voiced his concerns about Bitcoin, labeling it as the leading market share of ransomware.

SEC Chair Calls Bitcoin Ransomware Amid Market Rally

Despite the SEC approving 11 Spot Bitcoin ETFs earlier this year, Gensler continues to express disapproval of the cryptocurrency due to its connection to illicit activities.

He has established an enforcement-first approach to cryptocurrency regulation during his tenure, focusing on the industry’s illegal activities and maintaining concerns about Bitcoin’s volatility and potential risks to investors.

He further emphasized Bitcoin’s roles in illicit activities such as ransomware, money laundering, sanction evasions, and terrorist financing.

Readmore: Bitcoin Spot ETF Inflows Surge To Record $631 Million

Bitcoin’s Price Recovery Despite Regulatory Concerns

Despite these concerns, the SEC approved several Spot Bitcoin ETFs, leading to renewed institutional interest in the asset. However, Gensler maintains his position, stating that the approval of the investment products does not endorse Bitcoin as an asset.

Notwithstanding Gensler’s concerns, Bitcoin has shown signs of recovery, with its value rising by 6% in the last 24 hours, surpassing the $52,000 mark. Additionally, some traders anticipate Bitcoin’s price to surge to $64,000 soon due to technical analysis and institutional buying demand.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |