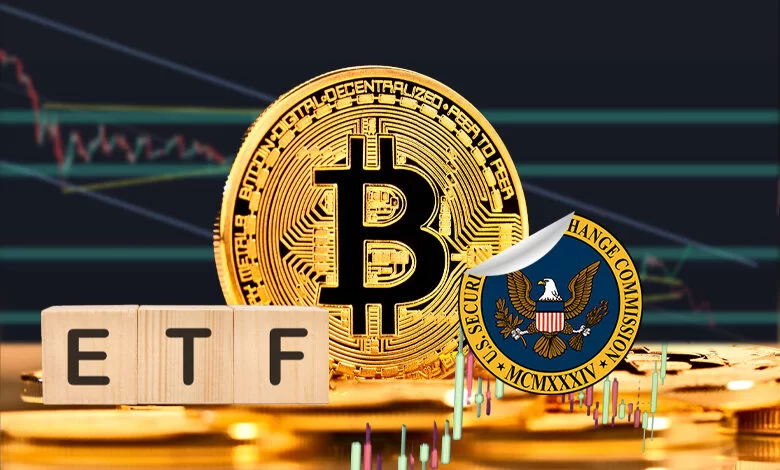

CryptoQuant Report: Bitcoin ETFs Dominate 75% of Fresh Investments, Surging Momentum!

Key Points:

- CryptoQuant analysis reveals over 75% of recent Bitcoin ETFs.

- Investment from these ETFs spikes to 2% of Bitcoin’s historical investment in just one month.

In a recent report by CryptoQuant, a prominent on-chain data analysis company, the landscape of Bitcoin ETFs investments is undergoing a notable shift.

According to their analysis, over the past two weeks, more than three-quarters of new Bitcoin investments have originated from Bitcoin ETFs, excluding Grayscale’s GBTC.

The report highlights a significant uptick in investment inflows through these Bitcoin ETFs, underlining a trend that signals a growing preference among investors. CryptoQuant’s findings reveal a striking statistic, stating, “We estimate that more than 75% of new investments in Bitcoin come from these ETFs.” This underscores the increasing significance of these investment vehicles in shaping the dynamics of the cryptocurrency market.

Spot ETFs Drive Bitcoin Investment Surge

Perhaps even more noteworthy is the rapid acceleration of investment from these ETFs within a concise timeframe. The report indicates that investment from Bitcoin spot ETFs has surged to constitute 2% of the total historical investment in Bitcoin in just one month. This measurement is based on realized market capitalization, providing insights into the evolving composition of Bitcoin’s investor base.

The data presented by CryptoQuant not only sheds light on the current dominance of Bitcoin spot ETFs in attracting new investments but also emphasizes their growing influence within the broader historical context of Bitcoin investment.

Rapid Rise of Bitcoin ETF Dominance Unveiled by CryptoQuant Analysis

The substantial increase in their share within a mere month underscores the dynamic nature of the cryptocurrency market and the adaptability of investors to new avenues of exposure.

As the cryptocurrency landscape continues to evolve, investors and industry observers are closely monitoring these trends, recognizing the impact of institutional investment vehicles on the market’s overall trajectory. The insights provided by CryptoQuant serve as a valuable resource for those navigating the complex and rapidly changing world of digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |