Key Points:

- Crypto money laundering activity significantly decreased in 2023, attributed to lower trading volumes.

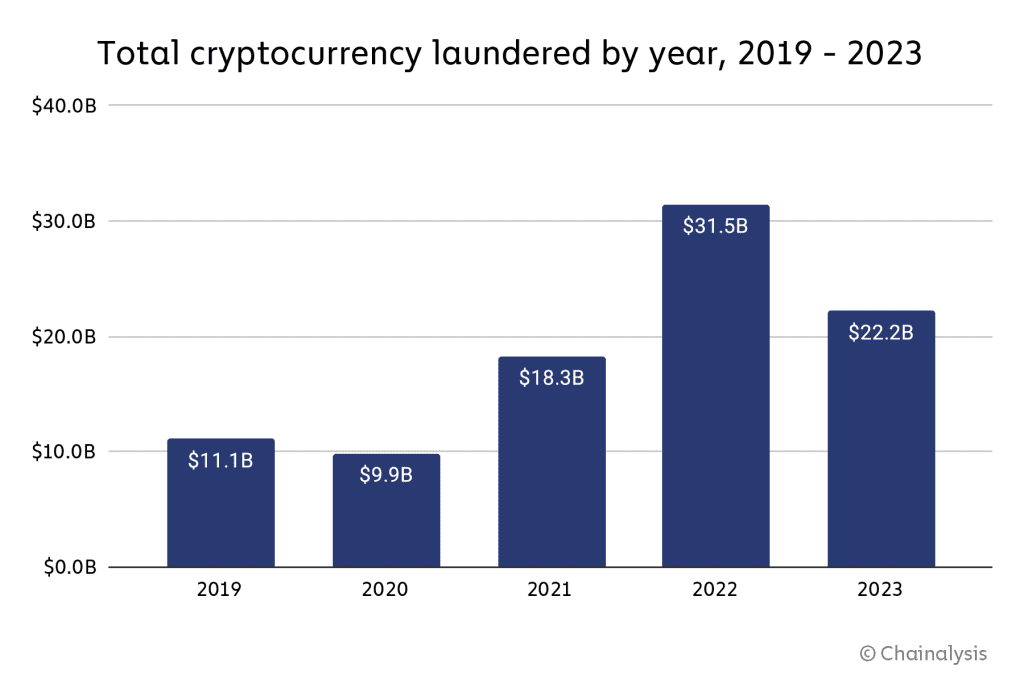

- $22.2 billion in cryptocurrency was sent from illicit addresses to various services in 2023, down from $31.5 billion in 2022.

In its annual report on crypto money laundering, blockchain analysis firm Chainalysis unveiled significant drops in illicit cryptocurrency activity in 2023.

Decline in Crypto Money Laundering: Chainalysis Report Highlights Trends

The decline, according to the report, can be attributed to lower crypto trading volumes and the emergence of sophisticated evasion techniques employed by threat actors.

Last year, illicit addresses were responsible for sending approximately $22.2 billion worth of cryptocurrency to various services, marking a noticeable decrease from the $31.5 billion recorded in 2022. This decline in crypto money laundering activity, which amounted to a 29.5% drop, outpaced the decrease in total transaction volume, which stood at 14.9%.

Centralized exchanges continue to serve as the primary destination for funds from illicit addresses, a trend that has remained relatively stable over the past five years. However, the share of illicit funds directed towards decentralized finance (DeFi) protocols has been on the rise.

A breakdown of service types used for crypto money laundering in 2023 reveals a slight decrease in the share of illicit funds directed towards illicit service types, alongside an increase in funds channeled into gambling services and bridge protocols.

Despite thousands of off-ramping services in operation, a handful of them concentrate the majority of illicit funds. In 2023, 71.7% of such funds were funneled into just five services, up from 68.7% in the previous year.

Lazarus Group and Evolving Tactics in Cryptocurrency Money Laundering

Chainalysis also noted the adaptability of threat actors, particularly the Lazarus Group, a North Korea-based entity, in adjusting their crypto money laundering strategies to evade detection.

The report underscores the importance of blockchain transparency in tracing illicit funds, citing instances where organizations like Hamas, designated as a terror group, have faced repercussions due to the visibility of their crypto transactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |