Bitcoin Surges to $52K Defying US PPI Dip as Fed Rate Cut Fears Ease!

Key Points:

- US Producer Price Index (US PPI) hits 0.9%, unsettling investors.

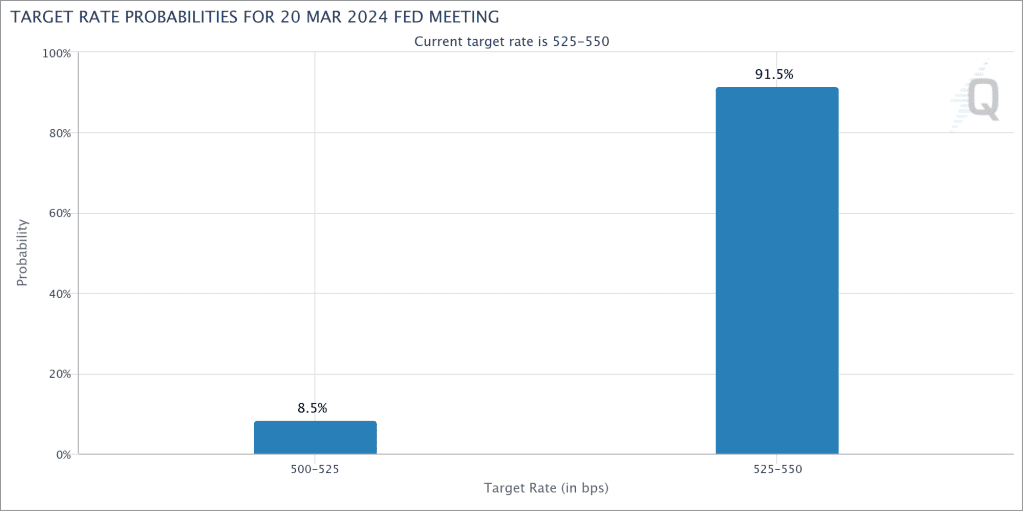

- March rate cut probability drops to 8.5% from 17.5%, post-PPI data.

- Hits $52,884, but faces resistance; market warns of potential fakeout.

In the aftermath of the recent Consumer Price Index (CPI) release, the United States grapples with heightened inflation concerns as the Producer Price Index (US PPI) numbers for January are unveiled.

The year-on-year US PPI stands at 0.9%, slightly lower than the previous month but exceeds market predictions by 0.3%.

This unexpected surge in inflation metrics, coupled with the preceding “hot” CPI data, has left financial markets wary of the Federal Reserve’s potential fiscal policy adjustments in the coming months. According to CME Group’s FedWatch Tool, the probability of an interest rate cut at the March meeting currently sits at a mere 8.5%, a drastic drop from the 17.5% forecast at the week’s outset.

PPI Hits 0.9%, Adding Pressure on Financial Markets

The Kobeissi Letter, a notable trading resource, asserts that the latest US PPI figures have effectively ruled out a March rate cut and cast doubt on the likelihood of a cut in May. This sentiment aligns with the broader market’s growing skepticism about the Federal Reserve’s role in curbing inflationary pressures.

Simultaneously, Bitcoin experienced a surge, reaching $52,884 on Bitstamp – its highest level since late November 2021. However, bullish momentum faced resistance from sellers. Market analysis by Skew, a popular trader, highlighted the significance of the 21-period exponential moving average (EMA) at approximately $51,000. The 4-hour timeframes depicted a volatile market, characterized by choppy price action and a series of inside bar closes within the same intraday balance.

Odds Plummet as March Rate Cut Hinges on Latest Economic Data

Skew suggested caution, noting the potential for a fakeout before a substantial and genuine market move, adding an element of uncertainty to the already complex financial landscape. As the crypto market navigates these dynamics, investors remain vigilant for signals that may impact the trajectory of both Bitcoin and broader financial markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |