Key Points:

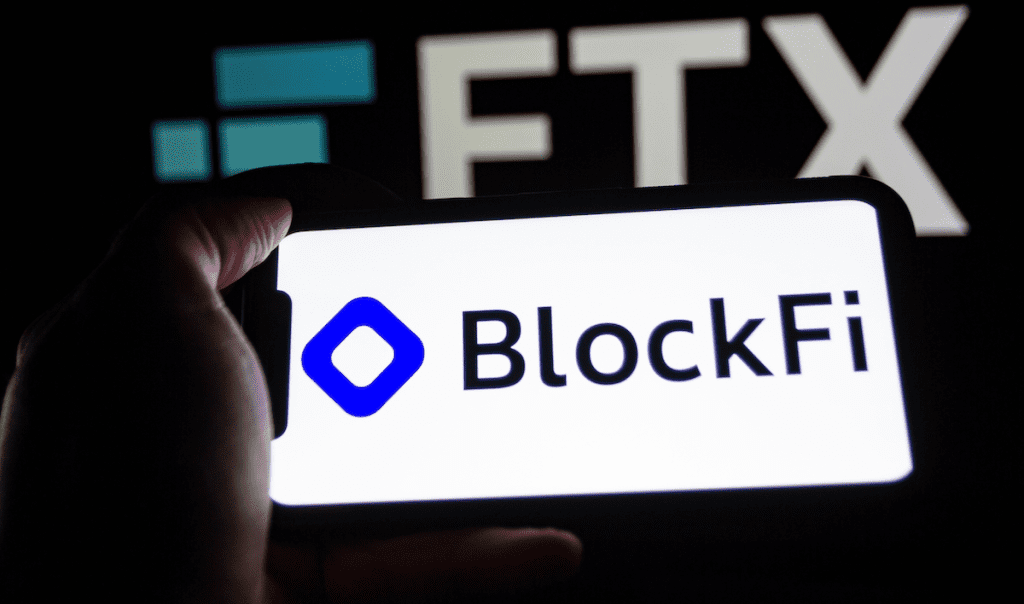

- A FTX settlement with BlockFi has now been agreed upon, with FTX agreeing to pay BlockFi up to $874 million.

- Priority $250 million payment to BlockFi; rest contingency on FTX’s repayment ability.

- FTX faces founder judgment; BlockFi drops lawsuit over seized assets.

Bankrupt crypto firms FTX and BlockFi have reached a settlement resolving disputes stemming from their 2022 collapses, as per court filings on Wednesday.

FTX Settlement With BlockFi: The Company Agrees to Pay BlockFi Up to $874 Million

FTX will pay BlockFi up to $874 million, subject to approval by U.S. Bankruptcy Judge John Dorsey in Delaware.

Under the FTX settlement with BlockFi, the crypto lender will receive $874.5 million in claims against FTX and Alameda Research. $250 million will be treated as a secured claim, prioritizing payment after FTX’s bankruptcy plan approval.

In exchange, FTX drops its claims against BlockFi, enabling BlockFi’s remaining claims to be paid like other similar claims under FTX’s plan, pending judicial approval. Kenneth Aulet of Brown Rudnick, representing the Committee of Unsecured Creditors, hailed the outcome as beneficial for BlockFi’s customers and creditors.

FTX and BlockFi had a complex relationship, with BlockFi receiving a $400 million credit line from FTX. The companies sued each other in 2023 over pre-bankruptcy loans. The FTX settlement with BlockFi also has a company clause to pay BlockFi $185.3 million for assets held in FTX trading accounts during the collapse.

FTX Founder Faces Sentencing as BlockFi Drops Lawsuit

FTX founder Sam Bankman-Fried, convicted of stealing $8 billion from customers, faces judgment on March 28. BlockFi drops a lawsuit over 56 million Robinhood shares, pledged as collateral, seized by the DOJ upon Bankman-Fried’s arrest.

Both companies navigated a tumultuous market crash in 2022, revealing FTX’s misuse of customer funds. BlockFi provided loans to FTX’s Alameda Research, with FTX offering rescue financing during market volatility.

While FTX aims to fully repay customers, the outcome remains uncertain. BlockFi, meanwhile, estimates partial repayment to interest-bearing account holders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |