How To Get Ethena Airdrop: A Comprehensive Guide To Farm Shards

Ethena, a project that has recently emerged on the cryptocurrency scene, is capturing widespread attention within the community, garnering interest not just for its innovative product, but also due to the notable names backing the protocol. Let’s explore with Coincu how to receive airdrops from this project and USDe’s usefulness.

What is Ethena?

Ethena is an innovative protocol built on Ethereum with a groundbreaking solution in the realm of decentralized finance (DeFi) with the launch of its Liquid Staking Derivative (LSD) protocol. The protocol aims to revolutionize traditional banking systems by offering users increased profits and a censorship-resistant synthetic dollar known as USDe.

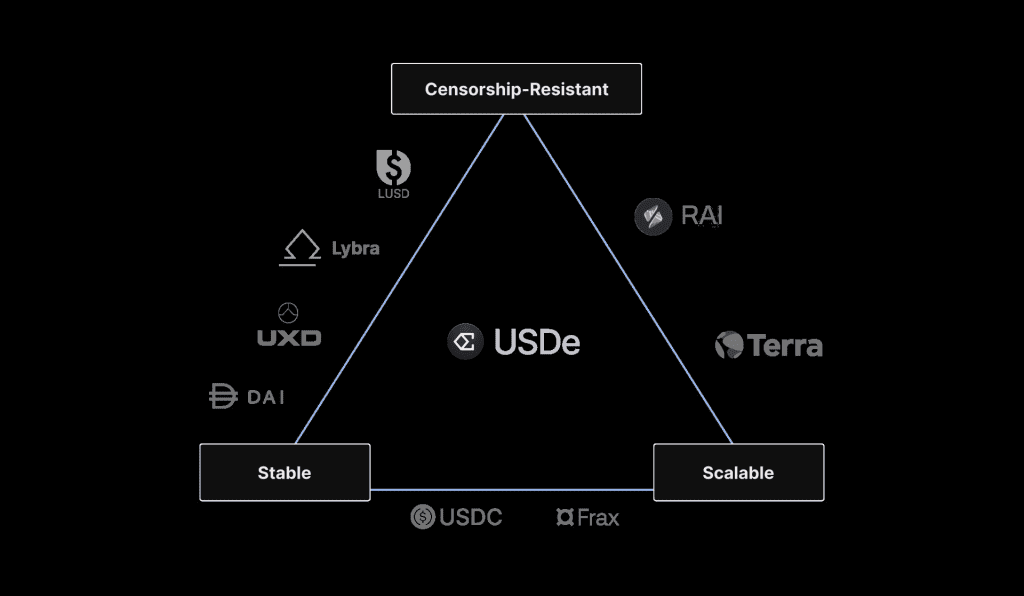

At the core of Ethena’s offering is USDe, a synthetic dollar designed to be decentralized, scalable, and stable. Unlike traditional fiat currencies, USDe is fully transparently backed on-chain and interoperable within the DeFi ecosystem. Ethena achieves this stability through a delta-hedging mechanism, ensuring resilience against market volatility.

One of the key features of Ethena is its introduction of the ‘Internet Bond,’ a globally accessible savings instrument. Users can mint USDe by mortgaging liquid staking tokens (LST) like tETH and rETH. These tokens enable users to earn fixed profits through the Internet Bond or engage in dynamic DeFi activities.

Moreover, Ethena‘s USDe employs a Delta-Hedging strategy to mitigate liquidation risks during highly volatile market conditions. This approach sets it apart from traditional Collateral Debt Position methods used by other synthetic asset protocols.

Read more: Top 5 Upcoming Crypto Airdrops!

Why does Ethena have airdrop potential?

Ethena is capturing the interest of investors and users alike due to its potential for a significant airdrop. Recently, the company secured an impressive $14 million in funding, a testament to its promising trajectory in the DeFi space. Notably, Ethena has attracted support from prominent investors, including Binance, Dragonfly, and Wintermute, further solidifying its position within the industry.

Unlike many other DeFi platforms, Ethena does not rely on its own native token. Instead, it operates with a stablecoin known as USDe. However, the absence of a native token does not hinder its ability to engage users through its innovative reward system called “shards.” Users have the opportunity to accumulate shards by engaging in various activities such as minting, providing liquidity, staking USDe, and even through referrals.

Individuals who amass these shards may potentially qualify for an airdrop, a feature that has piqued the interest of many in the DeFi community. This airdrop potential serves as an incentive for users to actively participate in the Ethena ecosystem, as it hints at the possibility of future governance token launches. Although they do not currently have a governance token of their own, they most certainly will in the future given the support of prominent players in the market.

Read more: Base Airdrop Guide: Claim Lucrative Airdrop Bonuses Now!

How to join farm shard on Ethena

Here’s a step-by-step guide to farming shards on Ethena:

Step 1: Visit the Ethena App Page

Begin by visiting the Ethena app page on your preferred web browser.

Step 2: Connect Your Ethereum Wallet

Connect your Ethereum wallet to the Ethena platform to facilitate transactions securely.

Step 3: Accept Terms and Continue

Once connected, review and accept the terms of service, then proceed to access the dashboard.

Step 4: Acquire Stablecoins

You’ll need one of the supported stablecoins, such as USDT, USDC, DAI, FRAX, etc., in your Ethereum wallet.

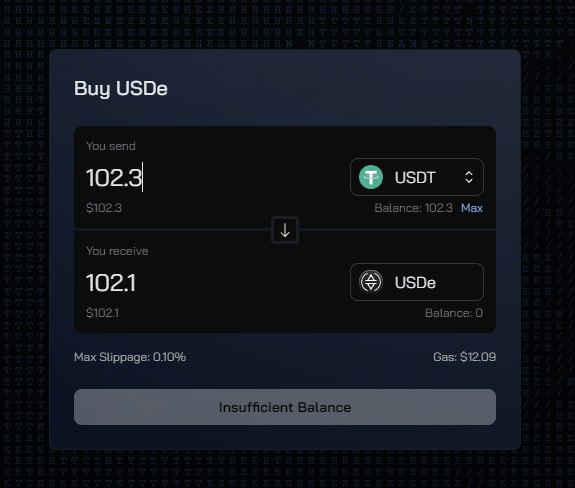

Step 5: Purchase USDe

Return to the Ethena platform and locate the “Buy” option. Swap your stablecoins for USDe, which is Ethena’s synthetic dollar.

Up to now, Ethena only allows market makers selected on the whitelist to send LST to have the right to mint USDe. However, retail investors can still have the opportunity to receive Shard-based airdrops by buying USDe through 6 stablecoins (including: USDT, USDC, DAI, FRAX, crvUSD, and mkUSD), staking USDe to receive sUSDe, providing liquidity into supported protocol pools, and inviting friends to join.

Step 6: Stake USDe

Navigate to the “Stake” section within the platform and stake a portion of your USDe tokens.

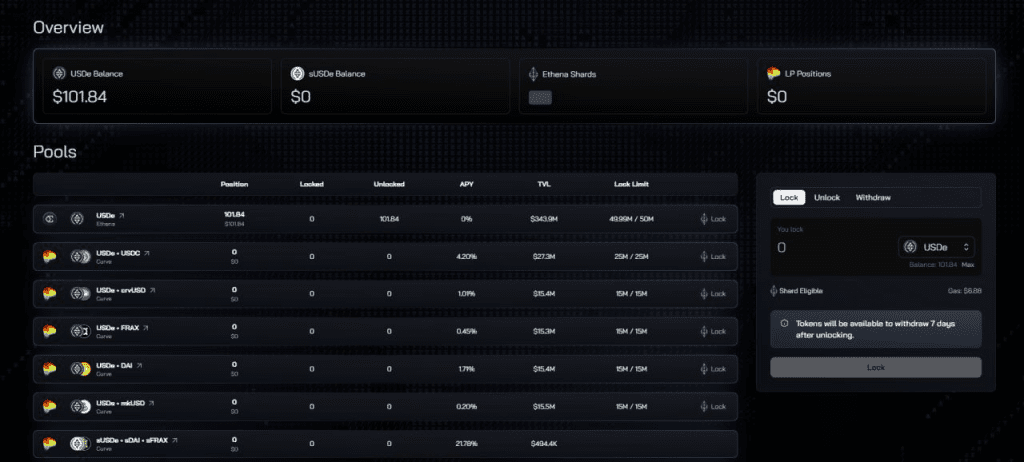

Step 7: Provide Liquidity

Additionally, contribute liquidity to one or more of the available pools on the platform.

Step 8: Earn Shards

By completing the above tasks, you will start earning points in the form of shards, which contribute to your eligibility for potential future airdrops.

Step 9: Referral Rewards

Encourage others to join Ethena by referring them to the platform. You’ll earn an additional 10% of the shards accumulated by each referral.

Notes when participating in Ethena airdrop

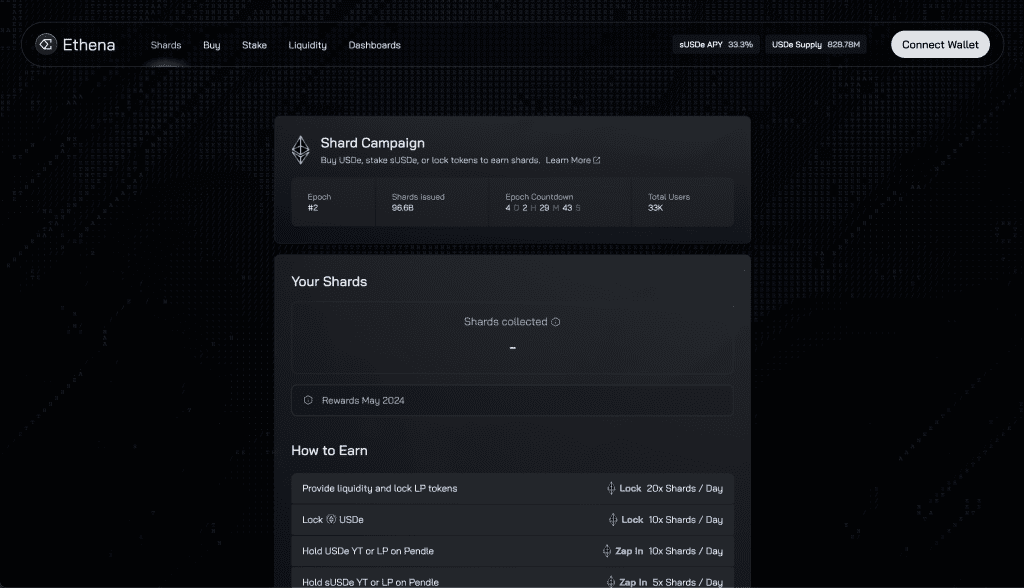

On the Ethena platform, scoring is determined by various activities, each offering a different number of shards per day:

- Buying and holding USDe: Users earn 5 shards per day for buying and holding USDe tokens.

- Staking USDe: Stake USDe to receive 1 shard per day.

- Locking USDe: Locking USDe tokens yields 10 shards per day.

- Providing liquidity and locking LP: Users earn 20 shards per day by providing liquidity and locking LP tokens.

- Referral bonuses: Referring new users earns them a 10% share of the shards they earn.

It’s important to note that conducting an airdrop on Ethena comes with costs, primarily due to the platform’s integration with the Ethereum network. Gas fees, which can vary depending on network congestion, typically range from $50 to $100. This expense is incurred for each airdrop performed on the platform.

Ethena USDe and Internet Bond

Ethena USDe

USDe is a synthetic dollar aimed at providing a groundbreaking solution within the cryptocurrency space. Unlike traditional stablecoins, USDe endeavors to offer censorship-resistant, scalable, and stable characteristics, all achieved through delta-hedging staked Ethereum collateral.

The team behind Ethena emphasizes that USDe directly tackles the “stablecoin trilemma,” which encompasses issues of scalability, mechanism design, and the lack of embedded yield in previous decentralized stablecoin designs. By utilizing derivatives on staked Ethereum collateral on centralized platforms, USDe aims to overcome these challenges while mitigating the custodial risks commonly associated with centralized stablecoins.

USDe will be fully backed on-chain, ensuring transparency, and will be freely usable within the DeFi ecosystem. Its stability will be maintained through delta hedging derivatives positions against protocol-held collateral, as outlined by the Etherea developers.

Internet Bond

The Internet Bond emerges as a groundbreaking digital bond operating on the Ethereum blockchain platform, serving a crucial role in stabilizing the price of USDe, Ethena’s synthetic dollar. Leveraging a sophisticated hedging strategy, the Internet Bond ensures that USDe maintains a stable value of 1 USD at all times.

Ethena Labs orchestrates this stability by implementing a 2-head hedging strategy, which involves creating counter positions in the derivatives market and utilizing other financial instruments. When users stake Ethereum to acquire USDe, Ethena simultaneously opens a ‘short’ position on Ethereum for an equivalent value. Essentially, this action involves speculating on the price of Ethereum decreasing.

In the event of Ethereum’s price increase, the value of the collateral (Ethereum) supporting USDe also rises. However, any potential loss resulting from the short position offsets this price appreciation. Conversely, if Ethereum’s price decreases, losses incurred from the decline are balanced by profits generated from the short position.

This meticulous approach ensures that any fluctuations in Ethereum’s price are effectively counterbalanced by gains or losses from the hedging position. Consequently, USDe maintains a steadfast peg to the USD, irrespective of market dynamics and Ethereum’s price movements.

How USDe makes profit and prevents price slippage

USD Profits through Diverse Channels

One of the primary avenues through which USD (USDe) generates profits is via Ethereum staking. Users engaging in Ethereum staking receive various benefits, including inflationary rewards from the Consensus Layer, fees from the Execution Layer, and capture of Miner Extractable Value (MEV). Notably, these profits are disbursed and calculated in ETH.

Ethena Labs, the entity behind USDe, engages in derivatives trading and utilizes delta hedging strategies. When USDe is minted, Ethena Labs initiates short positions to hedge the delta of the acquired asset.

This practice capitalizes on the discrepancy between supply and demand for asset exposure, resulting in positive interest rates and basis spreads, with the funding rate being one of the notable components.

Preventing Price Slippage

USDe ensures its value remains pegged to USD through the implementation of automatic delta-neutral hedges utilizing smart contracts on collateral. This mechanism ensures that the collective USD value of the collateral remains stable across all market conditions, thus bolstering confidence in the stability of USDe.

To further safeguard against price slippage, USDe leverages cross-market arbitrage opportunities. Users are empowered to capitalize on disparities in USDe pricing between Ethena Labs and other markets. Should USDe deviate from its intended value of 1 USD, users can execute buy or sell transactions to realign its price, thereby contributing to the maintenance of the peg value.

Conclusion

USDe not only generates profits through strategic avenues such as Ethereum staking and derivatives trading but also employs robust mechanisms to ensure price stability.

Ethena introduced a compelling Annual Percentage Yield (APY) of 27% for users. However, it’s crucial to acknowledge the associated risks, particularly regarding short orders on CEX and potential impacts on the pegging of ETH/stETH. Hopefully Coincu’s article has helped you know how to make airdrop on Ethena.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |