Market Overview (Mar 11–Mar 17): Ethereum Dencun Upgrade and MicroStrategy Overtakes BlackRock

Key Points

- MicroStrategy purchased an additional 12,000 Bitcoins, bringing their total to 205,000 BTC, making them the largest holder of BTC.

- The Ethereum Dencun Upgrade has been successfully activated on the mainnet. It aims to enhance Ethereum’s functionality and performance.

- The Federal Reserve’s emergency lending program will end, indicating a significant shift in the financial environment.

Explore the latest crypto market updates, key macroeconomic trends, Ethereum Dencun Upgrade, MicroStrategy Overtakes BlackRock, and promising projects like Ether.Fi. Stay ahead in the digital currency world.

Last week’s highlights big news (Mar 11–Mar 17)

MicroStrategy has made a significant move by purchasing an additional 12,000 Bitcoin. This acquisition raises their total holdings to an impressive 205,000 BTC, reclaiming their position as the largest holder of BTC from BlackRock, which holds 190,089 BTC.

The Ethereum Dencun Upgrade has been successfully activated on the mainnet in another development. This upgrade is expected to improve the Ethereum network, enhancing its functionality and performance.

Former US President Donald Trump recently discussed cryptocurrency on CNBC, signaling a shift in his stance and expressing support for Bitcoin. His comments have sparked conversations about the broader adoption of cryptocurrencies.

Under President Nayib Bukele’s leadership, El Salvador continues to champion Bitcoin. President Bukele stated that the country will continue buying 1 Bitcoin daily until it becomes too expensive to purchase with legal tender.

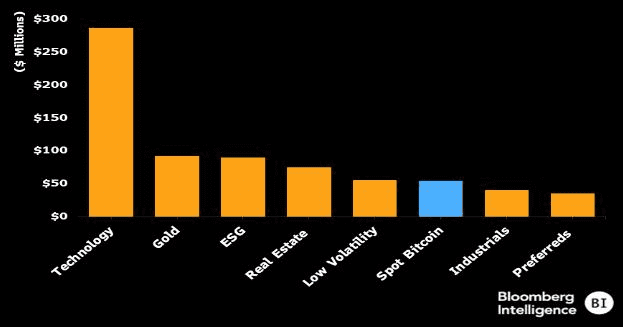

Bloomberg’s Eric Balchunas predicts that the Bitcoin ETF will surpass the gold ETF within the next few months. However, given the size of technology-related ETFs, it would still take a while for it to surpass ETFs like SPX.

VanEck has announced that they will waive the management fee for the Bitcoin ETF ‘HODL’ until March 31, 2025, providing an incentive for investors.

Coinbase has boldly filed a lawsuit against the SEC in the U.S. Court of Appeals. They accuse the SEC of acting arbitrarily and indiscriminately in refusing to regulate the crypto industry.

In Thailand, the Securities and Exchange Commission has created an exception allowing high-net-worth individuals and institutional investors to invest in crypto ETF funds—a significant shift in their approach.

According to data from The Block, the Solana blockchain generates nearly 691,000 new addresses daily, reaching an all-time high. Solana currently processes more daily transactions than Ethereum and other blockchains.

South Africa is set to license about 60 crypto platforms by the end of this month, indicating the country’s growing interest in embracing cryptocurrencies.

Lastly, the London Stock Exchange has confirmed that it will accept applications for the listing of Bitcoin and Ethereum Exchange Traded Notes (ETN) in the second quarter of 2024, marking another milestone in the acceptance of cryptocurrencies in traditional financial institutions.

Read more: Bitcoin Spot ETF Explained: All Things You Need To Know!

Macroeconomics (Mar 11–Mar 17)

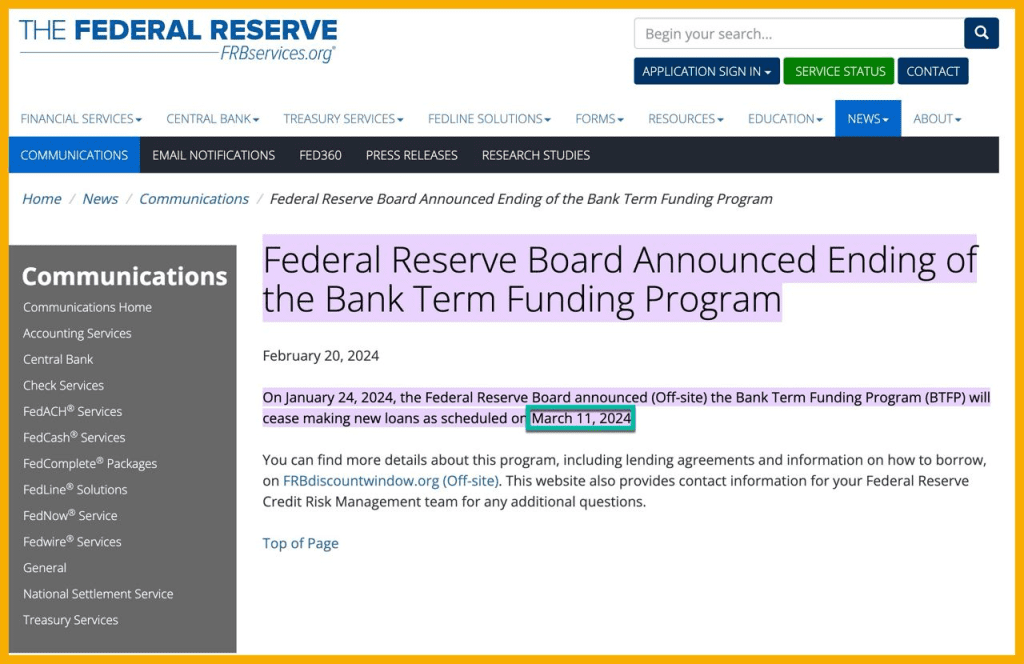

First and foremost, the Federal Reserve’s emergency lending program is set to end today. This means that banks will have to fend for themselves starting tomorrow, a significant shift in the financial environment that could have far-reaching implications.

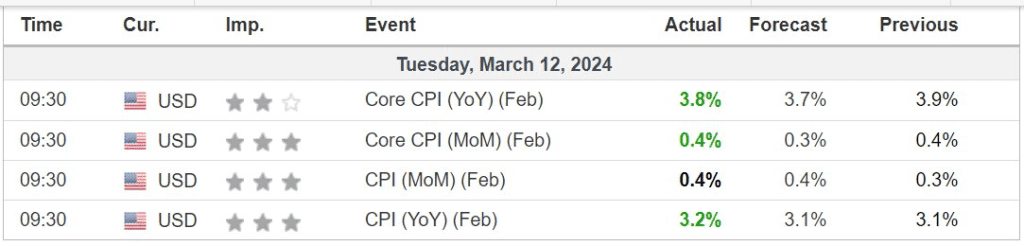

Regarding Consumer Price Index (CPI) updates, this month’s CPI stands at 3.2%, slightly higher than last month’s 3.1% and surpassing the estimated 3.1%. The Core CPI for the month is 3.8%, down slightly from last month’s 3.9% but exceeding the estimate of 3.7%.

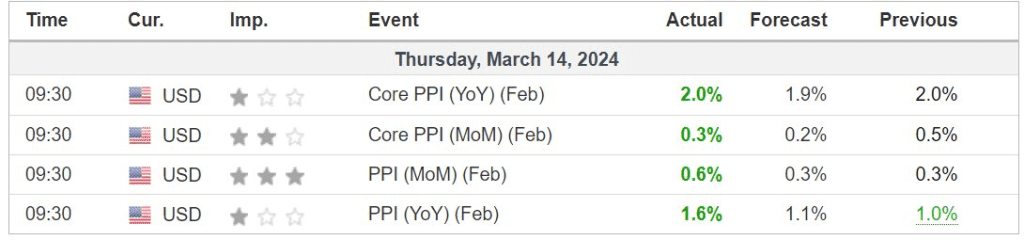

Turning to the Producer Price Index (PPI), which measures wholesale inflation, we see that PPI inflation rose to 1.6%, outpacing the forecast of 1.1%. Core PPI inflation stands at 2.0%, again higher than the forecast of 1.9%. The fact that both CPI and PPI are higher than estimated, albeit not by much, indicates that inflation remains stubborn.

Lastly, the Federal Reserve is set to announce this week’s interest rate on Wednesday at 11 a.m. U.S. time and Thursday at 1 a.m. There is a very high likelihood (98%) that interest rates will be kept unchanged, but we need to pay attention to two things:

- Signs from Chairman Powell on when to cut interest rates.

- When will the FED stop selling bonds?

Read More: Market Overview (Mar 4–Mar 10): Bitcoin Breaks ATH and Tether’s Market Cap Peaks

Prediction Market Crypto (Mar 11–Mar 17)

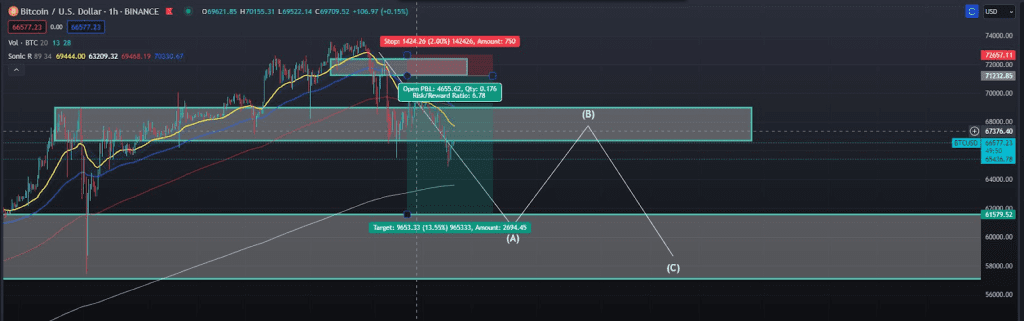

Bitcoin ($BTC) has seen a gentle sideways movement from its peak to below $66K in the past week. Most alternative coins (Alts) have sharply dropped, partly due to the surge in Meme coins. The trend for $BTC is decreasing in the short term, with a higher likelihood of returning to the 62k area than breaking 73k.

Ether.Fi, soon to feature on Binance Launchpool, is a noteworthy project in this climate. It is a liquid restaking protocol on Ethereum, providing options to stake ETH directly in your wallet or assets already staked on other platforms. This offers yield, Ether.fi points, and EigenLayer points.

Ether.fi also simplifies and reduces the cost of running nodes on Ethereum. It provides diverse features, including staking, DeFi, Solo Staker, and Institutional staking. Each feature presents unique opportunities for users and institutions alike.

In particular, the Farm $ETHFI token feature allows users to stake BNB and FDUSD in pools to farm ETHFI for a limited period. This dynamic between cryptocurrency trends and promising projects like Ether.fi highlights the exciting opportunities in digital currency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |