As the cryptocurrency industry continues to evolve, the landscape of crypto exchanges will witness a significant shift. With regulations tightening and compliance becoming a focal point, the number of cryptocurrency exchanges that prioritize anonymity without requiring Know Your Customer (KYC) verification is dwindling. Despite this trend, there still remain a few notable no-KYC crypto exchanges that cater to individuals seeking to trade cryptocurrencies with a greater degree of anonymity.

What Is KYC Verification?

Financial institutions worldwide implement KYC (Know Your Customer) protocols as a fundamental step in identity verification and risk assessment. This standardized process aids businesses in confirming the authenticity of their clients while evaluating potential risks associated with illicit activities.

At its core, KYC serves as the initial phase of anti-money laundering (AML) due diligence. Upon the onboarding of a new customer, financial institutions promptly initiate KYC procedures to establish and authenticate the customer’s identity. These measures enable institutions to gauge the risk profile of the customer, thereby mitigating the likelihood of involvement in financial crimes.

The KYC process typically entails the collection and validation of personal information, including the customer’s name, residential address, date of birth, and government-issued identification documents. In some instances, additional steps such as video verification or selfie authentication may be required to ensure compliance and bolster security measures.

Top 5 No-KYC Crypto Exchanges

Here are the top no-KYC crypto exchanges we selected:

MEXC

Overview

MEXC, recognized as one of the largest and most favored no-KYC crypto exchanges, has solidified its position by offering a plethora of features coupled with minimal fees, all without the necessity of sharing personal identification. Unlike traditional platforms that require email sign-ups, MEXC allows users to register using their preferred crypto wallets, such as MetaMask.

Once registered, users gain access to a plethora of functionalities within the MEXC ecosystem. They can seamlessly deposit cryptocurrencies into their accounts, facilitating various activities ranging from simple swaps to intricate trading maneuvers. With an extensive selection of cryptocurrencies available for trading, users can effortlessly diversify their portfolios or engage in speculative ventures, all within the confines of MEXC’s user-friendly interface.

Read more: MEXC Review 2023: Is It Safe Or Scam?

Features and Fees

Features

One standout feature of MEXC is its generous withdrawal limits, which currently stand at 30 BTC within a 24-hour period. However, for users seeking to execute larger transactions, MEXC offers the option to increase this limit to 80 BTC by completing basic KYC verification. This flexibility ensures that traders have the autonomy to tailor their trading experiences according to their specific requirements without compromising on security or compliance standards.

For those looking to onboard fiat currency into the crypto realm, MEXC facilitates a seamless process through trusted third-party providers such as MoonPay, Simpex, Banxa, and Mercuryo. These partnerships enable users to purchase cryptocurrencies using a variety of payment methods, including Visa, Mastercard, Apple Pay, Google Pay, and SEPA transfers.

Fees

The appeal of MEXC lies not only in its fee structure but also in its commitment to providing a seamless trading experience. With a diverse array of trading options available, MEXC caters to the needs of both seasoned traders and those just venturing into the world of digital assets.

What sets MEXC apart is its comprehensive range of services, catering to both spot and futures crypto trading enthusiasts who prioritize privacy. While the over-the-counter (OTC) market remains off-limits until basic KYC procedures are completed, MEXC’s spot trading platform stands out with its remarkable 0% maker and taker fees, a feat unmatched by any other cryptocurrency exchange operating without KYC requirements.

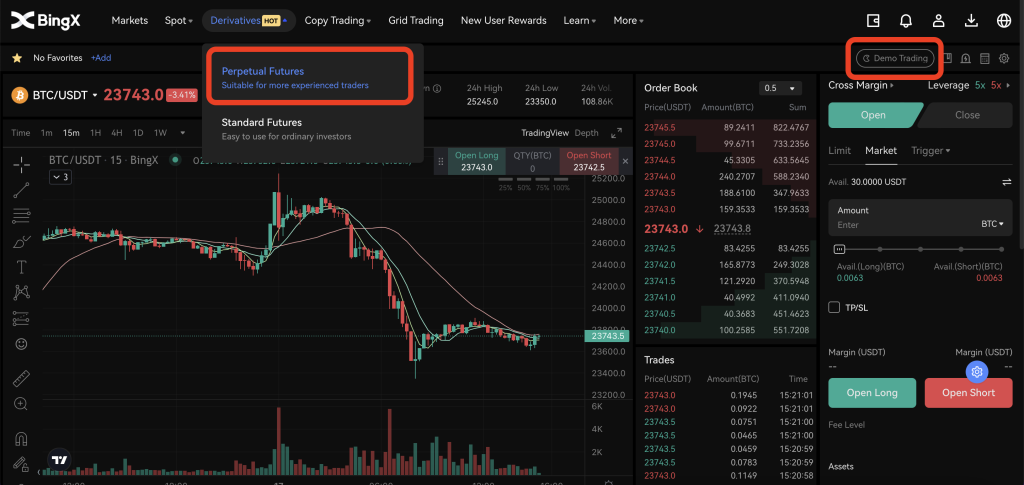

BingX

Overview

BingX steadily grown since its establishment in 2018, garnering a user base of over 5 million customers spanning across more than 100 countries. The platform caters to a diverse range of users, accommodating both novice investors and experienced traders alike with its array of features.

Among its offerings are various tools tailored to meet the needs of traders, including charting tools, live order books, multiple order types, and grid trading bots. This comprehensive suite of tools empowers users to make informed decisions and execute trades efficiently.

One notable aspect of BingX is its accessibility. Unlike many trading platforms that require lengthy verification processes, BingX allows users to start trading immediately without the need for verification. However, there are withdrawal limits in place for unverified accounts, capped at $50,000 within a 24-hour period.

Read more: BingX Reviews: A Leading Crypto Exchange?

Features and Fees

Features

BingX stands out with its unique feature, which allows users to follow and emulate the strategies of over 8,000 top traders. This function has proven immensely lucrative, with these traders collectively amassing over 38 million copier earnings and executing a staggering 130 million total orders.

In addition to its copy trading prowess, BingX offers grid trading functionality, empowering users to craft personalized trading plans and generate profits around the clock. With both spot grid and futures grid trading options available, users can diversify their strategies and capitalize on market opportunities whenever they arise.

Recognizing the diverse needs of its user base, BingX has tailored its offerings to cater to beginners and seasoned traders alike. For newcomers looking to familiarize themselves with the intricacies of crypto trading, the platform provides demo trading capabilities, allowing users to experiment with trades in a risk-free environment.

Ensuring the utmost security of user funds and data remains a top priority for BingX. The platform has earned a sterling reputation in this regard, boasting independently audited proof of reserves and undergoing rigorous security audits conducted by reputable firms such as Certik and SlowMist.

Fees

BingX distinguishes itself with its competitive fee structure, offering traders cost-effective transactions with fees of less than 0.2% per trade, comprising 0.1% for makers and 0.1% for takers.

CoinEx

Overview

CoinEx is making waves in the digital asset trading space with its unique offerings and robust security measures. Founded in December 2017 by Haipo Yang, the former Chief Technology Officer of ViaBTC, CoinEx is one of the no-KYC crypto exchanges that offers seamless user experiences.

Users can trade anonymously and without restrictions, enjoying the full spectrum of CoinEx’s offerings without disclosing personal information. However, CoinEx offers voluntary KYC verification for those seeking higher withdrawal limits and additional benefits. You can only own $10,000 worth of cryptocurrency in a day without KYC. You will need to validate your account in order to raise this amount.

Features and Fees

Features

At CoinEx, users have access to a wide range of features, including spot and futures trading, margin trading, yield farming through market making, and staking idle coins. Boasting support for a staggering over 750 tokens and 1150 trading pairs, CoinEx caters to a diverse range of investors.

One of CoinEx’s standout features is its proprietary matching engine, capable of handling up to 10,000 transactions per second. This high-performance infrastructure ensures that users can execute trades swiftly and efficiently, even during periods of peak market activity.

In addition to its advanced trading capabilities, CoinEx prioritizes the security of its users’ assets and personal information. The platform employs multiple security measures, including cold storage, multi-signature authentication, anti-DDoS protection, and SMS/email verification.

Furthermore, CoinEx has established a futures reserve fund to protect users against losses resulting from market manipulation. This proactive measure underscores the platform’s commitment to fostering a secure and transparent trading environment for all participants.

Fees

CoinEx implements a maker/taker fee model, wherein the trading fees depend on whether users execute market orders (taker) or set limit orders at specific prices (maker). Initially set at 0.2% for both market makers and takers, users have the opportunity to reduce their trading fees by holding CoinEx’s native CET tokens.

PrimeXBT

Overview

PrimeXBT presents traders with a comprehensive suite of features to enhance their trading experience. Offering a diverse selection of assets, including cryptocurrencies, forex, commodities, and indices, PrimeXBT empowers users with over 50 options to diversify their portfolios.

Notably, PrimeXBT is also one of the popular no-KYC crypto exchanges. Nevertheless, PrimeXBT retains the right to use a Customer Due Diligence process at any point to verify a client’s identity or source of funding.

Features and Fees

Features

One of the platform’s standout features is its leverage offering, enabling traders to amplify their potential profits with leverage of up to 100x. This feature provides an opportunity for users to maximize gains while carefully managing their risk.

Moreover, PrimeXBT introduces an innovative “Covesting” module, allowing traders to track and replicate the strategies of top-performing traders seamlessly. By following successful traders, users can learn from their expertise and potentially improve their own trading outcomes.

The platform’s user interface is designed to be intuitive and customizable, catering to traders of all experience levels. Advanced trading tools and features, including professional charts, multiple order types, secure wallets, and real-time risk management, are readily accessible to enhance the trading journey.

Moreover, PrimeXBT underscores its commitment to customer satisfaction by providing round-the-clock customer service. With 24/7 support available, traders can rest assured that assistance is always at hand to address any queries or concerns promptly.

Fees

PrimeXBT further enhances its appeal to traders with its competitive fee structure, boasting low fees across the board. With a minimal maker fee of 0.01% and a taker fee of 0.02%, PrimeXBT ensures that traders can execute their transactions efficiently without incurring significant costs.

For those engaging in copy trading through the “Covesting” module, a slightly higher fee of 0.05% is applied, still maintaining affordability compared to many other platforms.

dYdX

Overview

dYdX operates as a no-KYC crypto exchange running on the Ethereum blockchain, powered by the Starkware Layer 2 scaling protocol.

To commence trading on dYdX, users simply need to connect a non-custodial wallet. The platform supports a variety of wallets, including MetaMask, Trust Wallet, Coinbase Wallet, and others compatible with WalletConnect.

Since its inception in 2017, dYdX has facilitated over $20 billion in trading volume and boasts a user base of over 38,588 wallets. The platform’s native token, DYDX, serves various purposes including governance, staking, and fee discounts.

Features and Fees

Features

One of the distinguishing features of dYdX is its provision of derivative products, such as perpetual contracts and margin trading. However, it’s crucial to exercise caution with these features, particularly for less experienced traders, as they come with increased risk.

Security remains a top priority for dYdX, as the platform operates on smart contracts, adding an additional layer of protection for users’ funds. The user-friendly interface enhances the overall trading experience, catering to both novice and experienced traders alike. Moreover, dYdX rewards traders with DYDX tokens through its smart contracts, providing an extra incentive for active participation on the platform.

Fees

dYdX offers competitive trading fees, with a maker fee of 0.02% and a taker fee of 0.05%. This, coupled with its high liquidity and performance, attributed to its Layer 2 solution reducing gas costs and latency, positions dYdX as a leading DEX within the DeFi landscape.

Which no-KYC Crypto Exchange Has The Lowest Fees?

MEXC stands out for its user-friendly interface and competitive fee structure, making it an attractive option for both novice and seasoned traders alike. However, it’s essential to acknowledge that while these platforms offer convenience and cost-effectiveness, they may lack certain advanced features typically associated with exchanges mandating KYC procedures.

While the allure of no-KYC crypto exchanges lies in their convenience and anonymity, it’s essential to recognize that opting for lower fees may entail trade-offs in terms of available features and services. Users should weigh these considerations carefully to determine the most suitable platform based on their individual preferences and requirements.

What Is The Best no-KYC Crypto Exchange For Beginners?

For beginners venturing into the world of cryptocurrency trading, finding a user-friendly platform with robust support features is paramount. BingX is the top choice among no-KYC exchanges, renowned for its beginner-friendly interface and an array of supportive functionalities tailored specifically for novice traders.

At the forefront of BingX’s appeal is its intuitive interface, which is designed to streamline the trading experience for users of all skill levels. For beginners navigating the complexities of crypto trading, a friendly and accessible platform can significantly enhance their learning curve and overall satisfaction.

One of BingX’s standout features catering to newcomers is its provision of demo trading and copy trading options. These functionalities offer invaluable tools for beginners to familiarize themselves with the dynamics of cryptocurrency markets without exposing themselves to financial risks.

With demo trading, users can simulate trades in a risk-free environment, allowing them to experiment with different strategies and gain practical insights into market dynamics. This hands-on approach empowers beginners to build confidence and proficiency before committing real funds to trading activities.

Why Do Crypto Exchanges Require KYC?

Crypto exchanges, such as Coinbase and Binance, have become integral players in the digital economy, providing platforms for users to trade various cryptocurrencies. However, to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, most of these exchanges require KYC procedures.

KYC procedures play a vital role in protecting users from fraud. With verified identities, exchanges can create a safer trading environment, reducing the risk of fraudulent activities. Moreover, KYC verification fosters trust between crypto exchanges and traditional financial institutions, such as banks and payment processors.

In cases where significant sums of money are transferred between a user’s crypto exchange account and their bank account, KYC documentation can provide assurance to banks regarding the legitimacy of the funds. Without such verification, banks may be inclined to freeze or investigate transactions, potentially disrupting users’ financial activities.

Be Cautious With DEXs

DEXs have emerged as the cornerstone of KYC-free trading within the cryptocurrency market. These platforms offer users unparalleled access to a diverse range of cryptographic assets without necessitating the submission of personal details.

Trading on a decentralized exchange is remarkably straightforward. Users simply need to connect any adequately funded crypto wallet directly to platforms.

Despite their numerous advantages, decentralized exchanges have notable limitations, particularly in terms of facilitating crypto-fiat conversions. While DEXs excel at catering to users who already possess funded wallets, individuals seeking to purchase cryptocurrency for the first time may find it more convenient to utilize platforms equipped with trusted fiat on-ramps.

Conclusion

While KYC compliant exchanges offer certain advantages, such as adherence to regulatory standards, they require users to disclose personal information as part of the verification process. Contrary, no-KYC crypto exchanges operating requirements afford users the opportunity to engage in trading activities without the need to divide their data.

However, it’s essential to exercise caution, especially when dealing with no-KYC crypto exchanges. While they offer unparalleled freedom and privacy, they also come with inherent risks that traders must be careful of. Hopefully, Coincu’s article has helped you make more choices about no-KYC crypto exchanges.

FAQs

What is a no-KYC crypto exchange?

No-KYC crypto exchange is a platform that prioritizes user privacy and convenience, in contrast to traditional exchanges that mandate KYC procedures as part of their regulatory compliance.

Why should users use KYC-crypto exchanges?

This shift in preference is driven by several compelling reasons that highlight the benefits of engaging in crypto transactions without the need to disclose personal information.

One of the most significant advantages of purchasing cryptocurrency without KYC verification is the preservation of privacy. Users can execute trades without divulging sensitive personal details, maintaining a higher level of anonymity in their financial activities.

No KYC requirements make these exchanges accessible to users worldwide, irrespective of their location or access to government-issued identification. Unlike traditional exchanges that may exclude individuals without proper documentation, no KYC platforms offer an inclusive environment for anyone interested in participating in the cryptocurrency market.

Without the cumbersome process of KYC verification, registration and trading on no KYC exchanges are typically faster and more streamlined. Users can create accounts and commence trading almost immediately, eliminating the delays associated with identity verification procedures.

The absence of KYC verification reduces the risk of identity theft or data breaches, as users’ personal information is not stored on the exchange’s servers. By minimizing the collection and storage of sensitive data, no KYC platform mitigates the potential vulnerabilities associated with centralized storage systems.

What is the best no-KYC crypto app?

BingX distinguishes itself as the top recommendation for individuals seeking a crypto app without verification requirements. This innovative platform combines the trifecta of anonymity, global accessibility, and robust security measures, setting a new standard for user-friendly digital asset management.

Are no-KYC crypto exchanges safe and legal?

From a safety perspective, no-KYC crypto exchanges offer a unique advantage: minimal storage of users’ personal data reduces the likelihood of potential breaches or unauthorized access. Compared to KYC exchanges, where extensive personal information is collected and stored, the reduced data exposure on no-KYC crypto exchanges can mitigate certain risks associated with data security and privacy.

However, the absence of regulation and oversight presents its own set of challenges. Without regulatory compliance measures in place, no-KYC exchanges may be more vulnerable to risks such as money laundering and fraud. The lack of KYC procedures means that users can transact anonymously, potentially facilitating illicit activities without adequate safeguards in place.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |