Bitcoin Price Slips: Two-Week Low Amidst Cooling ETF Demand & Fed Rate Worries

Key Points:

- Bitcoin price is nearing a two-week low due to declining inflows into ETFs and concerns about a less favorable environment for speculative investments.

- The wider crypto market has lost about $420 billion since last week, with tokens like Ether, BNB, and Dogecoin also experiencing losses.

According to Bloomberg, Bitcoin price slips to a two-week low as ETF inflows decline and concerns about US interest-rate cuts rise. The crypto market, including Ether, BNB, and Dogecoin, is also down.

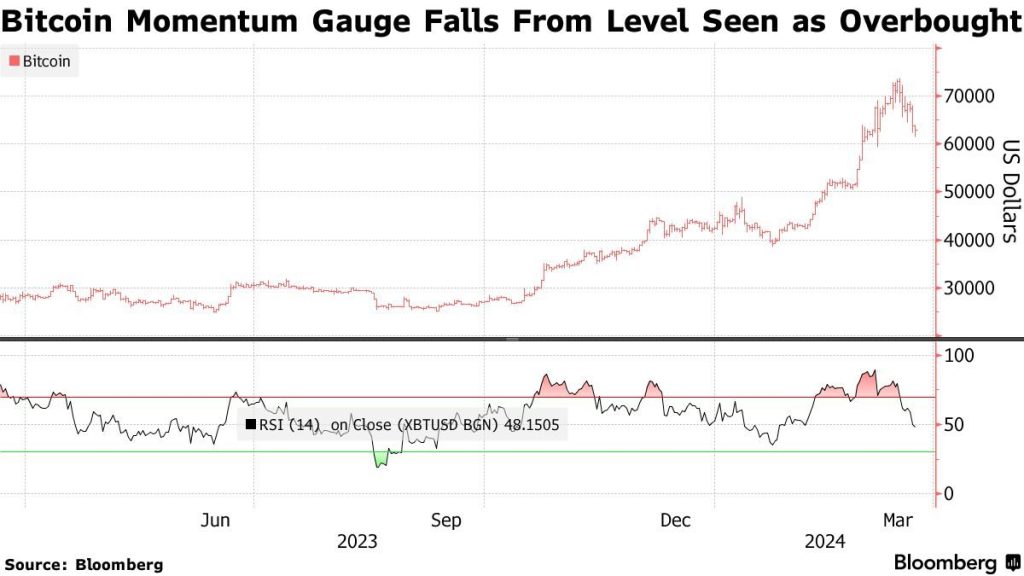

Bitcoin’s price is nearing a two-week low, fueled by declining inflows into dedicated exchange-traded funds (ETFs) and concerns about a potentially less favorable environment for speculative investments due to decreasing scope for US interest-rate cuts.

Bitcoin Price Slips to a Two-Week Low

The digital asset’s price has been falling almost daily since reaching a record high of nearly $73,798 on March 14. As of Wednesday, Bitcoin was trading at around $63,165.

This decline comes amid uncertainties about whether inflation surpassing targets will lead Federal Reserve policymakers to reduce rate cut projections. At the same time, demand for US spot-Bitcoin ETFs, which launched with much fanfare on Jan. 11, has cooled.

These products have attracted a net inflow of $11.6 billion, but investors have started to withdraw from them. Some of the recent struggles of Bitcoin are linked to the Fed’s outlook. The wider crypto market has lost about $420 billion since peaking at $2.9 trillion last week.

Readmore: Bitcoin NFT Market Explodes On Magic Eden With $100M In Trades

Other Cryptocurrencies Also Experience Decline

Tokens such as Ether, BNB, and Dogecoin are also experiencing losses. According to K33 Research, the liquidation of bullish bets using derivatives could continue, posing a potential obstacle for a quick recovery in the digital-asset market.

The current mood is downbeat, emphasized by this week’s slump in crypto-linked stocks, including Coinbase Global Inc., MicroStrategy Inc., and Monex Group.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |