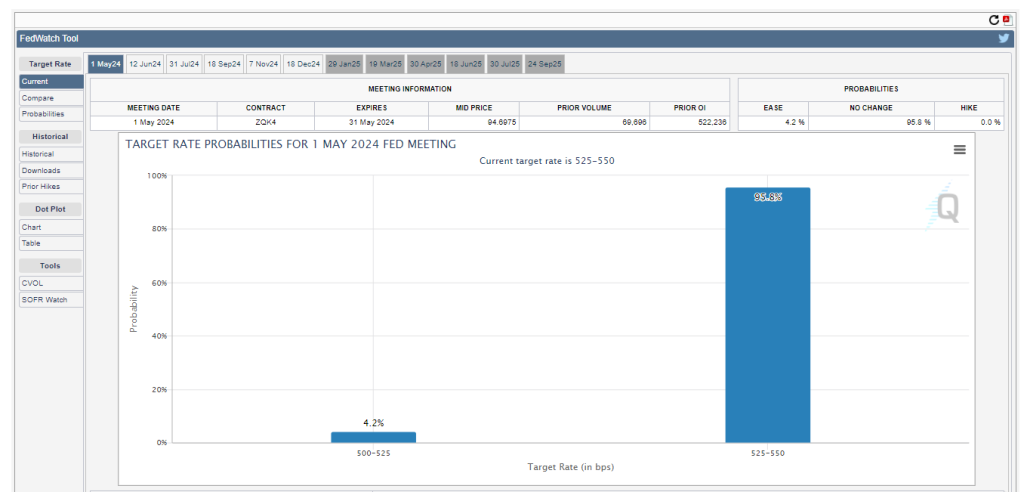

Key Points:

- CME Fed Watch keeping rates unchanged at 95.8%, with only 4.2% chance of a cut.

- Likelihood of unchanged rates drops to 36.4%, while 61% anticipate a 25 basis point cut.

- Data suggests cautious optimism in short-term, potential shift in June.

According to the latest data from the CME Fed Watch tool, the likelihood of the Federal Reserve maintaining interest rates at their current level in May stands at an overwhelming 95.8%.

This high probability suggests that market participants anticipate the Fed to keep monetary policy unchanged during its upcoming meeting.

Conversely, the probability of the Fed implementing a 25 basis point interest rate cut in May is relatively low, at 4.2%. This indicates a prevailing sentiment among investors that the Fed is unlikely to pursue further monetary easing measures at this time.

Market Anticipates Potential Shift in Monetary Policy!

Looking ahead to June, the CME Fed Watch tool reveals a different outlook. While the probability of the Fed maintaining interest rates unchanged decreases to 36.4%, a significant majority of 61% suggests the likelihood of a cumulative 25 basis point interest rate cut over the two-month period from May to June.

Moreover, the probability of a more aggressive cumulative 50 basis point interest rate cut in June remains minimal, standing at just 2.6%. This indicates that while market participants anticipate some degree of monetary policy accommodation by the Fed in the coming months, they do not expect a substantial deviation from the current interest rate trajectory.

The data from the CME Fed Watch tool offers valuable insights into market expectations regarding future Fed actions and their potential impact on monetary policy. The overwhelmingly high probability of the Fed maintaining interest rates unchanged in May reflects a consensus among investors that the central bank is likely to adopt a wait-and-see approach amid ongoing economic uncertainties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |