Ethena Review: Breakthrough Stablecoin Solution On Ethereum

Unlike popular stablecoins such as Tether’s USDT, Ethena takes a different approach by not relying on the traditional peg-holding method. Instead, Ethena’s stablecoin is backed by Ethereum as collateral. With the growing demand for stablecoins in various cryptocurrency applications, Ethena’s innovative solution could have significant implications for the broader market. Let’s learn about this project with Coincu through this Ethena Review article.

What is Ethena?

Ethena is a decentralized stablecoin issuance protocol built on Ethereum. At its core, Ethena aims to provide a stablecoin solution independent of traditional banking systems, offering users worldwide a reliable alternative for financial transactions.

USDe

Central to the project is the development of USDe, a stablecoin designed to maintain a consistent value while operating on the Ethereum blockchain. Unlike conventional fiat-based stablecoins, USDe seeks to transcend traditional financial barriers, providing users with a censorship-resistant and scalable digital asset.

Utilizing a delta-hedging strategy, USDe will be fully collateralized and transparently tracked on-chain, ensuring its stability and usability across various decentralized finance (DeFi) applications.

Read more: Space ID Review: Build Domain With Many Outstanding Features

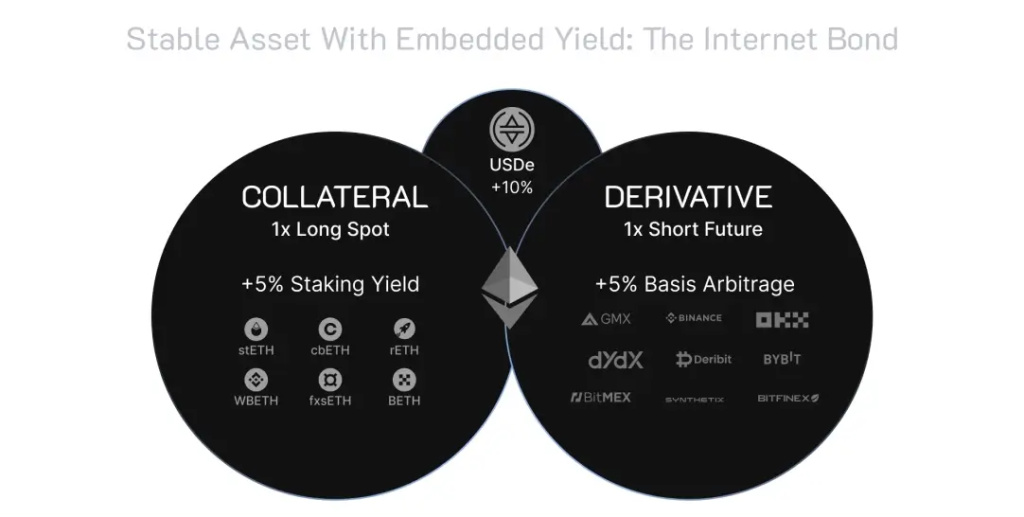

Internet Bond

Complementing the stablecoin is Ethena’s innovative savings tool, Internet Bond. This USD-denominated instrument leverages the power of USDe, combining profits from Liquid Staking Tokens (LST) with revenues generated from futures and perpetual swaps markets. The result is a groundbreaking on-chain bond, offering users a secure avenue for dollar-denominated savings while harnessing the potential of blockchain technology.

The Internet Bond further enhances Ethena’s ecosystem by offering users a unique opportunity to participate in crypto-native financial instruments. By combining staked Ethereum yields with market-derived revenues, the bond serves as a bridge between traditional finance and the burgeoning world of decentralized finance, empowering users to explore new avenues for wealth generation and preservation. Next, the Ethena Review article will tell you the potential of the project.

What Is The Potential Of Ethena?

The demand for stable assets such as Stablecoin remains robust in the market due to their versatility in serving exchange purposes, allocation within investment portfolios, and their reputation as a safe asset. Many portfolios incorporate a portion of Stablecoin to bolster defense, particularly during downtrends in the market.

The allure of a highly stable Stablecoin offering both asset reserves and an annual percentage rate (APR) in the tens of percent range begs the question: is it attractive?

MakerDAO’s Stablecoin, sDAI, which offers a 5% APR backed by US treasury bonds, stands as evidence of the attractiveness of such offerings, having attracted billions of dollars in investments. With the potential for an APR reaching up to 30% per year, an unprecedented high for stablecoin, it appears inevitable that further billions will flood into Ethena in the near future.

Moreover, the versatility of such stablecoins extends beyond mere APR. For instance, USDe can be introduced into the decentralized finance (DeFi) market, where it can be utilized as collateral on various lending protocols, as well as in platforms like Perp DEX or for yield trading opportunities such as those offered by Pendle.

Read more: AEVO Review: Binance Launchpool’s 48th Project

What Are The Risks Of Participating In Ethena?

Alongside its promising potential, Ethena and its user base confront notable risks that merit attention. Should the assets utilized as collateral and the orders initiated on multiple centralized (CEX) and decentralized (DEX) exchanges encounter issues leading to asset loss, there exists the grim possibility of users’ assets disappearing.

Moreover, employing stETH as collateral for a Short ETH position introduces another layer of risk. If stETH or any Liquid Staked Token (LST) deviates from its peg with ETH, the Short order against that collateralized asset faces immediate liquidation, potentially flooding the market with USDe without corresponding secured assets.

In addition to these inherent risks, Ethena grapples with a significant limitation. During adverse market conditions, the annual percentage rate (APR) of USDe may plummet to as low as 3%. Such a diminished APR poses challenges in retaining users as the allure of higher returns diminishes in the face of reduced profitability.

These risks underscore the importance of vigilant risk management practices and the necessity for users to carefully assess and mitigate potential vulnerabilities when engaging with Ethena’s offerings.

Read more: Kinza Finance Review: Breakthrough Lending Platform With Model ve(3,3)

Outstanding features of USDe

Ethena employs a robust collateral distribution mechanism utilizing on-chain MPC custody contracts. Furthermore, seamless integration with major liquidity venues bolsters risk management strategies while ensuring users maintain full custody of their USDe holdings.

USDe introduces a novel way for users to leverage their assets. By generating fixed profits through staking rewards from LST and funding rates of short positions, users can optimize their capital utilization.

Ethena’s provision for USDe minting based on LSTs not only enables long-term exposure to Ethereum but also fosters liquidity for USDe. Importantly, the absence of liquidation risk sets USDe apart from traditional stablecoins, as it operates on a delta-neutral mechanism, eschewing the inherent risks associated with Collateralized Debt Position (CDP).

One of the most compelling features of USDe is its immunity to liquidation risk. Unlike other algorithmic stablecoins that rely on debt positions (CDP), USDe’s issuance operates on a delta-neutral mechanism.

Ethena’s Operating Model

USDe Issuance Mechanism

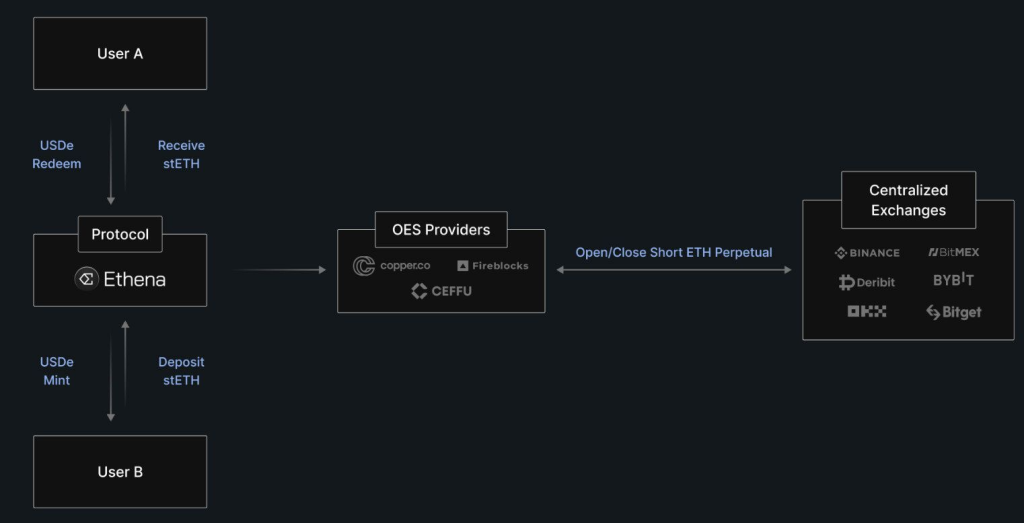

Ethena’s protocol has introduced a mechanism allowing users to obtain USDe by depositing Liquid Staking Tokens (LST), such as stETH and rETH, which represent staked Ethereum assets. This innovative approach offers users a seamless pathway to access USDe, a stablecoin pegged to the US dollar, leveraging their staked Ethereum holdings.

Upon depositing LST into Ethena’s protocol, users are able to mint USDe, the stablecoin, or redeem it as needed. However, it’s important to note that users will incur slippage fees and transaction execution costs during both the minting and redemption processes. These fees are factored into the overall transaction cost, ensuring transparency and clarity for users engaging with the protocol.

One distinctive feature of Ethena’s protocol is its hedging mechanism employed by Ethena Labs. After receiving LST from users, Ethena Labs initiates a short order on derivatives exchanges, devoid of leverage, with a value equivalent to the assets deposited by the user into the protocol. This strategic move serves to hedge against price risks associated with the deposited assets, thereby mitigating potential losses for users.

Protect against price fluctuations with a balanced Short position

Ethena learned from past incidents, such as the collapse of the Terra LUNA network due to fluctuations in the UST stablecoin’s peg. Leveraging this insight, Ethena has incorporated a balanced short position as a safeguard against price fluctuations, particularly concerning its use of volatile altcoins known as LSTs (stETH, rETH, WBETH) as collateral.

In the process of minting its stablecoin USDe, Ethena utilizes LSTs as primary collateral. However, recognizing the inherent volatility of these assets, Ethena has adopted a proactive stance by opening short positions to hedge against potential price swings.

This move serves as a protective measure, ensuring that even in the event of a sharp decline in the market value of LSTs, the profits generated from the short positions will offset any losses, thereby maintaining the stability of the underlying collateral.

sUSDe

Upon receiving USDe, users have the option to stake this stablecoin to earn sUSDe. The profitability of holding sUSDe stems from two key sources: firstly, the staking rewards derived from LSTs, and secondly, from the funding rate associated with the short position.

sUSDe’s reward mechanism for holders operates seamlessly, requiring no additional user actions. As sUSDe accrues in value over time, users benefit from its appreciation relative to USDe.

Let’s break down John’s transaction on Ethena to provide a clearer understanding of its operations. John initiates a purchase of 5000 USDe on Ethena, utilizing 5000 USDT as payment. Upon receipt of John’s USDT, Ethena converts it into 1 stETH, leveraging an assumed ETH price of 5000 USDT. Subsequently, Ethena utilizes this stETH as collateral to establish a 1x Short ETH position with a volume equivalent to 1 ETH on a centralized exchange (CEX).

This transaction structure ensures that John’s minting position, backed by 1 stETH and a Short position with a 1 ETH volume, remains secure and immune to liquidation regardless of ETH price fluctuations. The collateralization of John’s position mitigates the risk associated with market volatility, providing stability and reassurance to the participant.

ENA Airdrop and Season 2: Sats Campaign

Ethena unveiled its latest initiative, the Sats Campaign, which marks a significant milestone as Ethena transitions from using “Shards” to “Sats,” aligning with the protocol’s integration of BTC as a backing asset.

With the incorporation of BTC perpetual futures, Ethena now boasts an additional approximately $25 billion in open interest for delta-hedging, representing a remarkable 2.5x surge compared to the current ETH perpetual futures size, excluding the $11 billion CME open interest. Notably, the average funding on BTC has consistently mirrored ETH funding rates.

Year-to-date funding on BTC has averaged approximately 22% on a substantial $25 billion of open interest across major exchanges, translating to a potential annual gross cash flow opportunity of around $2.75 billion, with a significant portion attributed to fees from shorts.

Despite recent supply increases, Ethena’s delta hedging now encompasses roughly 15% of ETH open interest, showcasing its growing influence in the market.

While ETH funding rates remain largely unaffected, hovering around 60% at present, the protocol recognizes the importance of maintaining scalability to meet market demands. The integration of BTC perpetual futures is seen as a pivotal step towards achieving this goal.

The Sats Campaign, set to run for five months until September 2 or until USDe supply reaches $5 billion, aims to foster this growth trajectory.

Existing Season 1 Positions

Season 2 offers a 20% boost in Sats earned for existing Season 1 positions under two conditions: users adhere to vesting conditions outlined in recent communications, or they add new USDe into the new incentive program on the same wallet.

New Rewards and Partnerships

MakerDAO and Morpho

Morpho has launched USDe and sUSDe/DAI pools in collaboration with MakerDAO, offering users substantial rewards for collateral deposits and borrowing.

Users can expect to earn 20x Sats on USDe collateral and 5x Sats on sUSDe collateral.

Initial rewards cap set at $400 million additional USDe rewards on Morpho, bringing the total to $500 million.

Mantle, Pendle, and EigenLayer Points

Ethena integrates with Mantle, providing users with various opportunities to earn Sats in Season 2.

New Pendle pools on Mantle enable users to participate with lower gas fees and earn Sats and EigenLayer points.

Users can earn 20x Sats per USDe held in USDe YT or LP position, with a 100 million cap on EigenLayer points.

Additional Pendle Pools

The existing USDe Pendle pool on ETH L1 will reopen, offering users a chance to roll into Season 2 with a 100 million cap. Ethena and Pendle collaborate to launch two more pools as part of Season 2, details to follow in upcoming updates.

These partnerships and rewards signify just the beginning of Ethena’s expansion efforts in Season 2, with further integrations and partnerships on the horizon. Users can stay informed on campaign developments as Ethena continues to innovate and reward its community.

Read more: How To Get Ethena Airdrop: A Comprehensive Guide To Farm Shards

ENA token

Key Metrics

- Token Name: Ethena

- Ticker: ENA

- Blockchain: Ethereum

- Contract: 0x57e114B691Db790C35207b2e685D4A43181e6061

- Total Supply: 15,000,000,000 ENA

- Initial Supply: 1,425,000,000 ENA

Allocation & Vesting

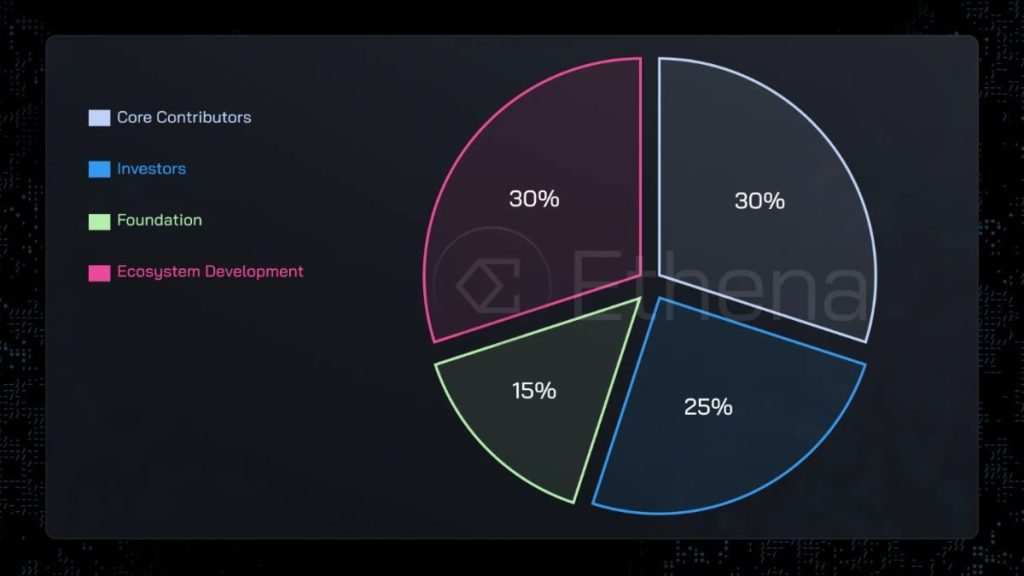

Allocation

A total of 15,000,000,000 ENA will be allocated as follows:

- Core Contributors (30%): 4.500.000.000 ENA

- Ecosystem Development (30%): 4.500.000.000 ENA

- Investors (25%): 3.750.000.000 ENA

- Foundation (15%): 2.250.000.000 ENA

Vesting

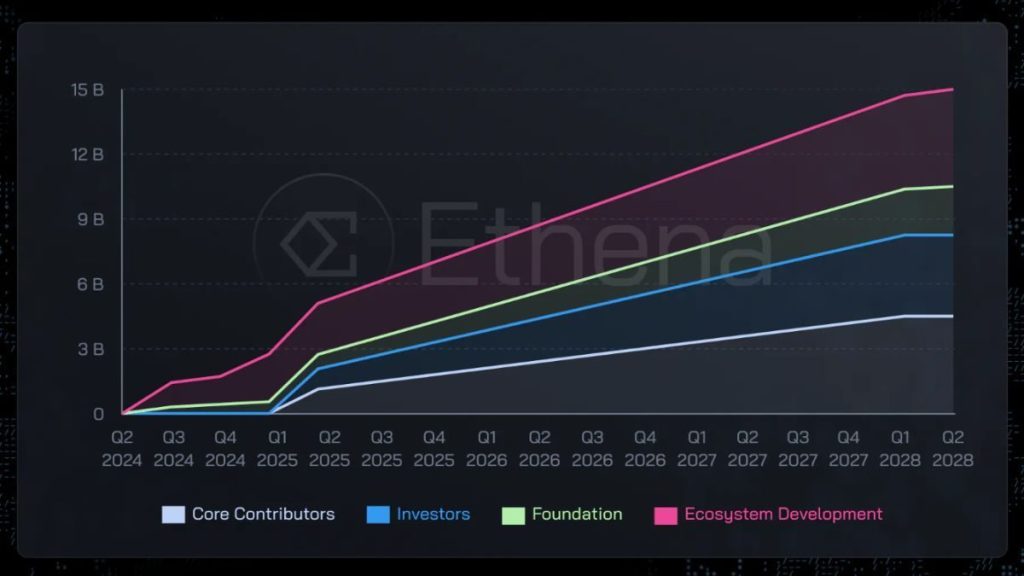

1,425,000,000 ENA tokens are in circulation at launch, making up roughly 9.5% of the total supply. The total number of tokens released into the market will not exceed 3 billion until one year after the TGE (Q1/2025), which is roughly twice as many as there were on the TGE day.

Nonetheless, Ecosystem Development, the section designed to encourage ecosystem development, is where the majority of the tokens issued in the first year are located. Conversely, hardly any Foundation tokens are made available. This tokenomics design partially demonstrates Ethena’s dedication to advancing the ecosystem throughout its first year.

ENA Token Sale

On March 29, 2024, Binance Launchpool announced the listing of the ENA token. Specifically, users can stake BNB and FDUSD to receive ENA from 7:00 AM on March 30, 2024, to 7:00 AM on April 2, 2024.

The number of ENA allocated for each pool is as follows:

- BNB pool: 240,000,000 ENA

- FDUSD pool: 60,000,000 ENA

Subsequently, at 3:00 PM on April 2, 2024, users can trade ENA on the Binance exchange with the following pairs: ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD, and ENA/TRY.

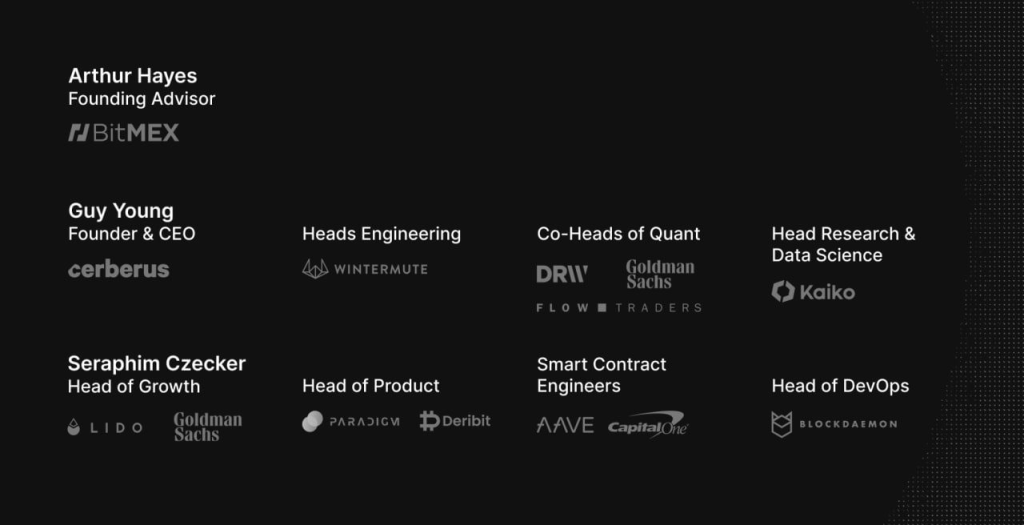

Ethena Team

The project development team is made up of seasoned professionals with backgrounds in technology, such as:

- Arthur Hayes: Founding Advisor.

- Leptokurtic: Founder and CEO.

- Guy Young: Founder

- Amine Mounazil: Double Degree Graduate

- James Baulcomb: People & Talent for Web3

- Seraphim Czecker: Head of Taking Risk

Investors and Partners

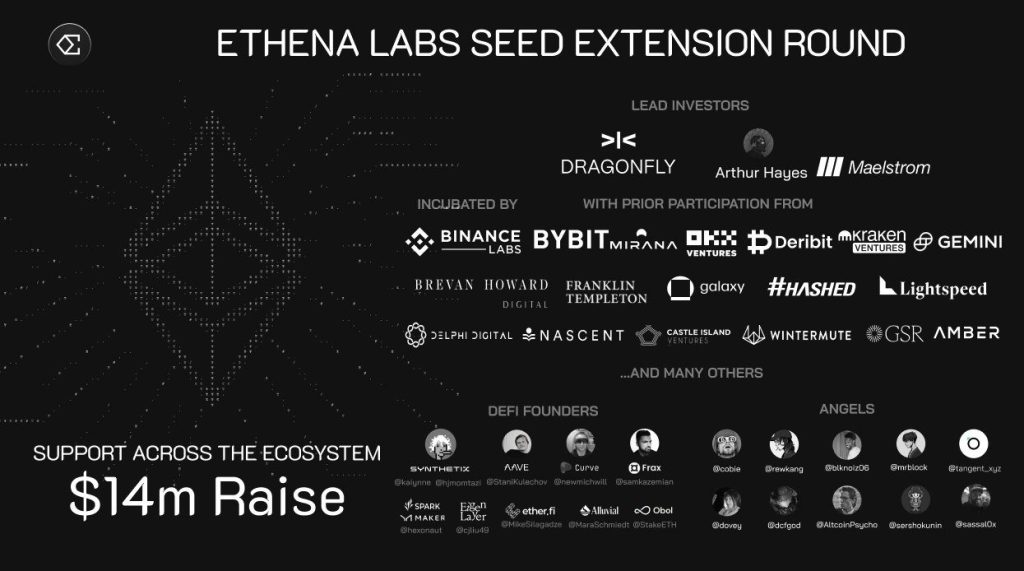

The projected release states that Ethena has raised money in three rounds of funding successfully; the details of the Binance Labs investment round from two years ago have not been made public. An aggregate of $20.5 million was invested in the remaining two rounds by a number of prominent market funds, including Bybit, Deribit, OKX Ventures, Dragonfly Capital, Arthur Hayes, and Binance Labs.

Media Channels and Community

- Website: https://www.ethena.fi/

- Telegram: https://t.me/ethena_labs

- Discord: https://discord.com/invite/HVfuYyNm8S

- Twitter: https://twitter.com/ethena_labs

- LinkedIn: https://www.linkedin.com/company/ethena-labs/

Conclusion of Ethena Review

Ethena is leading the way in crypto-financial innovation and reinventing the use case for stablecoins on the Ethereum network. With its innovative “Internet Bond” engine and delta-hedging mechanism, Ethena provides a scalable stablecoin and an alternative savings option that is not limited by conventional banking regulations.

As the protocol progresses, especially with the tokenomics reveal, and the engagement-driven Shard campaign, Ethena will enhance the growth and stability of its ecosystem. Hopefully, Coincu’s Ethena Review article has helped you gain more information about the project.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |