Market Overview (Apr 1 – Apr 7): Ripple Plans To Launch Stablecoin and Galaxy Digital’s New Fund

Key Points

- Ripple plans to introduce a USD-tied stablecoin, and Galaxy Digital plans to fund crypto projects with $100 million.

- The Federal Reserve maintains US monetary policy, awaiting more evidence of decreasing inflation before interest rate cuts.

- The Bitcoin market shows a potential for altcoin price increase prior to halving, diverging from previous cycles.

Ripple Plans To Launch Stablecoin, Galaxy Digital’s New Fund, and more. Get macroeconomic insights and BTC market predictions.

Last week’s highlights big news (Apr 1 – Apr 7)

Ripple plans has announced the introduction of a stablecoin tied to the USD price. The stablecoin, guaranteed 100% by USD deposits, short-term US Treasury bonds, and other equivalent cash assets, will be deployed on the XRP Ledger and the Ethereum blockchain.

Meanwhile, Galaxy Digital plans to raise $100 million for a new investment fund focused on early-stage crypto projects. Such initiatives are crucial in fostering innovation and growth within the crypto ecosystem.

In regulatory news, the Louisiana state House of Representatives has passed a bill to protect the ‘Fundamental Bitcoin Rights’ of the people. This bill safeguards the right to buy Bitcoin, the freedom to mine Bitcoin, the right to self-manage digital assets, and the freedom to operate a Bitcoin node.

In the realm of crypto exchanges, Crypto.com has announced plans to replace the service by launching the Crypto.com exchange in Korea. Elsewhere, Thailand’s largest crypto exchange, Bitkub Capital, is planning an initial public offering next year, which is expected to value the exchange at around 6 billion baht ($165 million).

Another interesting development comes from Telegram, which has announced that owners of public channels with at least 1,000 subscribers can receive 50% of the revenue from ads displayed on their channels. Moreover, Telegram is launching a new type of ad that users can buy with Toncoin.

Lastly, in a bid to counter regulatory scrutiny, Tron has asked the court to dismiss the SEC lawsuit, arguing that the SEC does not have jurisdiction over “foreign digital assets for foreign buyers on global platforms.”

Market Overview: Limited Bybit Referral Code 2024: NYNPOM (Claim $30000 Sign Up Welcome Bonus)

Macroeconomics (Apr 1 – Apr 7)

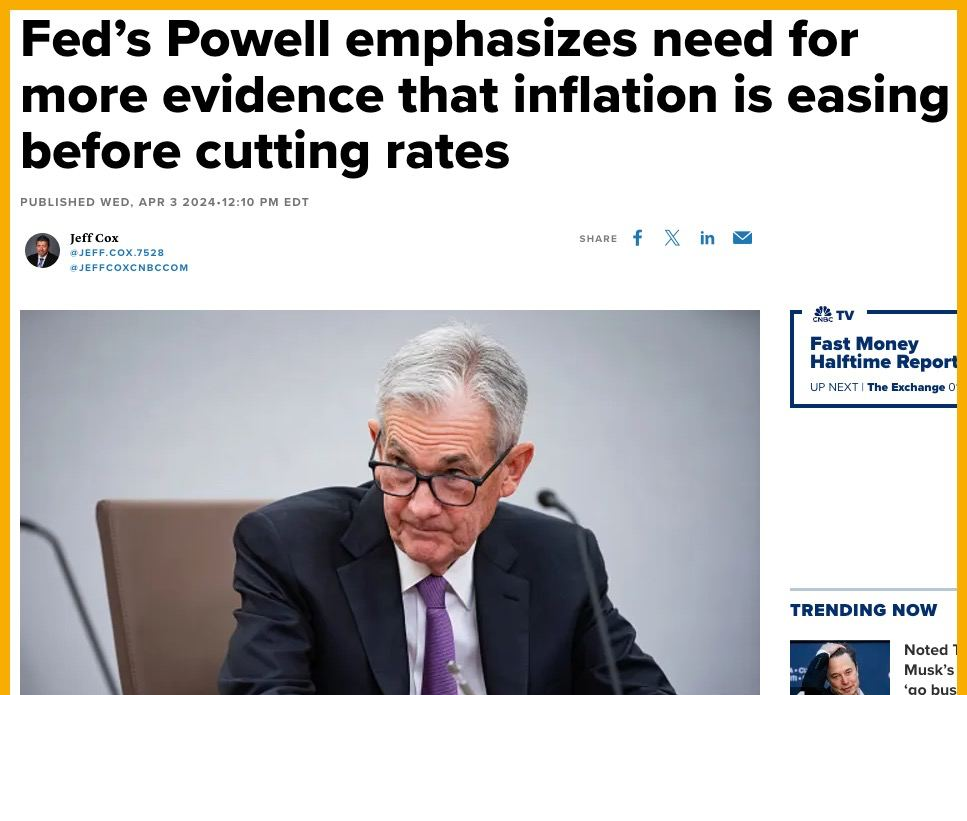

In a recent announcement, the Federal Reserve Chairman held the line on US monetary policy, emphasizing that more evidence of decreasing inflation is needed before interest rates could be cut. This stance demonstrates the Fed’s commitment to its 2% inflation target and indicates confidence in the economy’s current strength.

The chairman stated, “We do not anticipate lowering interest rates until we have greater confidence that inflation is moving sustainably towards the 2 percent target… With the economy’s strength and progress on inflation to date, we have time to wait for more data.” This message reinforces the central bank’s patient approach to fluctuating economic indicators.

The latest unemployment data supports the Fed’s positive outlook, showing a rate of 3.8%, as expected. This figure represents a decrease from the previous month’s rate of 3.9%, signaling robust job market conditions.

Furthermore, US non-agricultural employment data exceeded expectations, with the creation of over 300,000 new jobs in March, significantly higher than the forecasted 212,000. This upswing benefits the overall US economic situation but also adds complexity to the Fed’s decision-making process regarding interest rates.

Read More: Spot Ethereum ETF vs. Ethereum Futures ETF: Which Is The Better Investment?

Prediction Market Crypto (Apr 1 – Apr 7)

The weekly $BTC candle has shown quite a nice pullback signal. Genesis has sold $2.1 billion of Grayscale GBTC in the past few weeks, and Grayscale sold an equivalent amount of BTC to give Genesis money.

Then, Genesis bought 32,041 Bitcoin on April 2 at a price of $65,685, which means about $2.18 billion to start repaying creditors and victims, this could also be the reason for the BTC pullback.

If the candle closes in this area or above 70K, we can expect the altcoin scenario to have a price push week before halving. This is something that has never happened in previous halving cycles where Altcoin either crashed or slightly declined before halving.

This shows that this cycle will be very different from previous ones. All we need to do is focus on holding carefully the gems we have researched and believe in.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |