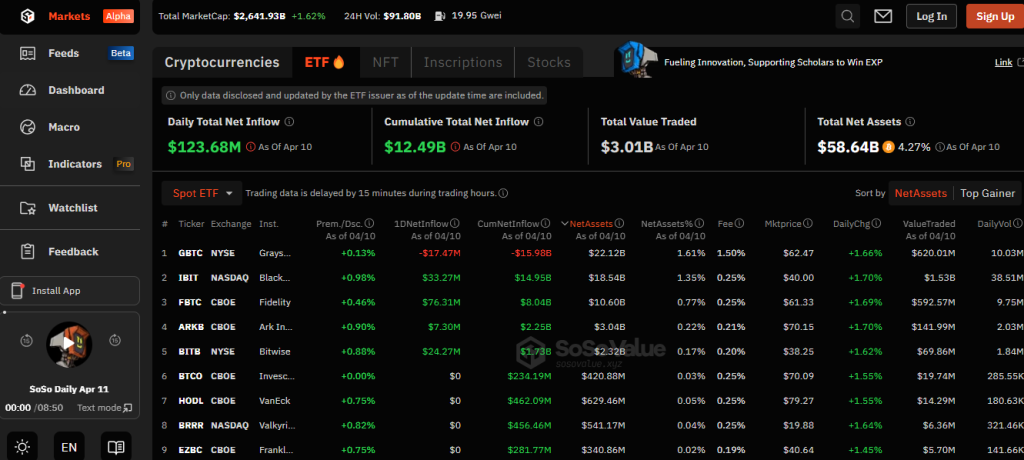

Bitcoin Spot ETFs See Massive $123M Inflows, Fidelity’s FBTC Leads, Grayscale Outflows!

Key Points:

- Bitcoin spot ETFs witness massive $123 million net inflow, highlighting surging investor interest.

- Fidelity’s FBTC leads with $76.31 million single-day net inflow, showcasing institutional confidence.

- Grayscale’s GBTC experiences $17.47 million net outflow, signaling shifting investor sentiment.

According to data from SoSoValue, the collective net inflow of Bitcoin spot ETFs surged to an impressive $123 million yesterday, marking a significant uptick in investor interest in cryptocurrency-related exchange-traded funds.

Among the notable movements within the ETF landscape, the Grayscale ETF GBTC experienced a notable net outflow of $17.47 million. This departure from the fund suggests a shift in investor sentiment or strategy, possibly influenced by market dynamics or individual investment goals.

Bitcoin Spot ETFs Attract $123 Million Inflows

The Fidelity ETF FBTC emerged as the frontrunner in terms of single-day net inflow, attracting approximately $76.31 million in new investments. Fidelity’s strong performance underscores the growing confidence among investors in the cryptocurrency market and highlights Fidelity’s position as a key player in the ETF space.

Following closely behind Fidelity, the BlackRock ETF IBIT also experienced a substantial net inflow of about $33.27 million. BlackRock’s ETF, known for its diverse investment offerings and strong track record, continues to attract investors seeking exposure to the burgeoning cryptocurrency market.

Readmore: Spot Bitcoin ETF Approval Timelines and Key Dates

Fidelity’s FBTC Leads with $76.31 Million Inflow

The surge in net inflows across various Bitcoin spot ETFs reflects the evolving investment landscape, where traditional financial institutions and retail investors alike are increasingly embracing digital assets as a legitimate investment avenue. Factors such as Bitcoin’s growing mainstream acceptance, its potential as a hedge against inflation, and the increasing accessibility of cryptocurrency investment products are driving this trend.

While the influx of funds into Bitcoin spot ETFs bodes well for the continued growth and adoption of cryptocurrencies, it also underscores the need for investors to carefully assess their investment strategies and risk tolerance. Cryptocurrency markets are known for their volatility and unpredictability, making it essential for investors to conduct thorough research and exercise caution.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |