STON.fi is a decentralized automated market maker (AMM) operating on the TON blockchain. It offers zero fees, low slippage, an intuitive interface, and seamless integration with TON wallets.

What is STON.fi?

STON.fi is an AMM DEX built and developed on the TON ecosystem that operates on the Request for Quote (RFQ) model and employs Hash Time Locked Contracts (HTLC). By removing third-party involvement, the platform enhances reliability and ensures transaction security. This project provides a straightforward, secure, and time-saving solution for exchanging assets across different blockchains.

The protocol of STON.fi doesn’t rely on assumptions. Instead, it carries out sequential and accurate verification steps to tackle challenges related to interoperability, security, risk mitigation, and transaction expenses within the DeFi sector. Moreover, STON.fi integrates various services into Telegram, enabling users to manage and execute asset transactions directly.

Read More: Top 10 Best Crypto Telegram Bots In 2024

How Does STON.fi Work?

A standard user flow for using STON.fi involves the following steps, similar to those of any DEX:

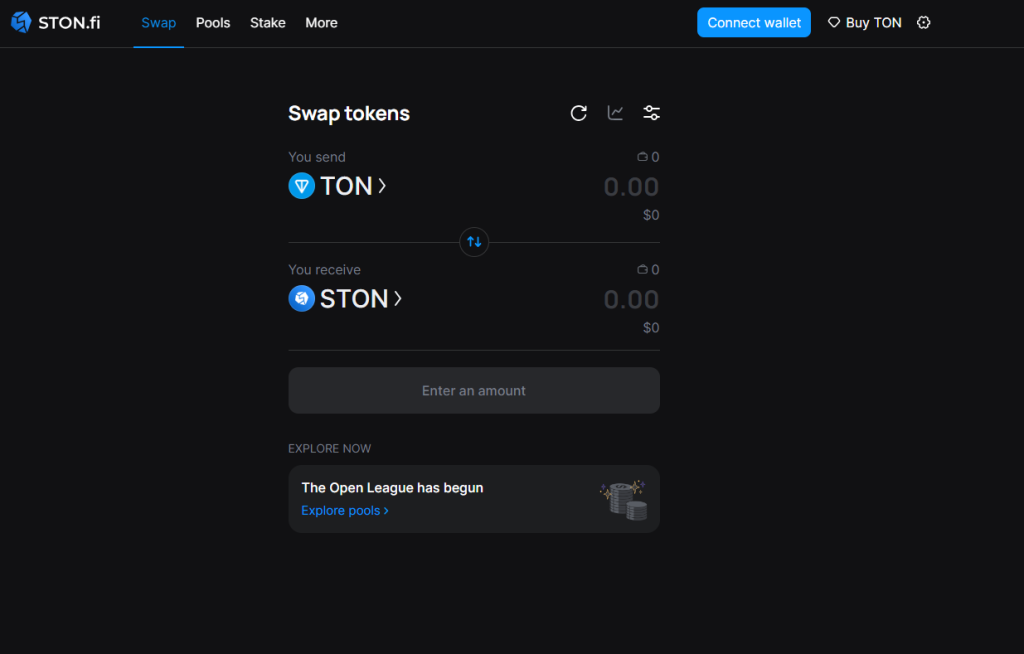

Users must connect two wallets to STON.fi to authorize transactions and access their token balances, unlike standard DEXs that only require one. They then select their desired trading pair for the exchange, even if the tokens are on different blockchains. After entering the amount of Token A to be swapped for Token B, the protocol calculates the exchange rate and displays the estimated received amount of Token B.

Users review the transaction details, including the exchange rate, fees, and estimated received amount. If all is satisfactory, they confirm the transaction through their wallet. Notably, STON.fi offers gasless transactions by deducting fees from the Token A amount, a feature that needs supportive infrastructure like wallets. STON.fi’s routing mechanism then processes the transaction. Upon completion, users receive confirmation and can view updated balances in their connected wallets.

Products

- Swap is the primary product of STON.fi, allowing users to exchange any token they desire.

When conducting a swap on STON.fi, users will be required to pay a 0.3% fee, with the breakdown as follows:

- 0.2% goes to liquidity providers as compensation, increasing the pool’s size.

- 0.1% is transferred to the StonFi protocol.

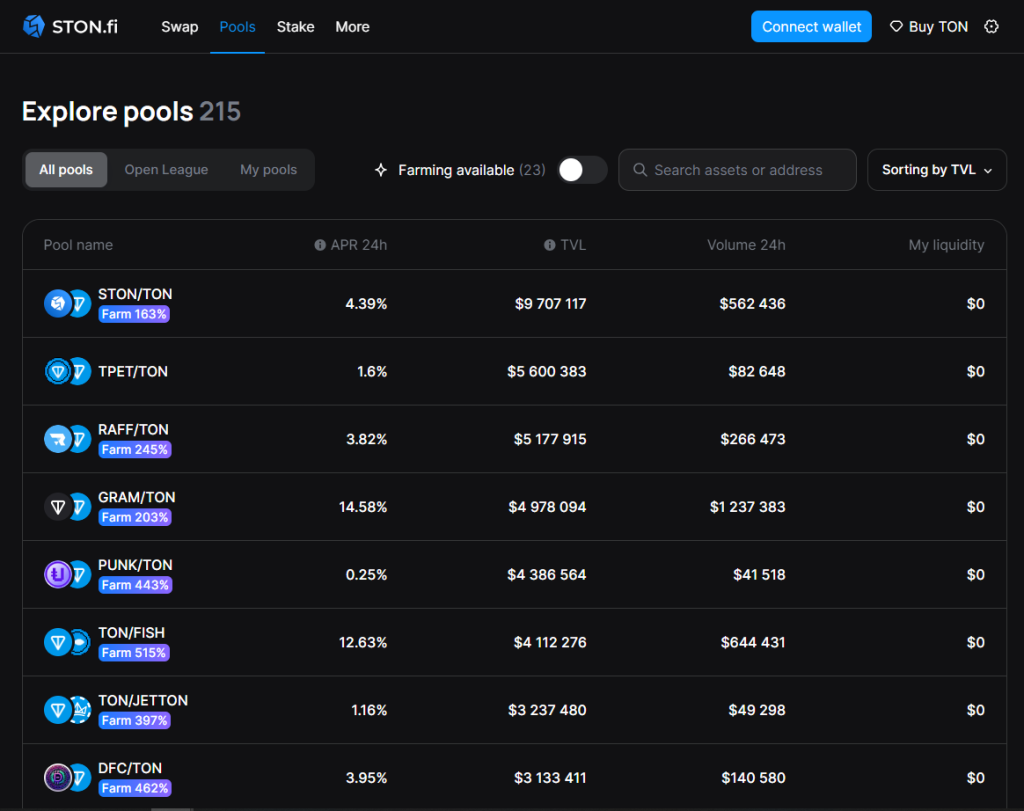

- Provide liquidity: users can add liquidity with two different currency pairs and earn fees with a very attractive APT rate.

- Stake: Users can stake $STON to earn additional profits and have the chance to receive airdrops.

Tokenomics and Use Case

Token metrics

- Ticker: STON

- Total supply: 100,000,000 STON

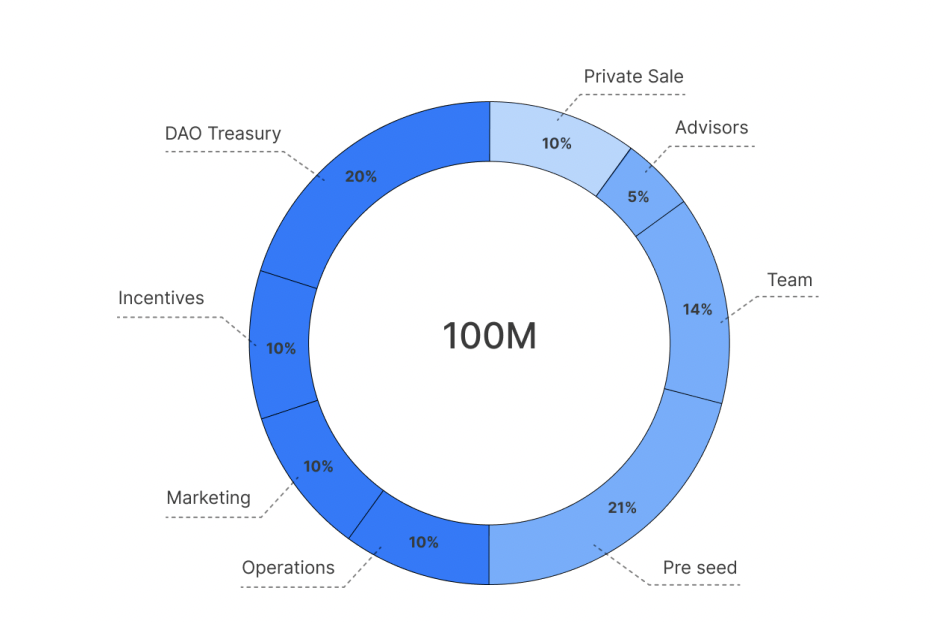

Token allocation

The distribution of the STON token is as follows:

- DAO Treasury: 20%

- User Incentive Programs: 10%

- Marketing: 10%

- Operations: 10%

- Pre-seed: 21%

- Team: 14%

- Advisors: 5%

- Private sale: 10%

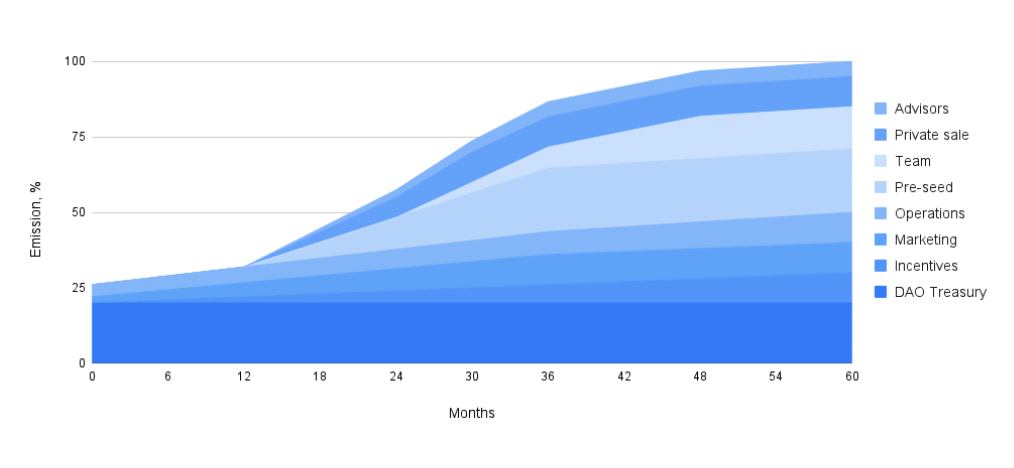

STON is set to be released according to the following schedule:

- DAO Treasury: 20% of the total supply has been staked to fund protocol development initiatives. The staked tokens will be locked for 24 months and can then be unstaked for the DAO’s use.

- Incentives: 10% of the total supply will be vested linearly over five years to incentivize user engagement with the project.

- Marketing: 10% of the total supply, with 2M tokens unlocked at TGE. The remaining 8 million tokens will vest over 3 years for marketing activities like airdrops and campaigns.

- Operations: 10% of the total supply, with 4 million tokens unlocking at TGE and the remaining 6 million vesting over five years for operational activities such as protocol development and liquidity provision.

- Pre-seed: 21% of the total supply will be locked for 12 months and paid out gradually over 2 years.

- Team: 14% of the total supply will be locked for 2 years and vested over 3 years.

- Private: 10% of the tokens will be locked for 1 year and vested over 2 years.

- Advisors: 5% of the total supply will be locked for 1 year and vested over 2 years.

Use Case

STON holders can:

- Engage in governance and vote through staking.

- Fee reductions can be obtained via the DAO governance process.

Where to Buy STON.fi?

You can directly purchase STON at ston.fi

Team and Investors

Team

Currently, no information about the project team has been disclosed.

Investor and partners

Currently, there is no specific information available about investors

Notable partners of the project include 1inch, Tonkeeper, and Tonstater.

Roadmap

Phase I:

- Cross-chain TON <–> TRON

- STON.fi SDK will support cross-chain operations. Any project will be able to integrate cross-chain operations.

Phase II:

- Cross-chain: Polygon and other EVM chains. More blockchain networks will be integrated into the STON.fi DEX protocol.

- Stableswap routing: Swap synthetic assets with the optimal path and the stableswap invariant. This opens access to any high-volume swap, lower fees, and does not limit the size of the swap to the liquidity amount.

Phase III:

- Cross-chain trustful protocol Full cross-chain protocol implementation access operation with any assets from integrated networks.

- Extra chain: A new network will be added to the cross-chain protocol.

Phase IV:

- Telegram bot with cross-chain swaps Telegram-bot has a user-friendly interface that provides all Telegram users with cross-chain operations.

- DAO governance: The DAO governance protocol will be launched.

Phase V:

- Limit order book Limit orders qualitatively expand the capabilities of trading and provide the ability to form orders to buy or sell at a fixed price.

- Margin trading is an advanced financial product. It refers to the practice of using borrowed funds from an AMM to trade assets, which serve as the collateral for the loan from the AMM.

- Gasless swap features allow transaction fees to be taken on the blockchain with any tokens. There is no need for native tokens for any operations.

Conclusion

After reading this article, I trust you now have a good understanding of the STON.fi project. It is ranked as the number one DEX project on the TON ecosystem, offering users the flexibility to conduct cross-chain transactions swiftly and securely.

CoinCu rates this project as promising for long-term investment, particularly in attracting external funds to the TON ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |