Zeta Markets Review: A Notable Perpetual Exchange on Solana

Zeta Markets lets users trade perpetual contracts for assets on the Solana blockchain. It has liquidation and insurance mechanisms and uses Chainlink and Pyth Network oracles for accurate asset price data.

What is Zeta Markets?

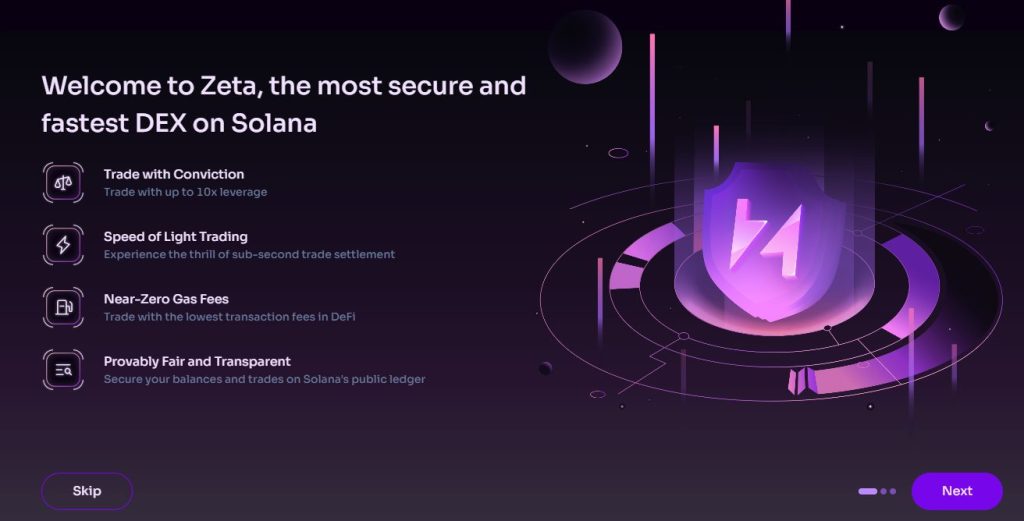

Zeta Markets is a decentralized derivative trading platform on Solana. It offers non-custodial trading with under-collateralized positions for fast long/short trades at up to x20 leverage. It combines the speed and user-friendliness of centralized exchanges with asset self-custody and transparency of DEX platforms. leading DEX platform on the Solana blockchain since 2021. Offers liquidation and insurance and uses Chainlink and Pyth Network oracles for price alignment.

Read More: The Solution To Connect Solana With The Bitcoin Network

Main Feature of Zeta Markets

Zeta Markets accepts only USDC as collateral for trading perpetual contracts. All transactions are in USDC, and users can only deposit and withdraw USDC. When placing orders, verification of initial margin and balance is required to prevent liquidation. A Liquidator takes over if liquidation occurs, trading with the party at Zeta Markets’ price. The Liquidator receives a 65% reward from the maintenance margin, with 30% going to them and 35% to the insurance fund. If a user’s account lacks funds, the liquidated collateral goes to the insurance fund for platform security.

Zeta Markets uses two on-chain oracles for accurate asset price updates:

- Pyth Network is the primary oracle for perpetual trades. If its data is current, Zeta Markets doesn’t need to consult Chainlink.

- Chainlink serves as the backup when Pyth’s data is outdated.

If both oracles have old data, Zeta Markets calculates the average of the last prices for precise and up-to-date pricing.

Read More: Solana Presale Meme Coins Abandoned After Raising 180,000 SOL

Products of Zeta Markets

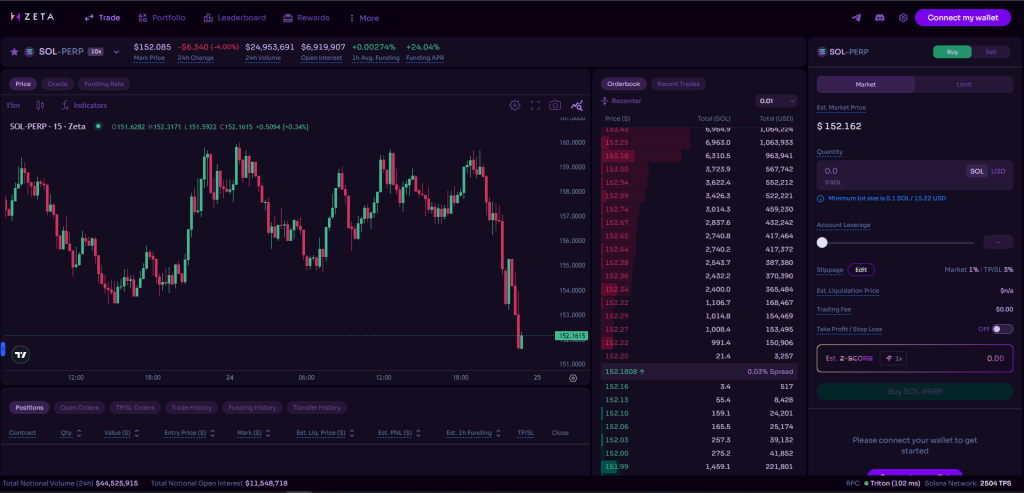

- Trade: This is a core feature of Zeta Markets, enabling users to trade long/short with a maximum leverage of x20. Based on their trading preferences, users also have the option to select between 2 order types: limit or market.

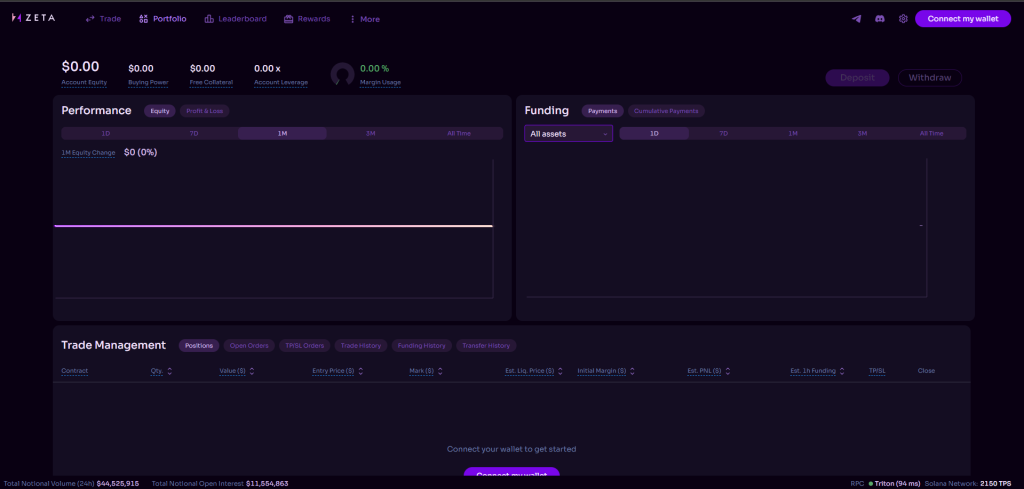

- Portfolio: This interface displays the long/short orders executed by the user, along with additional information such as profit, TP/SL…

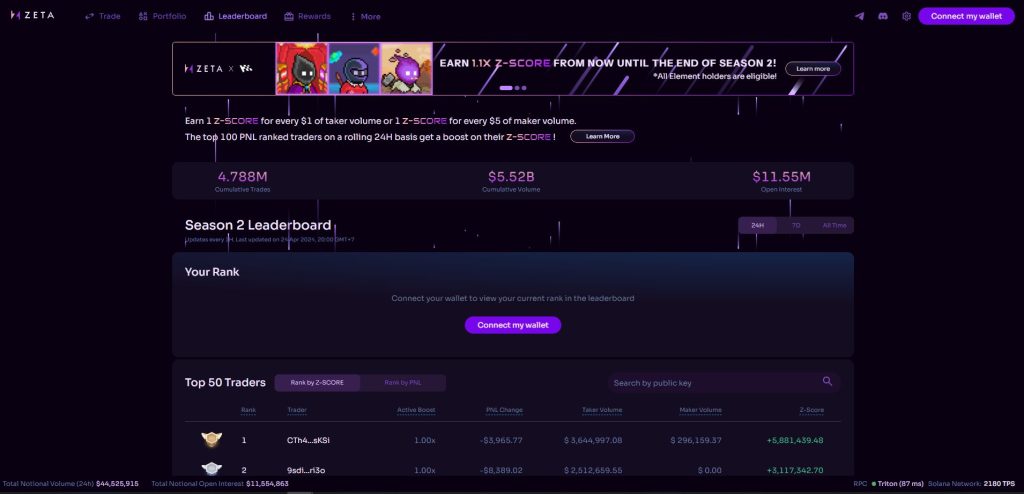

- Leaderboard and Z-Score: The Leaderboard highlights users achieving high rankings on the platform by trading and earning Z-Scores. Users can earn Z-Scores through active trading or holding Zeta Cards NFTs/Z-passes. Visit Tensor, an NFT Marketplace on Solana, to acquire these assets to earn Z-Scores.

Tokenomics and Use Case

Token metrics

- Token Ticker: $Z

- Total Supply: 1,000,000,000

Token allocation

Currently, the project has only announced 2 parts in the tokenomics. These include:

- Incentives (30%): allocated for maker and taker incentives to boost liquidity and improve exchange conditions.

- Airdrop (10%):

– 5% of supply is allocated to traders based on Z-Score.

– 1% is set for users who are also members of strategic communities in Solana.

– 4% is reserved for $Z stakers; longer staking = greater benefits.

Use Case

- Governance: $Z governs the Zeta protocol and will pioneer vote escrow tokenomics on Solana

- Staking: Unlocks governance rights & extra rewards; longer staking = greater benefits.

- Incentives: 30% of $Z’s supply is set aside for traders & liquidity providers

Where to Buy Zeta Markets?

Currently, Z is not listed on any exchange.

Team and Investors

Team

- Tristan Frizza: He is the Founder of Zeta Markets

- Imran Mohamad: He is the CMO of Zeta Markets

- Adrian C: He is the Business Development Lead of Zeta Markets

Investor and partners

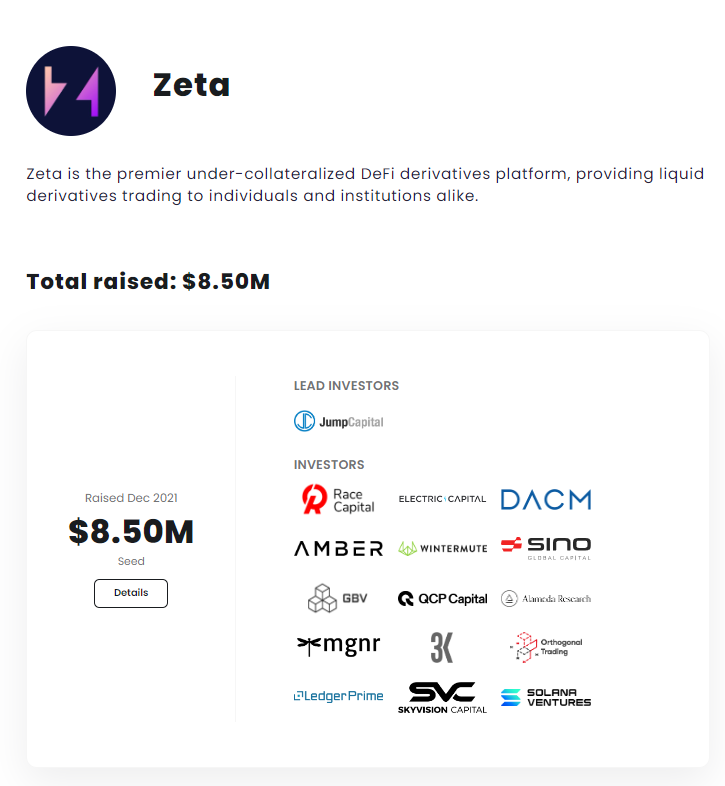

Zeta Markets successfully closed its Seed funding round on December 8, 2021, with the participation of multiple prominent investors. The total raised in this round was 8.5 million USD, with contributions from Jump Capital, GBV Capital, Solana Ventures, Sino Global Capital, Amber Group, Wintermute, and Electric Capital.

The Roadmap

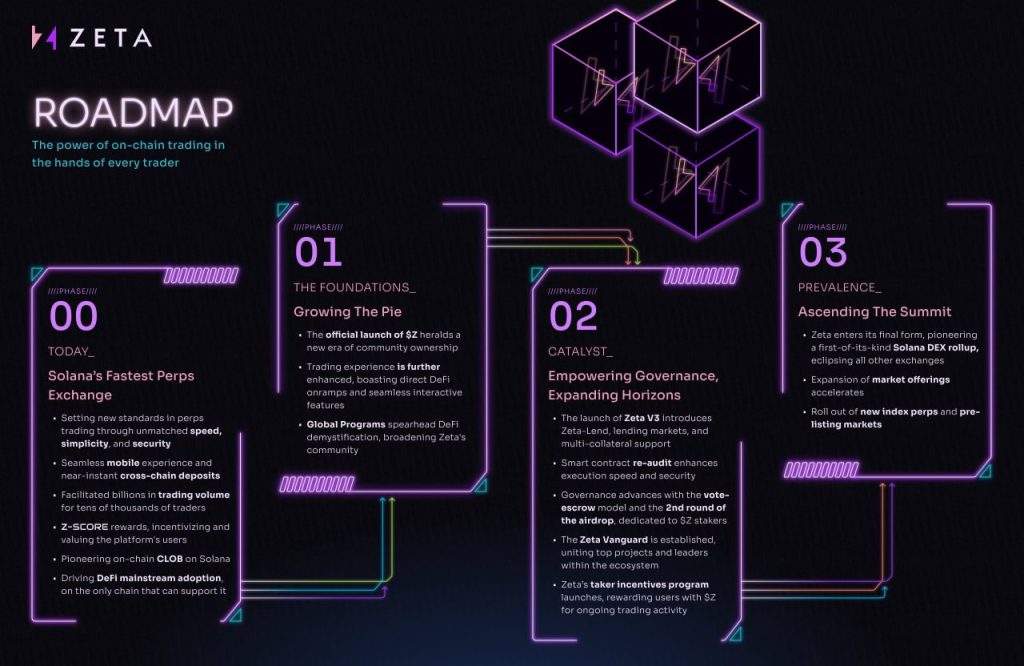

- Phase 1: Solana Fastest Perps Exchange: In Phase 1, Zeta focuses on refining tech and user experience and rolling out Z-Score. Users gain Z-scores through transactions and can double PnL rankings in 24 hours. The program offers:

– Earn 1 Z-Score for every $5 Maker transaction.

– Get 1 Z-Score for each $1 Taker transaction.

– Boosts include Z-Passes, Zeta Markets x Backpack Wallet, Zeta Markets x Pyth, and a referral program.

– Zeta rewards its community with the Ambassador Program and Zeta Creators Grant. - Phase 2: Growing The Pie: Zeta Markets will launch the $Z token and conduct an airdrop. This marks Zeta’s shift to a decentralized governance platform, distributing value directly to users. The company plans to add features, improve trading experience, and host DeFi community programs on Solana. The end of Z-Score Season 2 in April will kick off Phase 2.

- Phase 3: Empowering Governance, Expanding Horizons: This phase marks the most significant technology updates from Zeta Markets, as they launch Zeta V3 with new features like Zeta-Lend, which now supports more collateral assets. Additionally, the project has outlined plans for a second airdrop in this phase, explicitly designated for $Z stakers.

- Phase 4: Ascending The Summit: Zeta is evolving into its ultimate form by introducing a groundbreaking Solana DEX rollup. This move positions it as a competitor to centralized exchanges (CEXs), leveraging its impressive scalability. Simply put, Zeta is concentrating on developing its own Rollup platform, similar to a Solana L2, to boost scalability while maintaining Solana’s robust security features.

Conclusion

Zeta Markets is a platform that enables users to trade perpetual contracts for different assets on the Solana blockchain. The platform incorporates liquidation and insurance mechanisms for user protection. It relies on reputable oracles like Chainlink and Pyth Network to maintain accurate asset price data compared to the market.

CoinCu rates Zeta Markets as a prominent derivative project within the Solana ecosystem, offering a significant advantage in attracting capital. Moreover, the project has the potential to receive airdrops.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |