Key Points:

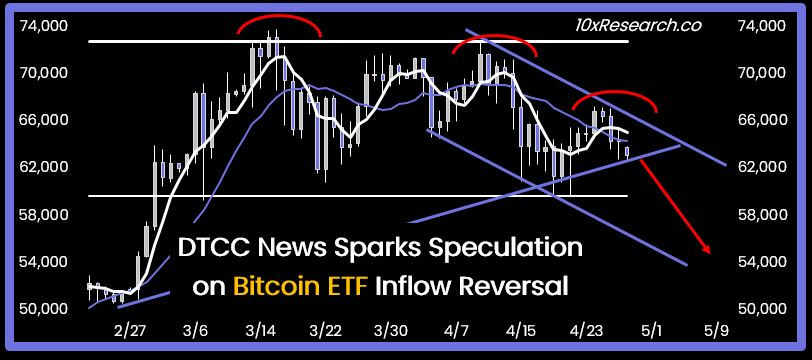

- Crypto research firm 10x Research highlights new lows and warns of a downward trend in Bitcoin’s market.

- ETFs including Bitcoin face 100% haircut in collateral valuation, potentially impacting investor sentiment.

- 10x Research’s analysis suggests a risk of ETF capital inflows reversing, signaling a significant shift in the crypto market.

Crypto research firm 10x Research has raised concerns about Bitcoin’s recent performance, highlighting new lows and the emergence of a downward trend in the market.

This observation comes at a crucial time, with the Depository Trust and Clearing Corporation (DTCC) issuing a statement that could potentially impact Bitcoin’s trajectory.

On April 4, 10x Research published an article discussing the self-reinforcing mechanism framework of Bitcoin, suggesting a risk of ETF capital inflows reversing. This analysis suggests that the current market dynamics may lead to a significant shift in investor sentiment towards Bitcoin.

DTCC’s Crypto Collateral Crackdown

The DTCC, a prominent securities clearing and settlement firm, announced changes set to take effect from April 30, 2024, regarding collateral valuation. Notably, corporate notes or bonds rated B1 to B3 will see an increase in collateral valuation from 50% to 70%. However, the most significant change lies in the treatment of investments linked to cryptocurrencies such as Bitcoin.

Under the new guidelines, any ETF or investment vehicle incorporating Bitcoin or other cryptocurrencies as underlying assets will no longer receive collateral valuation. Instead, they will be subjected to a 100% haircut, meaning their value will not be recognized for collateral purposes. This adjustment underscores the increasing scrutiny and risk associated with cryptocurrencies in traditional financial systems.

The implications of these changes are significant, potentially impacting the attractiveness of Bitcoin-related investments for institutional players. As regulatory scrutiny intensifies and market conditions evolve, investors and industry stakeholders will need to closely monitor developments to navigate the dynamic landscape of cryptocurrency investing.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |