US-based Spot Bitcoin ETFs Draw $112M From Hong Kong Asset Managers

Key Points:

- Hong Kong firms invested $112m in US Bitcoin ETFs.

- Yong Rong and Ovata invested $38m and $74m respectively.

- US Bitcoin ETFs attract investors due to lower fees, higher volume.

Hong Kong asset managers invested $112M in US-based spot Bitcoin ETFs. Yong Rong Asset Management and Ovata Capital Management are the main investors. Despite local offerings, US ETFs attract due to lower fees and higher volume.

Hong Kong-based asset managers have made significant investments in US Spot Bitcoin ETFs, totalling $112 million.

Massive Investments in US-based spot Bitcoin ETFs by Hong Kong Managers

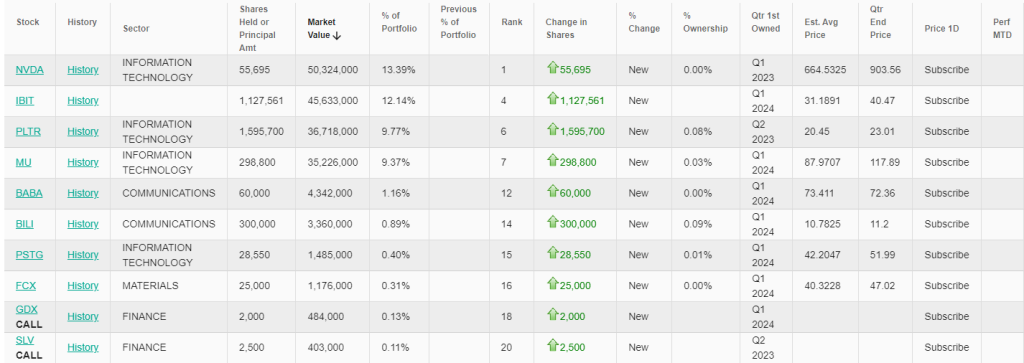

Yong Rong Asset Management purchased $38 million of BlackRock’s iShares Bitcoin Trust (IBIT), while Ovata Capital Management invested over $74 million in four separate Spot Bitcoin ETFs. These investments are noteworthy given the availability of similar offerings in Hong Kong.

2024 has seen the rise of Bitcoin ETFs as a major development in the finance sector, with the US approving their issuance in January and Hong Kong following suit in April.

Readmore: April Is The Worst Month For Bitcoin Amid ETF Outflows: Report

US Bitcoin Investment Offerings Remain Attractive Despite Local Options

Despite this, US offerings have seen more success. The recent investments by Hong Kong asset managers underscore this trend.

Yong Rong Asset Management’s investment in BlackRock’s IBIT accounts for 12% of its holdings. Ovata, on the other hand, spread its investments across four Spot Bitcoin ETFs issued by Fidelity, Grayscale, Bitwise, and BlackRock, making it the largest allocator.

Despite the approval of Bitcoin and Ethereum investment offerings in Hong Kong, US offerings continue to attract due to their low fees and high volume.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |