Network Contracts Liquidated: $75.9M Lost in 24 Hours, Shocking Traders!

Key Points:

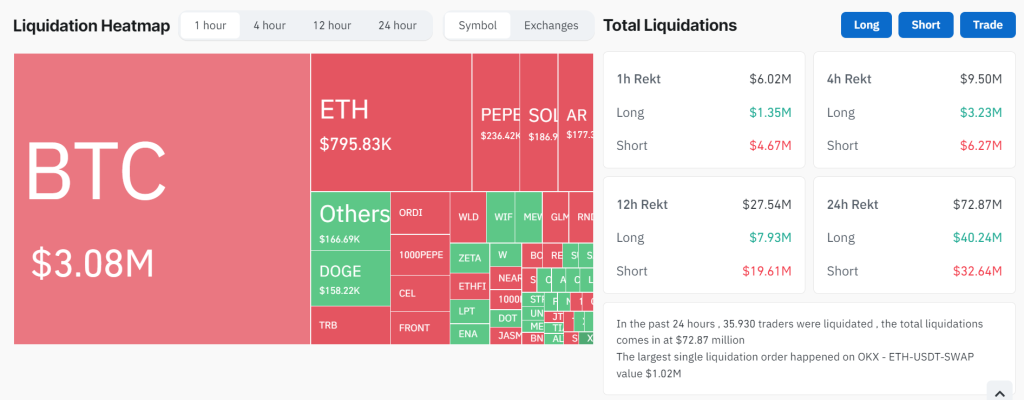

- In the past 24 hours, cryptocurrency contracts worth nearly $76 million were liquidated, impacting over 36,000 traders.

- The liquidations saw long positions totaling $44.36 million and short positions amounting to $31.57 million, reflecting widespread market turbulence.

- Heightened volatility and regulatory uncertainties contributed to the widespread liquidations, prompting traders to reassess risk management strategies and trading practices.

Data from Coinglass has unveiled staggering figures of liquidated contracts, shaking both seasoned investors and newcomers alike.

Over the past 24 hours, a jaw-dropping sum of US$75.9238 million has been liquidated across various contracts, marking one of the most significant upheavals in recent market history.

What’s particularly alarming is the number of individuals impacted by this cascade of liquidations. A whopping total of 36,936 traders found themselves on the receiving end of forced liquidations, abruptly ending their positions within the market. Among them, both long and short positions bore the brunt of the market turmoil, with long positions liquidated amounting to US$44.3564 million and short positions totaling US$31.5674 million.

Readmore: US Election Overview: Swing States, Coalitions, And 2024 Prospects

Long and Short Contracts Hit in Market Upheaval

This sudden surge in liquidations has sent shockwaves throughout the cryptocurrency community, prompting a reevaluation of risk management strategies and trading practices. Market analysts attribute the widespread liquidations to a confluence of factors, including heightened volatility, regulatory uncertainties, and margin call triggers.

While seasoned traders may have braced themselves for such market swings, the sheer magnitude of liquidations underscores the inherent risks associated with cryptocurrency trading. For many, it serves as a stark reminder of the importance of vigilance and caution in navigating the unpredictable waters of the digital asset landscape.

As the dust settles and traders take stock of the aftermath, the resilience of the cryptocurrency market once again comes into question. Will this latest bout of turbulence deter investors, or will it pave the way for renewed confidence and opportunities? Only time will tell as the market continues its perpetual dance between risk and reward.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |