Bitcoin Profit Surge: Over 86% Addresses Defy Recent Price Slump!

Key Points:

- Despite recent Bitcoin price dips, 86% of BTC addresses still in profit.

- Investor resilience shines amid market volatility.

- Study underscores Bitcoin’s enduring value proposition and investor confidence.

Despite recent fluctuations in Bitcoin profit value, a recent study reveals that a whopping 86% of BTC addresses are still basking in profits.

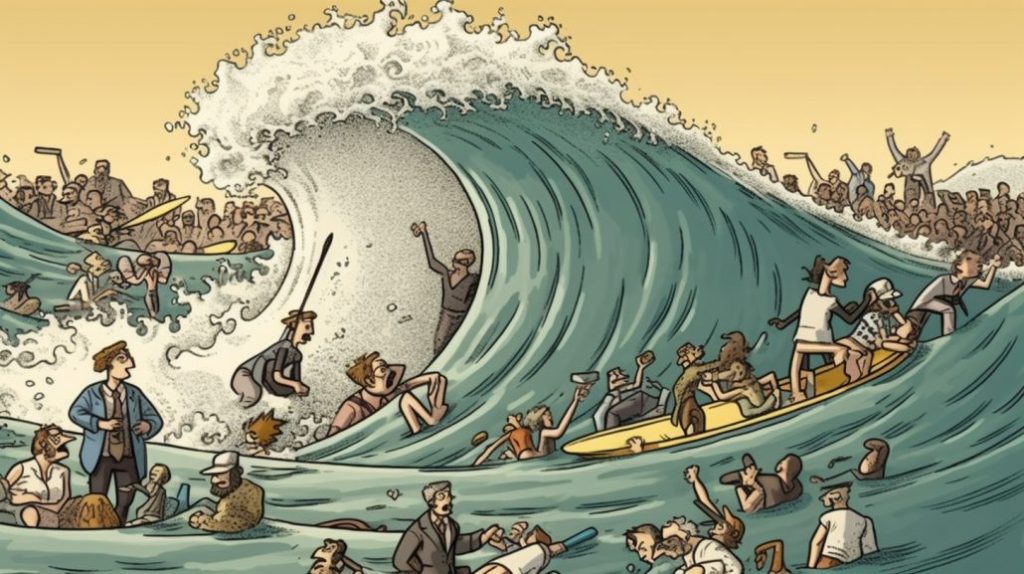

While the cryptocurrency market has been witnessing a roller-coaster ride with its price plunging, this statistic sheds light on the resilience of Bitcoin investors.

The cryptocurrency world is no stranger to volatility, and recent weeks have been no exception. Bitcoin, the leading digital currency, experienced a downward trend, causing concern among investors. However, amid the chaos, a surprising trend emerged – the majority of Bitcoin addresses are still in the green.

Readmore: US Election Overview: Swing States, Coalitions, And 2024 Prospects

Majority of Bitcoin Holders Weather Price Volatility

This revelation comes as a beacon of hope for Bitcoin enthusiasts who may have been apprehensive about the recent price actions. Despite the bearish sentiment prevailing in the market, a significant portion of Bitcoin holders have managed to weather the storm and remain profitable.

The study’s findings not only underscore the inherent strength of BTC addresses but also highlight the confidence and resilience of its investors. It indicates that a substantial number of individuals and institutions have adopted a long-term approach to their Bitcoin investments, allowing them to withstand short-term market fluctuations.

This data could potentially boost investor confidence in Bitcoin’s ability to bounce back from downturns. It serves as a reminder of the fundamental value proposition of Bitcoin as a decentralized digital asset with a finite supply, immune to the whims of central banks or governments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |