Market Overview (May 6 – May 12): SEC Actions & Surprising Market Trends

Key Points

- From SEC actions to suing Robinhood, Bitcoin’s daily mining revenue dropped significantly after halving.

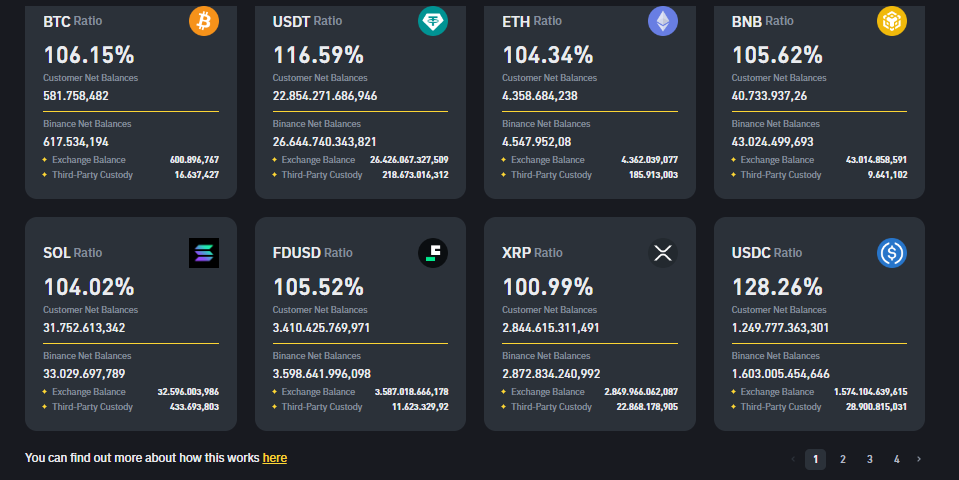

- Binance announced over 100% reserves for all coins in May, while Grayscale withdrew its Ethereum Futures ETF application.

- Emerging trends suggest a robust wave in the digital currency market, with a rise in the release of mainnet and tokens expected in Q2.

Explore the week’s biggest crypto news, from SEC actions to mining shifts and regulatory changes. Stay ahead in the crypto landscape.

Last week’s highlights big news (May 6 – May 12)

To begin with, the U.S. Securities and Exchange Commission (SEC) has sent a ‘Wells Notice‘ to Robinhood, signaling its intent to sue the company. This isn’t an isolated incident, as the SEC had previously dispatched similar notices to Uniswap and Consensys, the company supporting Ethereum and owning Metamask.

On another note, the Bitcoin mining industry has witnessed a significant shift. The average daily mining revenue reached 60 million USD in the first four months of 2024. However, post-halving, this figure dropped to 30 million USD, indicating a substantial impact on the miners’ income.

Meanwhile, Binance has announced proof of reserves for May, with all coins having over 100% reserves. The number of BTC that Binance is reserving for customers stands at 581,758 BTC, while the total BTC owned by Binance is 617,534 BTC.

In a surprising move, Grayscale has withdrawn its application for the Ethereum Futures ETF. It’s important to note that this was an application for the Ethereum Futures ETF, not the Ether Spot ETF.

FTX went bankrupt in November 2022 and has promised to compensate 98% of its victims with 118% of their lost assets, calculated at November 2022 prices. This means that victims will receive their original assets plus an additional 18% as compensation.

The political landscape is also changing, with Trump stating his intent to end the hostility toward crypto in the United States and pledging his support to allow crypto businesses to continue operating there.

In Japan, SBI Holdings bank has partnered with Chiliz to expand the fan token ecosystem. They plan to establish a joint venture to give local fans access to tokens from famous football clubs.

In Indonesia, the Commodity Futures Trading Supervisory Agency (Bappebti) has set up a Crypto Supervisory Committee to monitor and assess the activities of the crypto industry. Besides, India’s Anti-Money Laundering Agency has issued licenses to Binance and KuCoin, indicating a growing acceptance of cryptocurrency in the country.

Kenya’s president has appointed Marathon Digital, the largest public Bitcoin mining company in the United States, as an advisor on digital currency regimes and energy needs related to mining. Finally, the Philippines Securities and Exchange Commission is preparing to announce a legal framework for digital assets and transactions in the second half of 2024.

Read More: Market Overview (Apr 29 – May 5): Ethereum Security Status, Bitcoin ETF, and Market Predictions

Macroeconomics (May 6 – May 12)

Last week’s macroeconomic news was filled with significant updates and events. One of the key takeaways was the statement from Fed Governor Michelle Bowman, who stated that she doesn’t see the need for a rate cut this year. This statement has implications for the financial markets and the wider economy.

MONDAY, MAY 13

- Fed Vice Chairman Philip Jefferson and Cleveland Fed President Loretta Mester both participate in a seminar.

TUESDAY, MAY 14

- Wholesale inflation (PPI)

- Fed Governor Lisa Cook speaks

- Fed Chairman Jerome Powell speaks

WEDNESDAY, MAY 15

- Inflation CPI data: Estimate 3.4% | Last month: 3.5%

- Core inflation CPI data: Estimate 3.6% | Last month: 3.8%

- Minneapolis Fed President Neel Kashkari speaks

- Fed Governor Michelle Bowman speaks

THURSDAY, MAY 16

- New York Fed President Williams speaks

- Fed Vice Chairman for Supervision Michael Barr testifies

- Cleveland Fed President Loretta Mester speaks

- Atlanta Fed President Raphael Bostic speaks

FRIDAY, MAY 17

- Fed Governor Christopher Waller speaks

Prediction Market Crypto (May 6 – May 12)

The past week in the cryptocurrency market saw Bitcoin (BTC) maintaining its position above the 60k mark. However, most alternative coins (altcoins) experienced a downturn. A select few, including large-cap coins in the AI sector, MEME, and TON, resisted this trend due to the ‘Notcoin’ effect.

Two significant dates to look out for in May are the 14th and 15th, corresponding to the release of the PPI and CPI, respectively. Historically, these dates have shown a sideways trend in the cryptocurrency market due to weak liquidity and susceptibility to manipulation. It’s also worth noting that the CPI often mirrors the trend of the PPI.

As we enter the second quarter of the year, a rise in the release of mainnet and tokens is expected. These releases are typically planned to align with optimal market periods, hinting at a possible robust wave in the digital currency market. This could offer a prime opportunity for those looking to invest.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |