Key Points:

- U.S. April inflation drop led to Bitcoin’s 4% increase to $64,000.

- Flat market and crypto volatility spiked options market volatilities.

- Weak Ethereum rate against Bitcoin opens cross-currency trading opportunities.

According to Greeks, Bitcoin jumps after CPI report showed a slight decrease in U.S. inflation, causing crypto market volatility. Meanwhile, ETH hit a record low.

The U.S. inflation rate slightly decreased in April, according to the Consumer Price Index (CPI) report, leading to significant fluctuations in the crypto market. The CPI report, which showed an inflation increase of 0.3% compared to the 0.4% in March, was generally welcomed.

Bitcoin jumps after CPI triggers market volatility

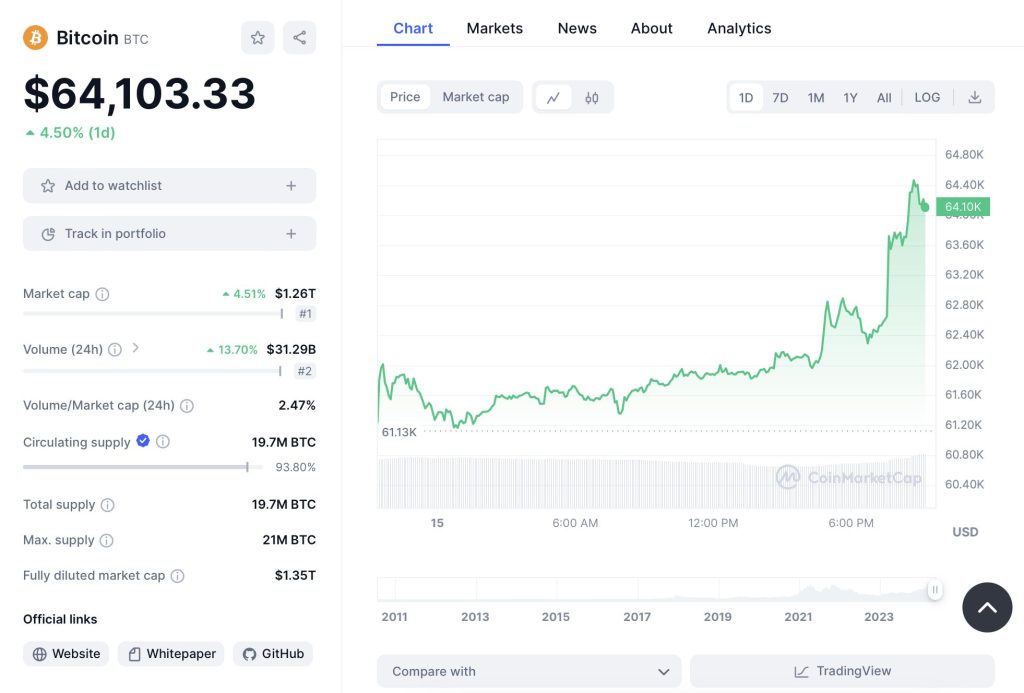

Despite the results matching expectations, it triggered significant volatility in the crypto market. Bitcoin saw a 4% increase, moving its value up to $64,000 with the Maxpain point now at $62,000. This shift prompted some short-term sellers to enter the hedging zone.

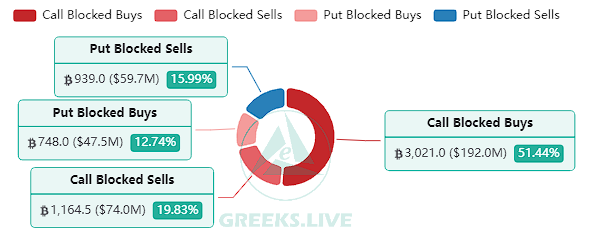

The options market also responded notably, with all major term implied volatilities (IVs) quickly reaching new highs for the month.

The upward movement was facilitated by the recent flat market, which had previously lowered major term options IV to new annual lows, thus making them extremely cost effective for buyers. Every recent event driver seems worth buying options for.

Ethereum shows weakness amid cross-currency trading opportunities

Meanwhile, Ethereum (ETH) showed a slight weakness, hitting a record low in the ETH/BTC rate. This situation provides an opportunity for cross-currency options trading.

The constant decrease in inflation during 2023 led many, including the U.S. Federal Reserve, to anticipate a considerably relaxed monetary policy in 2024.

Readmore: Crypto Market Sees V-shaped Reversal: Perfect Time For Buyers?

Traditional markets respond positively to mild inflation

However, inflation has slightly increased this year, along with continuous economic growth. The trend has squashed the possibility of imminent central bank rate cuts.

Alongside the release of the inflation numbers, the retail sales data for April showed a flat result compared to the 0.4% increase expected and March’s 0.6%.

Traditional markets reacted positively to the mild inflation and economic data, with S&P 500 futures growing by 0.5% and the 10-year Treasury yield dropping seven basis points to 4.37%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |