Market Overview (May 13 – May 19): Unicoin SEC Registration and the Rise of Meme Coins

Key Points

- Unicoin registered with the U.S. SEC, promising returns over 9,000,000%, while the SEC takes action against major entities like Uniswap, Robinhood, Coinbase, and Binance.

- The Central Bank of the Philippines approved the Coins.ph exchange to test the PHPC stablecoin, and South Korea’s Infinite Block became a validator on the XRP Ledger network.

- Cryptocurrencies ended the previous week with Bitcoin at $66,278, and a growing interest was observed in certain trending tokens like $IQ, $BICO, $CHAT, and others.

Discover the latest crypto news: SEC registrations, Central Bank approvals, market trends, and more. Stay updated!

Last week’s highlights big news (May 13 – May 19)

Unicoin, a token resembling Uniswap and promising returns over 9,000,000%, has secured registration from the U.S. SEC. This occurs while the SEC engages in lawsuits against well-known entities like Uniswap, Robinhood, Coinbase, and Binance.

The Central Bank of the Philippines greenlit the Coins.ph exchange to test the PHPC stablecoin, tied to the Philippine Peso. In a contrasting narrative, Tornado Cash developer Alexey Pertsev faces a 5-year prison sentence after a Dutch court convicted him of money laundering.

Wisconsin Investment Commission’s purchase of BlackRock’s 99 million USD Spot Bitcoin ETF signals growing institutional crypto interest. Circle Company (USDC) is relocating its legal headquarters to the U.S. ahead of its planned IPO. These moves hint at the increasing mainstream acceptance of cryptocurrencies.

Kraken exchange contemplates delisting USDT in the EU to adhere to EU’s MiCA regulations. This underlines how regulatory compliance continues to shape crypto exchanges’ operations.

The Bitcoin Asia event in Hong Kong drew over 5,500 attendees despite the ongoing Chinese Bitcoin trading ban. This shows the persistent public interest in cryptocurrencies, even amid regulatory challenges.

South Korean firm Infinite Block announced its status as a validator on the XRP Ledger network, which contributes to the expansion of the XRP Ledger ecosystem in South Korea. Besides, El Salvador continues to embrace Bitcoin, launching a website to track its Bitcoin Treasury. This reflects the country’s ongoing commitment to its revolutionary Bitcoin experiment.

Read More: Market Overview (May 6 – May 12): SEC Actions & Surprising Market Trends

Macroeconomics (May 13 – May 19)

CPI UPDATES:

➡️ This Month’s CPI = 3.4%

- Last Month = 3.5%

- Estimate = 3.4%

➡️ This Month’s Core CPI = 3.6%

- Last Month = 3.8%

- Estimate = 3.6%

Major economic events next week

Two crypto-related bills will be voted on in the House:

- Bill Against CBDC Surveillance

- Bill Clarity on what is a security/investment contract

MONDAY, May 20th

- Fed Supervisory Vice President Michael Barr speaks

- Fed Governor Christopher Waller gives a welcoming speech

- Fed Deputy Chairman Philip Jefferson speaks

TUESDAY, May 21st

- Fed Governor Christopher Waller speaks

- Fed Supervisory Vice President Michael Barr speaks

- Cleveland local Fed Chair Loretta Mester, Atlanta local Fed Chair Raphael Bostic and Boston local Fed Chair Susan Collins speak together in a panel discussion

WEDNESDAY, May 22nd

- Minutes of the Fed’s May FOMC meeting (We will see whether all Fed officials agree with Fed Chair Powell on keeping interest rates high for longer and not raising interest rates anymore)

THURSDAY, May 23rd

- Deadline for Vaneck’s Ethereum ETF proposal (SEC must reject or approve)

- Atlanta local Fed Chair Raphael Bostic speaks

FRIDAY, May 24th

- Fed Governor Christopher Waller speaks

Read More: Ethereum ETF Applications: Is There Potential For New Breakthrough?

Prediction Market Crypto (May 13 – May 19)

The cryptocurrency ended the previous week trading at $66,278. Observers closely watch the 64.6k and 63.4k levels, respectively, as Bitcoin might rechallenge these levels. At the time of writing, the primary cryptocurrencies, Bitcoin and Ethereum, have their respective support levels at $64,684 and $2940, respectively.

The third total support level is at 625 billion in market capitalization. Bitcoin represents 55.10% of the total market cap, followed by Tether (USDT.D) with 4.85%, which is on an uptrend.

From a market trend perspective, the growing interest in selected trending tokens such as $IQ, $BICO, $CHAT, $MANEKI, $PAJAMAS, $PEPE, $PYTH, $NOT, $HANK, and $VOXEL can be seen. A look at Q1 2024 exposes many factors that have taken center stage in cryptocurrency. They include AI, SocialFi, Memecoin, Layer 2 Base, BRC-20, DeSoc, GameFi, DePIN, and the emergence of ETFs.

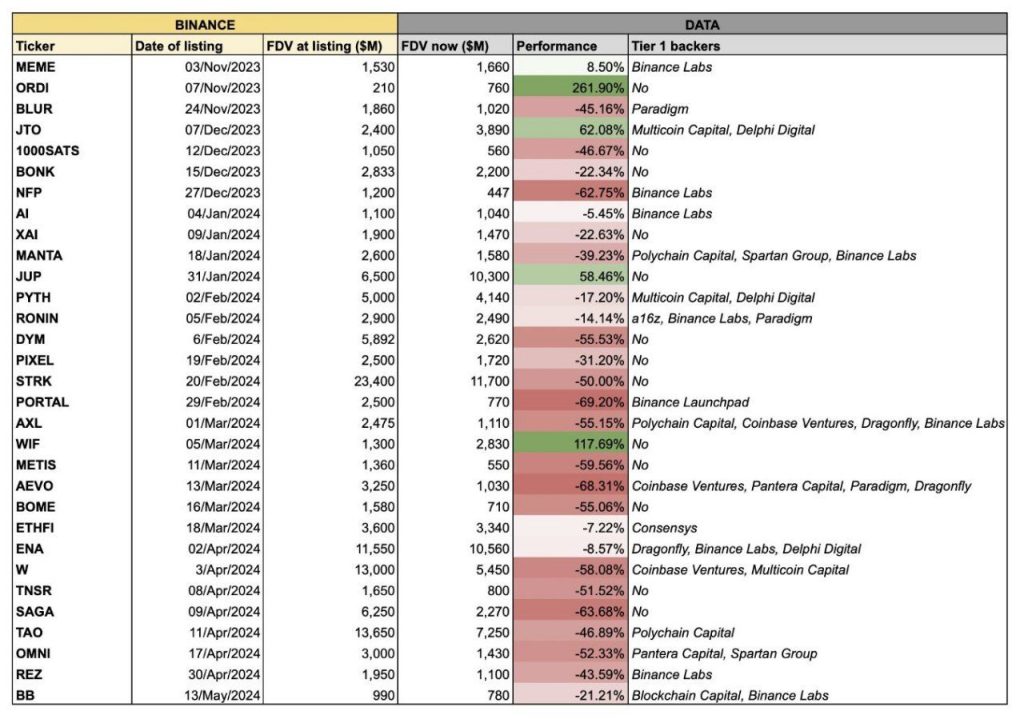

Of the recently listed coins on Binance, most have experienced a depreciation in value. However, those that have seen an appreciation in value mostly have three common characteristics: they are part of the $SOL system; they are meme coins and do not have quality backers.

These patterns imply that meme coins might be an important element of the market in the future. Their wide acceptance, coupled with possible high yields, makes them an attractive possibility for investments. As for contemporary technology coins, this market is just flailing around, and only future events will determine how well they do.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |