Spot Ethereum ETF Approval Nears As SEC Requests Faster 19B-4 Filings

Key Points:

- SEC’s review of 19b-4 filings sparks hope for Ethereum ETFs.

- Analysts raise odds for spot ether ETF approval.

- Ethereum ETF approval could significantly boost cryptocurrency interest.

The SEC accelerates 19b-4 filings review, sparking hope for Spot Ethereum ETF approval. However, approval isn’t guaranteed and depends on the classification of Ether.

According to CoinDesk, the U.S. Securities and Exchange Commission is said to have accelerated the review of 19b-4 filings for exchanges. The said development lights up the hope for the approval of Spot Ethereum ETFs.

SEC Accelerates Review of 19b-4 Filings

However, the mere fact of approval of the 19b-4 filings does not necessarily guarantee the authorization of the ETFs. S-1 applications are necessary before issuers can start trading. S-1 application approval is indefinite since no specific deadline exists.

Despite such uncertainty, a company in dialogue with the SEC expresses optimism about the chances of approval. The company’s optimism marks a significant shift from previous weeks when the SEC seemed reluctant in its processes.

Readmore: Pyth Grants $50 Million In PYTH To Stimulate Ecosystem Growth

Odds Increase for Spot Ethereum ETF Approval

Eric Balchunas and James Seyffart, analysts from Bloomberg Intelligence, raised their odds from 25% to 75% for the approval of a spot ether ETF following chatter that SEC could be adopting a more favorable stance towards applications.

However, the analysts later clarified that the odds were related to the 19b-4 approvals.

The SEC is expected to decide on VanEck’s spot ether ETF on May 23rd. Meanwhile, the SEC is investigating whether Ether—the primary asset of the Ethereum blockchain—qualifies as a security.

Potential Impacts of Spot Ethereum ETF Approval

SEC investigates Ethereum’s transition from a proof-of-work to a proof-of-stake consensus mechanism. If the SEC classifies Ether as a security, such classification could impede the approval of spot ether ETF applications.

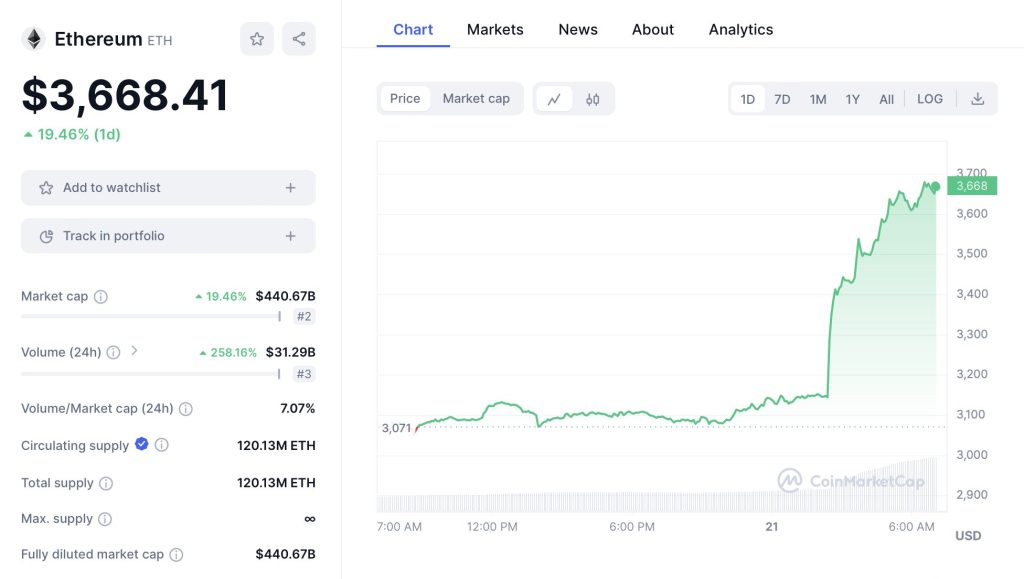

Should authorities approve the ETFs, Ethereum, already seeing an 19% rise in the last 24 hours, could skyrocket like Bitcoin’s surge upon its ETF approval.

ETF approval could generate much interest in the overall cryptocurrency market. Two crypto-based ETFs available on the stock market could boost crypto innovation and investor interest greatly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |