Fidelity Files Revised S-1 For Spot Ethereum ETF Launch Amid SEC Signal

Key Points:

- Fidelity submits revised Spot Ethereum ETF application to SEC.

- SEC shows positive shift towards spot Ethereum ETFs.

- Ethereum ETF approvals could significantly impact market dynamics.

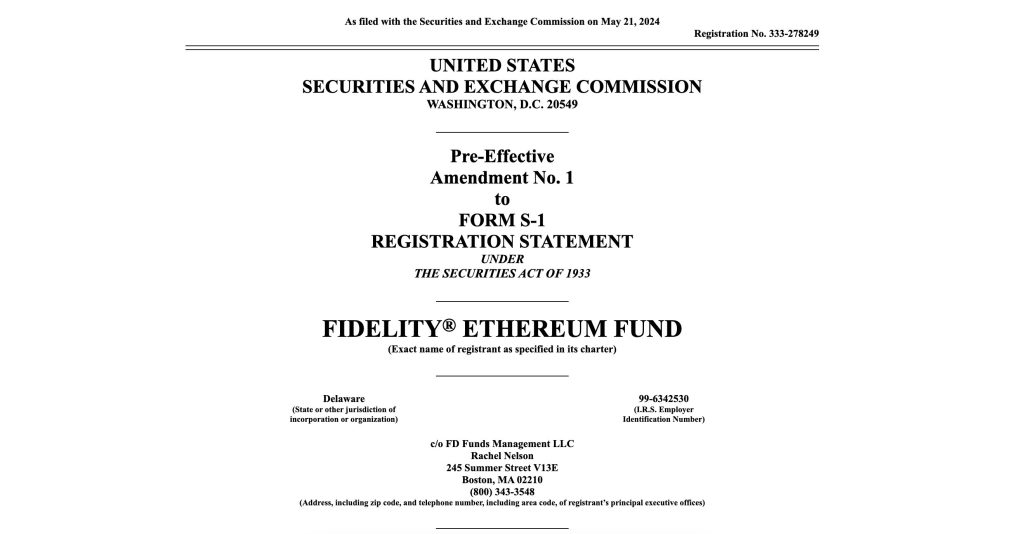

Fidelity is looking to unveil a Spot Ethereum ETF, having filed a revised S-1 application to the SEC. The ETF will not engage in staking to avoid regulatory problems.

Fidelity is pushing through with plans to launch a Spot Ethereum Exchange-Traded Fund (ETF). It has filed a revised S-1 application to the United States Securities and Exchange Commission (SEC). Timing that, a decision on Ether ETFs could finally be expected by May 23.

Fidelity Plans to Launch Spot Ethereum ETF

The revised application detailed that the underlying Ether tokens in the proposed ETF by Fidelity are not going to stake. Excluding staking is a tactical move to avoid security and regulatory matters associated with such activities.

While staking can add to the security of the network and garner returns, questions around the custody of the assets and legal regulations arise. Fidelity wants to avoid those concerns and ensure the ETF does not fall outside the scope of regulation.

An S-1 filing is a document the SEC requires for the public offering of securities in the United States. It ensures transparency and conformity with federal laws by providing a detailed view of the security and the issuer of the security.

Readmore: Spot Ethereum ETF Approval Could Surge ETH To $8,000 By 2024

Avoiding Staking to Circumvent Regulatory Issues

Sources indicate that the SEC modifies its stance on spot Ethereum ETFs under political pressure and the shift in regulatory issues. This leads the SEC to ask ETF issuers to revise their 19b-4 filings, insinuating a more positive view on the financial instruments.

Lastly, the possible approval of Ethereum ETFs may greatly affect the market. The ETF market has already seen positive activity, with the United States spot Bitcoin ETF market noting a total daily net inflow of $303 million, the highest since May 3.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |