Key Points:

- The SEC is speeding up Ethereum ETFs approval process.

- Approval would let ETFs hold actual Ethereum.

- Spot Ethereum ETFs could launch this week.

The SEC is reportedly fast-tracking approval for spot Ethereum ETFs, which would allow ETFs to hold actual Ethereum.

The U.S. Securities and Exchange Commission (SEC) is reported to be leaning toward approving spot Ethereum Exchange-Traded Funds, or ETFs.

SEC Accelerates Review for Ethereum ETFs

According to a report from Barron, the SEC is actively accelerating the review process of applicants’ documents for spot Ethereum ETFs.

Currently, the SEC allows ETFs to hold Ether futures. But the new approval would mean they would be able to hold the actual Ethereum currency.

Recently, the SEC asked exchanges to update their 19B-4 filings for their spot Ethereum ETFs, which might mean an approval by a crucial deadline this Thursday.

Implications of Spot Ethereum ETF Approval

To approve the Ethereum ETFs, the SEC must authorize both the 19b-4s (exchange rule changes) and the S-1s (registration statements).

And if both these elements are approved, it’s likely that all ETF applications will be approved at once, allowing the funds to go live and be available for trading in the market.

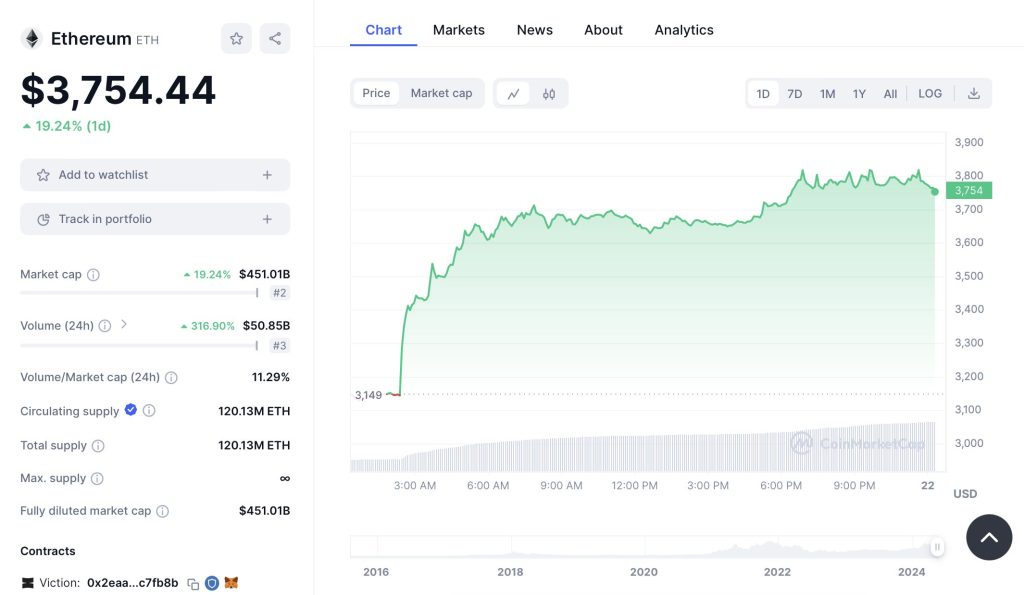

The approval of the Ethereum ETFs may impact the cryptocurrency market. Ethereum, as the second-largest cryptocurrency by market capitalization after Bitcoin, increased its value by nearly 20% to trade at $3,754.44 at the time of the report.

Readmore: Spot Ethereum ETF Approval Could Surge ETH To $8,000 By 2024

Potential Introduction of Spot Ethereum ETFs This Week

The SEC’s approval of Bitcoin ETFs took a considerable amount of time, and the market expects a similar timeline for Ethereum ETFs.

However, the introduction of spot Ethereum ETFs into the market may be as soon as this week if all approvals are given. The SEC has yet to officially comment on these reports.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |