Key Points:

- Symbolic Capital’s sale of 6,968 ETH may have lowered Ethereum’s price.

- BlackRock and Fidelity have reapplied for Ethereum ETFs with the SEC.

- The SEC is poised to approve Ethereum ETFs by May 23.

ETH price dropped right after Symbolic Capital Partners sold 6,968 ETH, valued at approximately $27.38M. Meanwhile, spot Ethereum ETF interest goes on, with a decision expected by May 23.

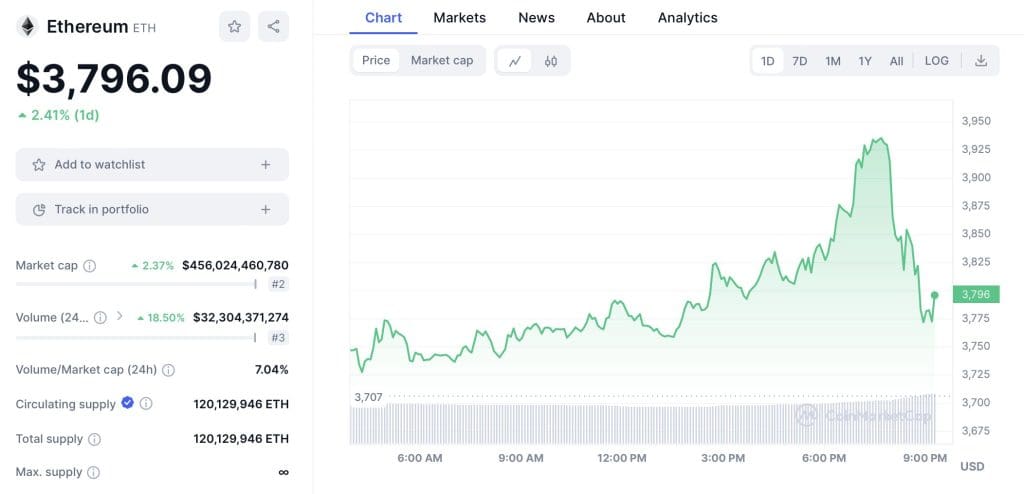

The price of Ethereum (ETH) may have been suppressed due to the sale of 6,968 ETH by MEV trading firm Symbolic Capital Partners. According to monitoring by Twitter user @ai_9684xtpa, ETH briefly fell below 3800 USDT half an hour ago.

ETH Price Drop Following Massive Sale

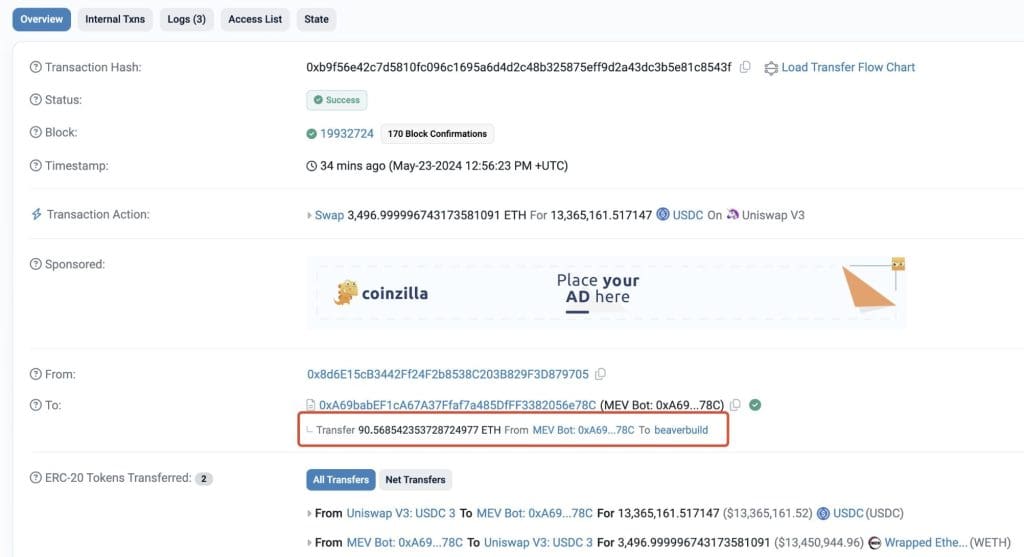

As reported, Symbolic Capital Partners sold 6,968 ETH, equivalent to about 27.38 million U.S. dollars, within a minute. The average selling price stood at 3,930 U.S. dollars, with a single transaction selling 3,497 ETH at once on the chain and a bribe fee of 90 ETH.

Ethereum has recently been a focus in the market due to its spot Ethereum exchange-traded funds (ETFs). According to a report from CoinCu, BlackRock has refiled for its spot Ethereum ETF based on an amended 19b-4 form to the United States Securities and Exchange Commission (SEC).

Readmore: Spot Ethereum ETF: BlackRock Re-files Critical Form With SEC

Recent Developments in Ethereum ETFs

It is also reported that Fidelity continues to plan for a spot Ethereum ETF with a revised S-1 application sent to the SEC. Projections suggest a decision regarding Ether ETFs may be out by May 23.

The US SEC is seemingly ready to greenlight spot Ethereum ETFs, a report from Barron says. ETH is trading at $3,796 at the time of writing, after retreating from the recent high of $3,935 set during a two-month high earlier.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |