Key Points:

- US SEC approves Spot Ethereum ETFs.

- Approval expands institutional access to Ethereum.

- Issuers await clearance for Ether-based ETFs.

The SEC has approved the issuance of Spot Ethereum ETFs, expanding access to the world’s second-largest cryptocurrency. Several issuers await clearance of their individual filings.

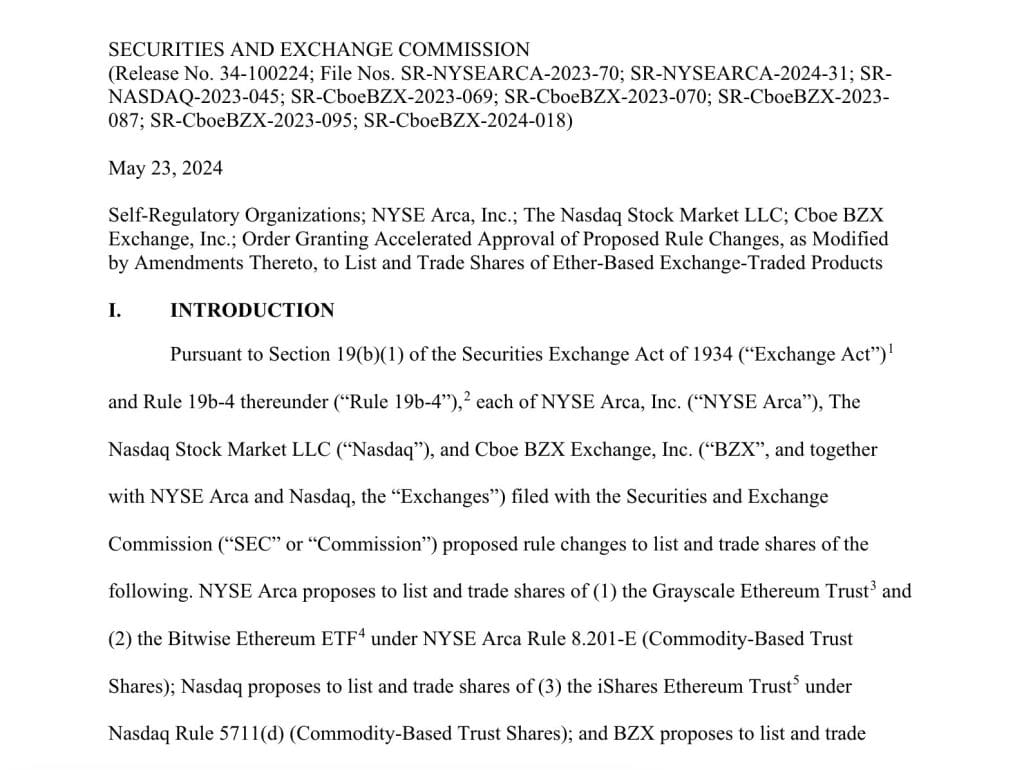

The US Securities and Exchange Commission has cleared the path to allow the issuance of Spot Ethereum Exchange-Traded Funds (ETFs), a major development in the nation’s crypto landscape. The decision arrives within five months of the SEC’s clearance of Spot Bitcoin ETFs.

SEC Approves All Spot Ethereum ETFs

Spot Ethereum ETFs stand as the second crypto-based ETF cleared by the SEC, paving the way for expanded access to the world’s second-largest cryptocurrency by market capitalization for institutions.

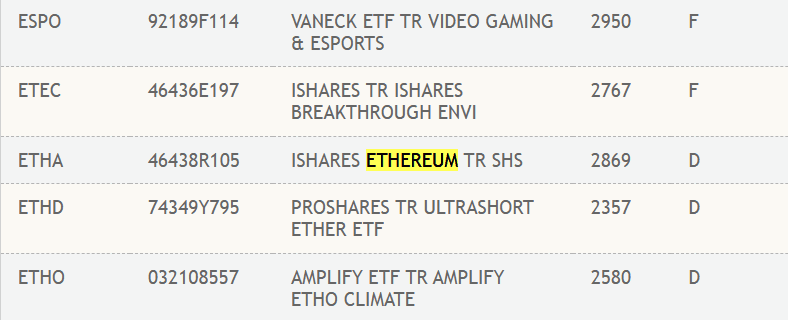

Watcher.Guru recently reported that BlackRock’s Spot Ethereum ETF has been registered with the DTCC under the ticker ETHA.

Although the initial decision was to put off the approval due to the earlier negative sentiment toward cryptocurrencies, the SEC has expanded the ETF market to include both Bitcoin and Ethereum. However, issuers would need to wait for the clearance of their individual filings.

The market was expecting the introduction of another cryptocurrency following the approval of the Spot Bitcoin ETFs at the start of 2024. Predictions were most pegged on Ethereum. However, the overall sentiment of the SEC dampened such optimism.

Impact of SEC’s Decision on Crypto Market

In mid-May, a surprise move by Bloomberg shifted the approval odds from 25% to 75%. The market began readying itself for the introduction of an Ethereum-based investment product.

The approval of Spot Ethereum ETFs by the SEC now means the United States hosts crypto-based ETFs for the two largest digital assets worldwide. The move greatly impacts reshaping the nation’s stance on such assets.

Several issuers, including VanEck, ARK21 Shares, Hashdex, Invesco Galaxy, Franklin Templeton, Fidelity, and BlackRock, have applied for the listing of Ether-based ETFs. Among these, VanEck is facing the most imminent deadline for approval.

Readmore: Powerful Bipartisan Support For Crypto In Congress, Says Senator Lummis

Ethereum’s Potential Market Trajectory

The issuers now only await the clearance of their S-1 forms after the SEC has approved the Ethereum ETF 19b-4 forms. The SEC may require more time to process each filer, especially if the regulator retains any skepticism towards the Ethereum ETFs.

The effect these developments will have on the markets remains to be seen. In the three months after Bitcoin’s listing, the asset would go on to realize an all-time high.

Many have said that Ethereum will follow the same trajectory, as the ETF anticipation has already propelled the asset nearly 30% over the last week.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |