Key Points:

- JPMorgan doubts SEC will approve Solana and other crypto ETFs.

- SEC’s Ethereum ETFs approval pushes boundaries due to classification debates.

- Despite optimism from some analysts, JPMorgan remains cautious on more crypto ETFs.

According to The Block, JPMorgan says Solana ETF approval prospects are dim, citing the SEC view of most cryptocurrencies as securities. Exceptions are Bitcoin and Ethereum.

JPMorgan says the prospects of the United States Securities and Exchange Commission (SEC) approving Solana and other crypto exchange-traded funds (ETFs) remain dim. The firm is skeptical, even after the SEC approved Ethereum ETFs recently.

JPMorgan’s Skepticism on Solana ETF Approval by SEC

JPMorgan’s managing director and global market strategist, Nikolaos Panigirtzoglou, was quoted as saying that the bank doesn’t think the SEC is going to approve Solana or any other token ETFs. He cited the SEC’s standpoint that most cryptocurrencies are regarded as securities.

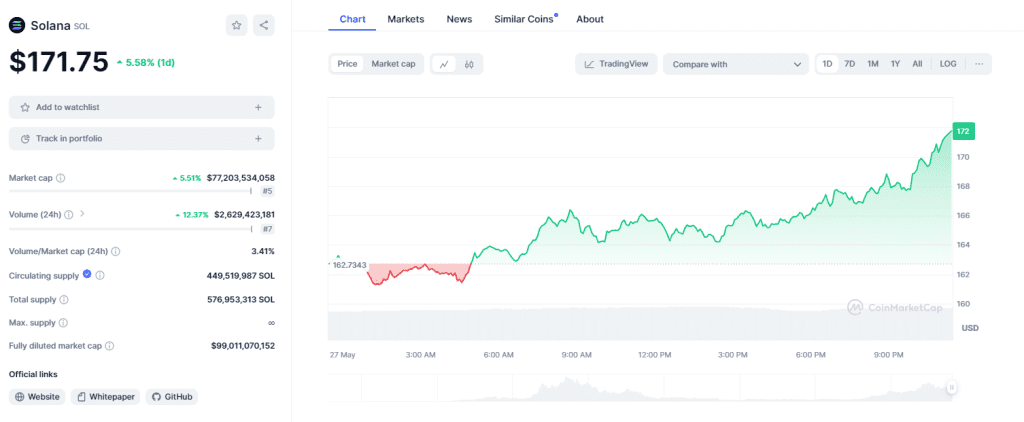

At the time of writing, Solana is trading at approximately $171.75, representing a nearly 6% increase over the last 24 hours, as shown by CoinMarketCap.

The SEC, according to Panigirtzoglou, was pushing the boundaries with its approval of Ethereum ETFs. He argued that there was still debate among the stakeholders over the classification of Ethereum as a security.

Panigirtzoglou said the SEC wouldn’t go on to approve other token ETFs, as the regulator has the view that all other tokens outside Bitcoin and Ethereum are tokens that should be regarded as securities.

Readmore: Floki Telegram Trading Bot Fuels 23% Price Surge

Potential for More Crypto ETFs Following Ethereum ETF Approval

However, the SEC might pass approval for other crypto ETFs should U.S. lawmakers pass legislation stating that most cryptocurrencies are not securities. No such legislation currently exists. The SEC recently approved spot Ethereum ETFs in what some analysts have termed as a political move.

The regulator approved 19b-4 forms for eight spot Ethereum ETF applicants, including Grayscale, Bitwise, BlackRock, VanEck, Ark 21Shares, Invesco, Fidelity, and Franklin. Trading of the ETFs is expected to start in the coming weeks, pending SEC sign-off.

Some analysts, however, think the SEC’s recent approval of Ethereum ETFs could be the gateway to the opening of more crypto ETFs pegged on other cryptocurrencies and tokens, while JPMorgan remains cautious.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |