Mt. Gox Plans Secure Handling of Bitcoin and Bitcoin Cash for Repayments!

Key Points:

- Mt. Gox confirms multiple transactions today aimed at preparing repayments to creditors before the October 31 deadline.

- With the deadline approaching, Mt. Gox intensifies efforts to fulfill obligations to creditors, signaling progress in the repayment process.

- Despite challenges, Mt. Gox demonstrates determination by accelerating transactions, providing hope to creditors awaiting compensation.

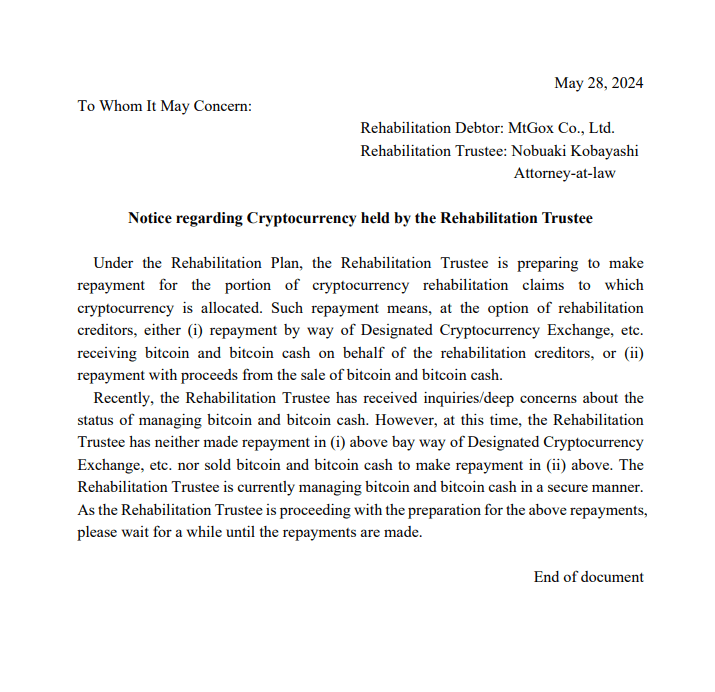

Mt. Gox clarified that they have not initiated direct repayments of Bitcoin (BTC) or Bitcoin Cash (BCH) through designated cryptocurrency exchanges, nor have they sold any BTC or BCH to facilitate repayments.

The Rehabilitation Trustee is diligently managing both cryptocurrencies in a secure manner.

Former Mt. Gox CEO, Mark Karpelès, echoed similar sentiments on X, emphasizing the cautious approach taken by the Trustee. Karpelès stated, “The Trustee is transferring the tokens to another wallet in preparation for potential distributions this year, and will not immediately sell Bitcoin.” This strategy aligns with the objective of ensuring a systematic and well-organized process for potential distributions to creditors.

Mt. Gox Accelerates Transactions for Creditor Repayments

The announcement comes amid ongoing efforts to address the fallout from the infamous Mt. Gox hack, which resulted in the loss of significant amounts of BTC and BCH. The Rehabilitation Trustee’s careful management of these assets reflects a commitment to maximizing the value available for repayments while minimizing market disruption.

Creditors of Mt. Gox have been eagerly awaiting updates on the repayment process, with many hoping for a resolution after years of uncertainty. The Trustee’s approach, focusing on secure handling and potential distributions, offers a glimmer of hope for those affected by the exchange’s collapse.

The statement also underscores the complexities involved in managing the assets of a defunct cryptocurrency exchange and highlights the importance of transparent communication with stakeholders. As the Trustee continues to navigate the repayment process, stakeholders will remain vigilant for further updates regarding the distribution of assets and the resolution of outstanding claims.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |