Key Points:

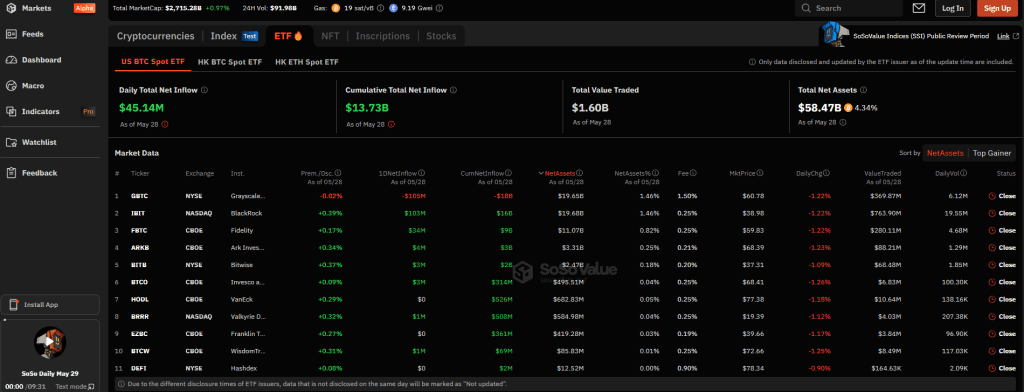

- Bitcoin spot ETFs saw a net inflow of $45.1432 million on May 28, marking 11 consecutive days of positive inflows.

- BlackRock ETF (IBIT) led with a $103 million inflow, while Fidelity ETF (FBTC) added $34.3451 million, indicating strong investor confidence.

- Grayscale’s Bitcoin Trust (GBTC) faced a $105 million outflow, highlighting a shift towards newer ETF options with better liquidity and lower fees.

Bitcoin spot ETFs experienced a significant net inflow of $45.1432 million, marking the 11th consecutive day of positive inflows. This trend highlights the growing investor interest and confidence in Bitcoin as an asset class.

Leading the pack was BlackRock’s ETF, IBIT, which recorded a substantial inflow of $103 million. This strong performance underscores BlackRock’s influence and the trust investors place in its financial products. Fidelity’s ETF, FBTC, also saw considerable interest, with an inflow of $34.3451 million. This steady influx indicates that Fidelity’s reputation and its strategic positioning in the market are attracting significant investor capital.

Grayscale’s Bitcoin Trust (GBTC) experienced an outflow of $105 million on the same day. This outflow from GBTC may reflect a shifting investor preference towards newer ETF offerings that promise lower fees and improved liquidity compared to the traditionally more expensive and less liquid trust structure offered by Grayscale.

Grayscale Bitcoin Trust Faces Outflows

The overall trend of sustained inflows into Bitcoin spot ETFs is a positive signal for the cryptocurrency market, suggesting robust institutional interest. These consistent inflows are likely driven by a combination of factors, including growing mainstream acceptance of Bitcoin, increased regulatory clarity, and the ongoing search for alternative assets in a volatile economic environment.

The movement of funds between different ETFs also indicates a competitive landscape where newer products like those from BlackRock and Fidelity are gaining traction at the expense of older structures like GBTC. As more firms enter the market with innovative offerings, competition is expected to intensify, potentially driving further growth and innovation in the cryptocurrency ETF space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |