The cryptocurrency exchange market may seem scarily saturated, but understanding the fees that are so nuanced on a crypto exchange can be a game-changer for traders. Today, let’s join Coincu to learn about crypto exchange fees that you can refer to.

What Are Crypto Exchange Fees?

Crypto exchange fees refer to the costs incurred by a person from a platform involved in the buying, selling, or trading of cryptocurrencies. These may vary considerably, depending on a specific exchange, type of transaction, trading volume, and other factors. Here are some common types of fees you can expect to find on crypto exchanges:

- Trading Fees

- Deposit and Withdrawal Fees

- Exchange Rate Fees

- Network Fee

- Margin Trading Fees

- Subscription or Membership Fees

- Inactivity Fees

These are fees incurred when you execute trades on a particular exchange. These fees usually take on a percentage form of the total traded amount or fixed charges on every trade. Trading fees can vary with trading volume, the type of the order, and the type of user—maker or taker.

Some exchanges charge a deposit fee or a withdrawal fee. The deposit fee can be on all deposits made into your account or on particular deposit options, while withdrawal fees can be based on the means of payment used, such as bank transfer, credit card, or cryptocurrency transfer.

Exchanges may charge a fee for trading between various cryptocurrencies or between cryptocurrencies and fiat currencies. The exchange rate incorporates the exchange fee and can sometimes not be shown as a separate line.

For cryptocurrency transactions, network fees are normally included with the processing of that transaction on the blockchain. This fee is paid to miners or validators who complete and validate the transaction in the blockchain network.

Some exchanges also offer margin trading, which basically provides the user with leverage when trading. In such cases, there would be additional fees in relation to borrowing funds and holding margin positions.

Some exchanges offer premium services or features to its users for a subscription or membership fee.

Inactivity fees can also be incurred in some exchanges if an account stays inactive for a fixed period.

Readmore: Top Zero-Fee Crypto Exchange Platforms (2024)

Crypto Exchange Fees Comparison

| Exchange | Fees | Deposit Fee | Withdrawal Fee |

| Binance | 0.0012% to 0.1% maker fees, 0.0124% to 0.1% taker fees | Depends on fiat currency | Blockchain Fees |

| OKX | 0.005% to 0.8% maker fees, 0.015% to 0.1% taker fees | Depends on fiat currency | Blockchain Fees |

| Coinbase | 0.0% to 0.4% maker fees, 0.05% to 0.6% taker fees | USD Deposits: $10 | USD Withdrawals Fees: $25 Crypto Withdrawals Fees: Blockchain Fees |

| Crypto.com | 0.0% to 0.75% maker fees, 0.05% to 0.075% taker fees | Free | USD Withdrawals Fees: $25 Crypto Withdrawals Fees: Blockchain Fees |

| ByBit | 0.005% to 0.1% maker fees, 0.015% to 0.1% taker fees | Depends on fiat currency | Blockchain Fees |

| Kraken | 0.0% to 0.16% maker fees, 0.1% to 0.26% taker fees | Depends on fiat currency | Blockchain Fees |

| Gemini | 0.03% to 0.2% maker fees, 0.1% to 0.4% taker fees | 0.0% to 3.49% | Blockchain Fees |

| Kucoin | 0.005% to 0.1% maker fees, 0.025% to 0.1% taker fees | Free | Blockchain Fees |

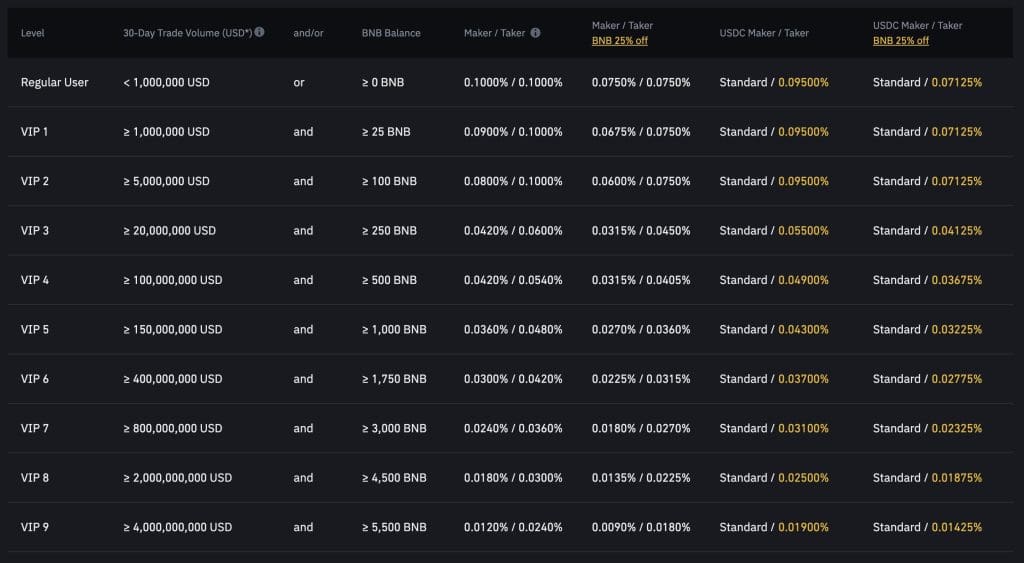

1. Binance

Binance will usually be found to have some of the lowest trading fees in the entire cryptocurrency space. Crypto exchange fees on the Binance.US platform are a bit higher compared to those of others in the space but are still competitive with some of the major exchanges.

The majority of traders typically enjoy low fees based purely on this reason alone, and Binance has become the go-to platform for serious traders looking to save some money on trading fees.

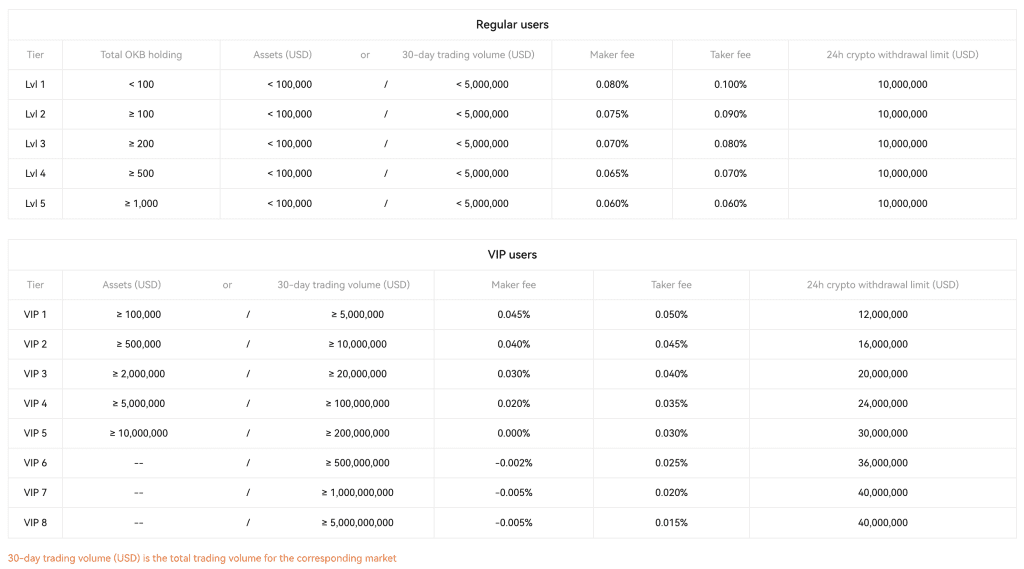

2. OKX

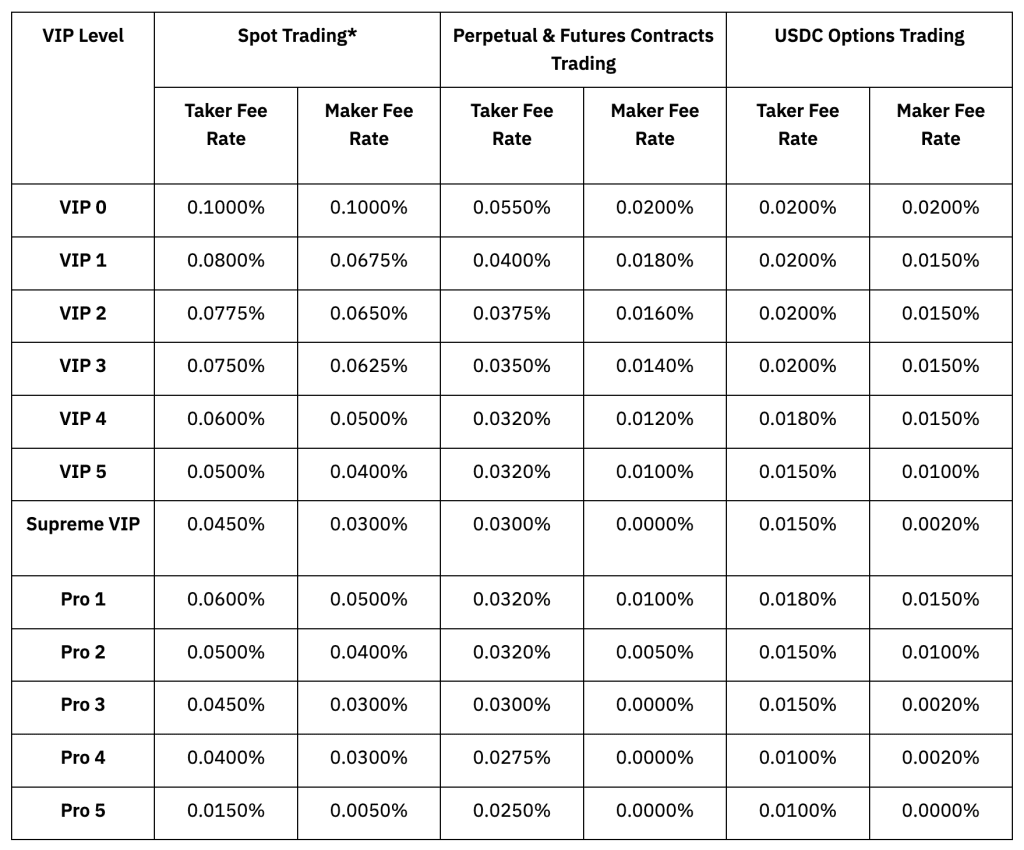

OKX follows a tiered fee structure based on trade volume and account holdings. Spot trade fees can go as high as 0.06%. Traders who are doing large volumes or holding large amounts of OKB, the platform’s native token, will earn discounts. There are also other fee schedules for futures, swaps, and options.

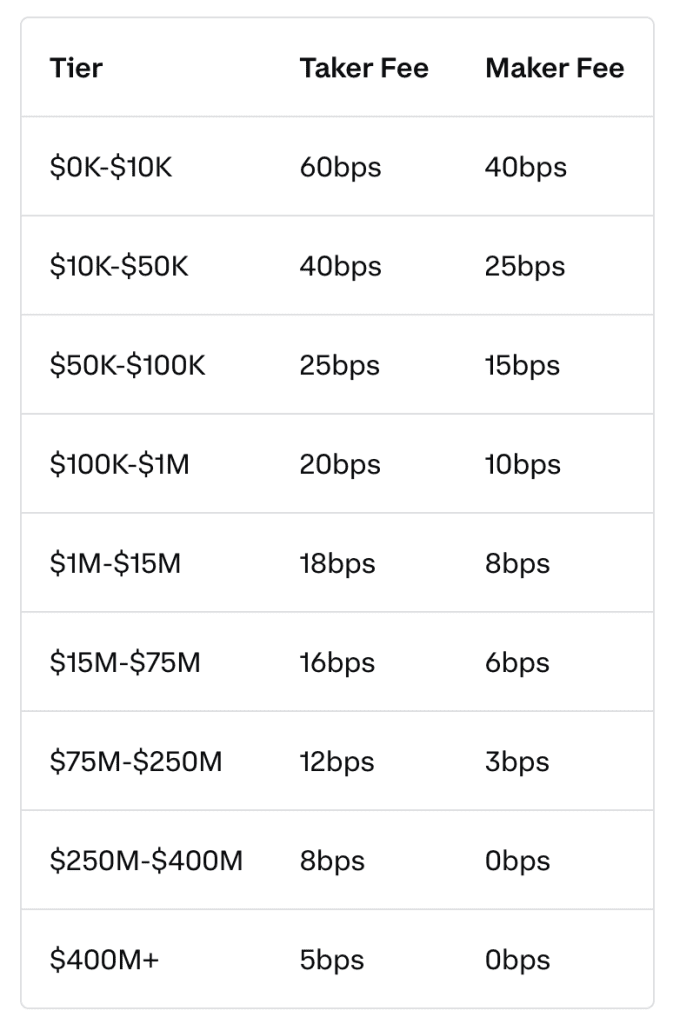

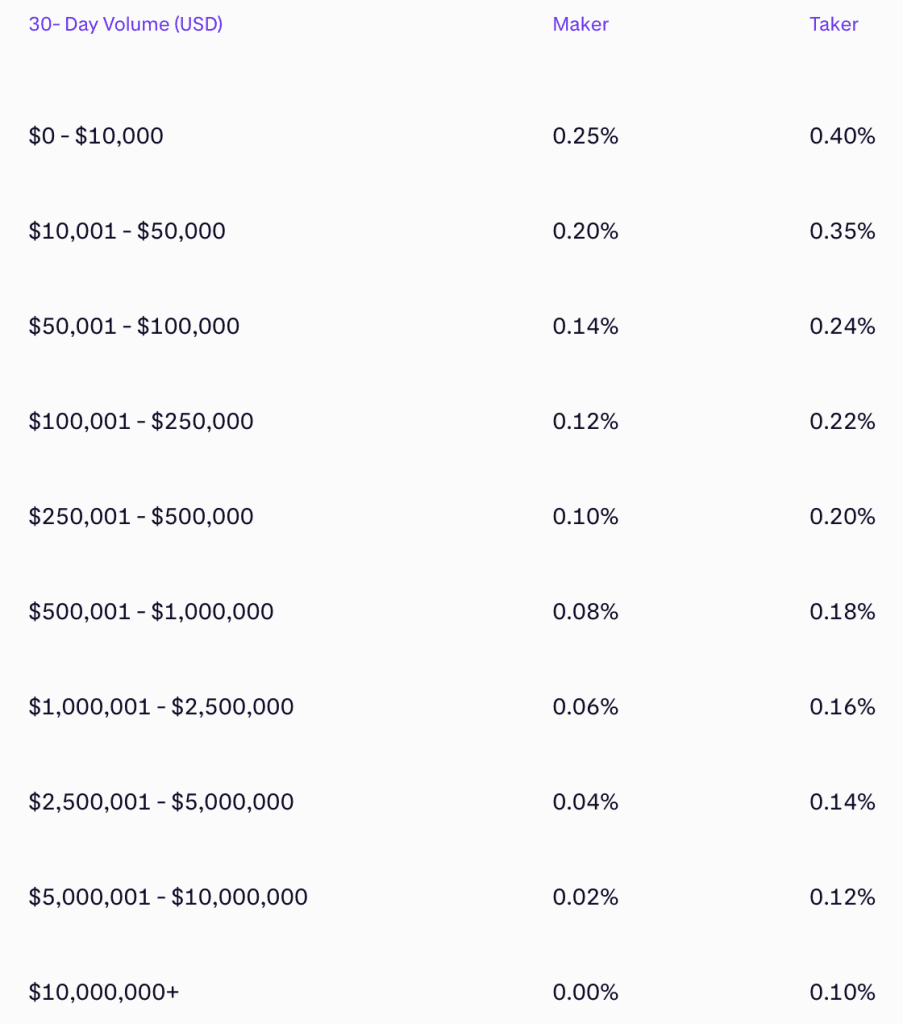

3. Coinbase

There is no single consolidated page for the fee structure; it is all over the platform. Coinbase segregates the traders into two categories: makers and takers. The maker is promoted through the fee schedule.

Makers pay the transaction fees of 0.00% to 0.40%. Conversely, takers pay the fees as well; it is 0.05% to 0.60% of their transaction. The fee declines with the user’s tier and transaction volume, which is in favor of trading larger amounts.

In this way, through the tier-based system, Coinbase encourages a higher volume in transactions by lessening the fee for a user as they transact more, so it is about making an environment where trade will be more active.

4. Crypto.com

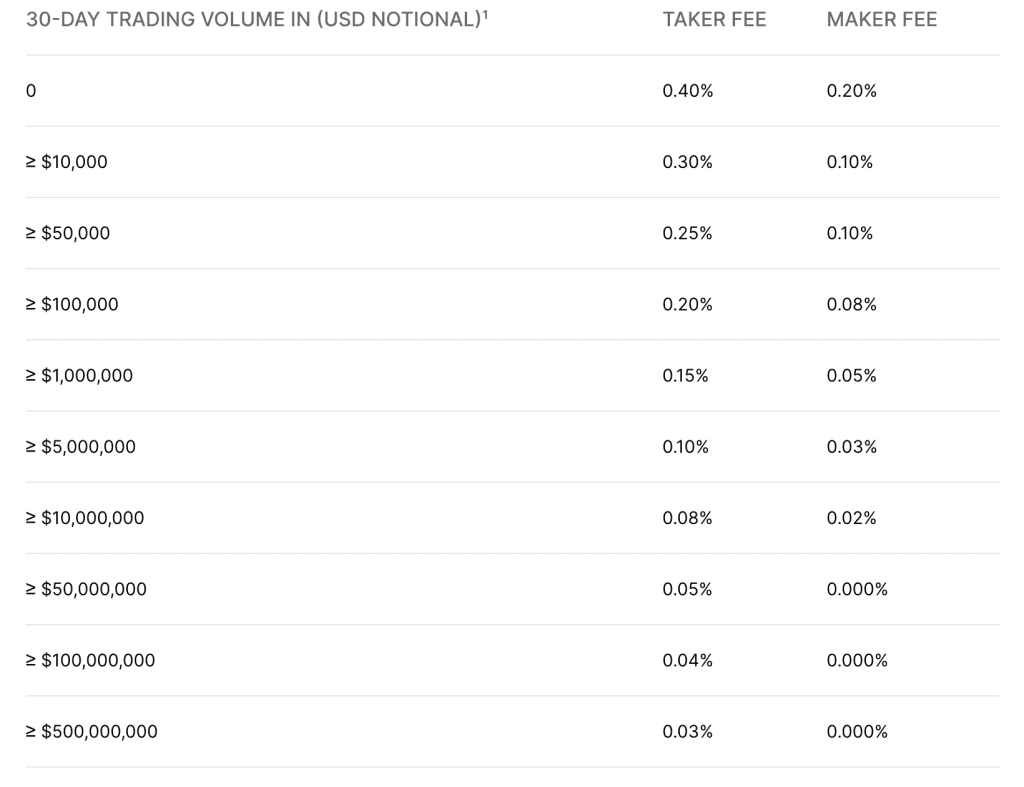

Crypto.com had a tiered fee structure and its own crypto, CRO, as an incentive. New Crypto.com users who don’t stake CRO will face a trading fee of 0.075% if their aggregate month-to-month trading volume is below $250,000. While this is slightly below the fee charged by a number of its major competitors, it is not the most frugal basic option.

Crypto.com will offer substantially lower fees for higher volumes. Larger-volume traders can pay as little as zero percent as a maker or 0.05% as a taker without staking CRO. However, holding at least 1,000 CRO in a user’s wallet can lead to further discounts. At this staking level, traders with up to $250,000 in monthly volume benefit from a reduced fee of 0.072%. The fees keep decreasing with larger CRO stakes, making it an attractive proposition for active traders to invest in CRO.

One major advantage is that the app does not charge extra per-trade fees, making it even more competitive in the market. For this reason, many people would want to use Crypto.com since it turns out to be a savior for all the traders who want to save the cost incurred in trading.

5. ByBit

Bybit’s fee structure follows a maker-taker model. According to this model, market takers are charged a trading fee when they execute trades at the current market price with the aim of removing liquidity from the order book. Conversely, market makers are offered a negative trading fee, otherwise known as a rebate, and this negative fee will be added to the price. This rebate is set to encourage market makers to add liquidity, which improves market depth and stability.

For day traders who buy and sell cryptocurrencies many times a day, it is important to understand Bybit’s fee structure so that trading strategies can be optimized and costs managed efficiently.

Readmore: Bybit Review: Reputable Exchange, Up To 100x Leverage On Bitcoin

6. Kraken

In the case of Kraken, the price depends on the type of trade you are looking at and the platform you are on. On the regular platform, for immediate purchases, Kraken levies a percentage fee on the transaction, plus the potential spread fees. All these are transparent, and the user knows the exact figures before confirming the transaction. Users also have to consider some other fees that will be associated with the funding method that they chose, such as credit card fees.

Kraken Pro, on the other hand, has a different fee structure. Kraken Pro commonly offers more aggressive pricing than mainstream Kraken. Pricing on Kraken Pro is based on the total of your trading volume over the past 30 days. Most trades on Kraken Pro are subject to a 0.26% taker fee or a 0.16% maker fee.

A maker order refers to a trade not instantly matched against an existing order. These orders tend to place some liquidity into the platform. In that case, they take a lower fee. The other case is of taker fees, which are charged for orders matched against pre-existing orders of other users on the market; in this case, it will take a bit of a higher fee.

7. Gemini

Gemini is unique with its pricing for several reasons. While most exchanges use a maker/taker schedule that involves different fees from one tier to another, Gemini’s is different. Instead, the fees change depending on volume as well as the platform – mobile or desktop. The mobile and desktop types of users also have their different schedules of fees.

While Gemini is quite transparent on its pricing, this is a bit challenging for users to go through. The dynamics here are brought about by the differences in platforms and trading volumes. Moreover, while Gemini is quite open, its flat fee tends to be a bit higher compared to what the market offers.

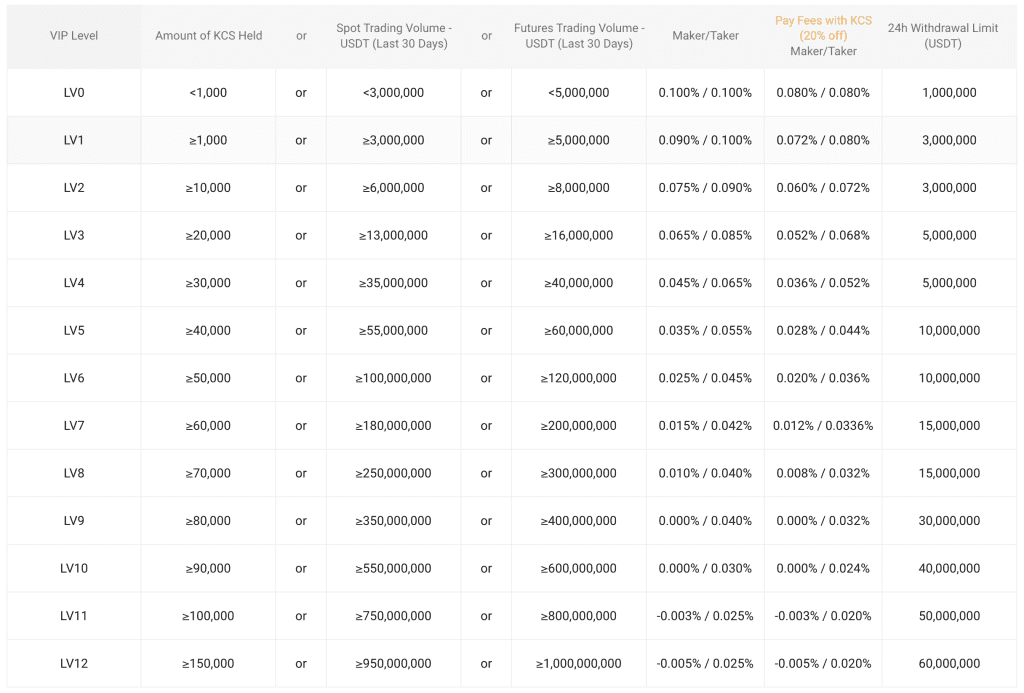

8. Kucoin

KuCoin has a graduated maker/taker fee model that offers traders fees between -0.005% and 0.1% based on the tier level.

The KuCoin fee system is quite competitive, especially with regard to its peer companies in the industry. In fact, some of its competitors go as high as 0.50% per trade while KuCoin remains cheaper.

KuCoin offers trading fee discounts based on the KuCoin Token (KCS) holding balance of the user. In this way, besides encouraging participation in the KuCoin ecosystem, it also rewards loyal customers. KuCoin not only has trading fees but also withdrawal fees, which vary from one asset to another and can be adjusted under the market condition.

Readmore: KuCoin Review: New Trading Platform With Extremely Competitive Fees

Important Features of Crypto Exchange Fees Comparison

Some of the key features to bear in mind while comparing between the various crypto exchanges include:

- Trading Fees

- Maker and Taker Fees

- Volume Discounts

- Deposit and Withdrawal Fees

- Exchange Rates

- Subscription or Membership Fees

- Inactivity Fees

- Loyalty Programs

- Regulatory Compliance Costs

- Security Features

It refers to the fee charged on the platform for each trade executed by the user. This is usually represented as a percentage of the trade value; however, sometimes it is just a flat fee for each trade.

Some exchanges have two different fees: the maker fee is applied when adding liquidity to the order book by making a limit order that is not being matched by an existing order, whereas the taker fee is when liquidity is removed from the order book by making any order that is matched with an existing order.

Other discounts exist on some of the exchanges for the quantity transacted, sometimes being presented as a decrease in the cost of trading against an increase in the amount of trade. It can be a good feature for high-volume traders.

Fees may be charged when depositing funds into your account or withdrawing funds from your account. The fee might be different based on the payment method used and the type of cryptocurrency being transferred.

Exchanges normally have a spread or margin against the exchange rate when exchanging fiat currency for cryptocurrencies and vice versa. Please do take these into account, as these do affect the overall costs of trading.

Exchanges are available that offer different tiers or premium services that often have added perks or lower trading fees that a user can accomplish with a monthly or annual fee.

Some exchanges will have a charge if an account remains dormant for a particular period. This fee encourages a user to remain active on the platform.

These are some loyalty programs in which exchanges allocate a discount to the user or any bonus based on the trading activity or tenure on the platform.

Exchanges, depending on jurisdiction and regulatory requirements, can pass the compliance costs to users in terms of increased trading fees or other charges.

Exchanges making an investment in solid security will pass on a little bit of a higher charge to the users to cover the costs of keeping a safe trading environment.

Are Trading Fees on DeFi Exchanges Cheaper than CEXs?

As in the centralized crypto exchanges, the amount of trading fees differs from one decentralized exchange to another, depending on the exchange platform. DeFi trading fees can generally be lower, with less intermediation, but they vary with network congestion. Centralized exchanges have more liquidity and stability, but possibly higher fees due to regulatory compliance and operational costs.

On the Flipside

Choosing the right exchange goes beyond trading fees. While low fees may be attractive, smart investors know that the ability of a platform to offer other features that can greatly affect portfolio growth is always better than requiring one to trade continuously.

The reputation and liquidity of an exchange are key indicators of whether a platform will be reliable. Similarly, the supported coins determine a choice for investors. There are those investors who wish to get access to platforms that expose them to a great choice of digital assets. A rich choice of coins and tokens means that the investor can select a broad range of them that gives users more leverage for diverse portfolio management and diversification strategies.

Why Should You Care about the Crypto Exchange Fees Comparison?

At the world of cryptocurrency trading, even a single percentage point’s difference holds immense relevance. At the first glance, it may look inconsequential, since we may be looking at decimals, but these differences hold major significance, especially for people involved in long-term trading activities.

For people maximizing on their investment returns, understanding and comparing the fees charged by one cryptocurrency exchange and another is key. Minimizing the trading fees is an added advantage to increasing the value of any investment in general.

It enables traders to cut costs through a close examination of the costs on the various exchanges. It becomes a cost-cutting exercise that will enable them to maximize on their strategies in the best way through each transaction. Understanding the fee structures of the different platforms will help traders make wise choices that are harmonious with their financial objectives and risk tolerance.

Conclusion

Whether you are a sophisticated investor or a newbie tiptoeing into the world of cryptos, understanding the details regarding crypto exchange fees becomes important for an optimal trading strategy.

The cryptocurrency market is decentralized and volatile, under the command of multiple exchanges constantly competing for prominence. Each one of them offers a unique set of features, from the design of the user interface to the level of security, but it is the fee structure that most times acts as a tiebreaker when making the final choice for the traders.

However, it is important to take other factors into account. Security, liquidity, customer support, and trading pairs should be considered equally important before settling on a cryptocurrency exchange.

FAQs

Which crypto exchange has the lowest fees?

Based on the comparison table, you can see that Crypto.com is the exchange with the lowest fees.

Which factors are the most important when choosing the best cryptocurrency exchange provider?

Security is paramount. Make sure that your security is built with strong measures, like powerful encryption, two-factor authentication, and cold storage for your funds, or else your assets could be in danger of theft or hacking.

Are all the top cryptocurrency exchanges based in the United States?

No, not all of the top cryptocurrency exchanges are based in the United States. While the U.S. is home to several prominent exchanges such as Coinbase, Kraken, and Gemini, there are many other leading exchanges located in different countries around the world like OKX, and Kucoin.

Which crypto has the lowest transaction fees on Binance?

BNB is the native cryptocurrency of the Binance exchange, and it is often used to pay for trading fees on the platform. Binance offers discounts on trading fees for users who hold BNB in their accounts, which can make transactions cheaper compared to using other cryptocurrencies.

What is the best crypto exchange for beginners?

Kraken is the best exchange for beginners, with robust security features and a user-friendly interface.

Are Binance fees less than Coinbase?

Binance generally offers lower trading fees compared to Coinbase, especially for active traders and those using advanced trading features.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |