Ripple’s XRP Sale Worth $78 Million Is Putting Great Pressure on Token Prices

Key Points:

- Ripple sold 150 million XRP worth $78 million on June 7, contributing to price pressure on XRP.

- Ripple’s XRP sales have frequently led to local price crashes, with seven out of twelve sell-off days in 2024 resulting in negative price actions for XRP.

Ripple Labs has recently intensified market activity by selling 150 million XRP from its reserves on June 7, according to Finbold.

Ripple’s XRP Sale Intensifies Market Pressure

Ripple’s XRP sale, valued at approximately $78 million, represents 0.25% of XRP’s market cap of $29.25 billion and has led to increased pressure on XRP prices.

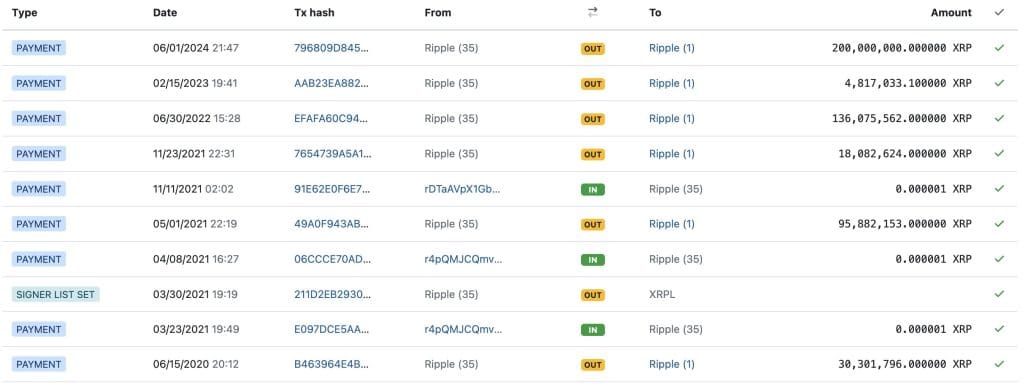

The transaction follows Ripple‘s release of 1 billion XRP from its initial allocation on June 1, which is now locked in monthly escrow until 2027. In addition, the Ripple (35) account contributed an extra 200 million tokens, bringing the total to 400 million XRP added to the sell-off reserves.

Ripple’s XRP sale activities primarily stem from the ‘Ripple (1)’ treasury account, which sends tokens to the ‘rP4X2hTa’ account. This movement introduces previously non-circulated tokens into the market, causing supply inflation. These tokens currently reside in the ‘rP4X2hTa’ account and are expected to be distributed to intermediary addresses like ‘rhWt2bhR’ before reaching cryptocurrency exchanges, following past patterns.

XRP Prices Historically Affected by Ripple’s Token Sales

Ripple’s sales have historically impacted XRP’s market price significantly. Of the 12 sell-off days in 2024, only five have seen positive price movements—on February 5, 11, April 14, May 13, and 20—while the remaining seven days led to local price crashes, highlighting the importance of monitoring Ripple’s token movements.

Furthermore, XRP has faced a negative performance in three out of the first five months of 2024. Despite the broader cryptocurrency market seeing substantial gains, with Bitcoin and Ethereum rising by 70% year-to-date and other altcoins soaring by over 100%, Ripple’s value has dropped by nearly 15%, currently trading at $0.53.

In more positive news, Ripple recently announced a partnership with Clear Junction to enable instant, secure, GBP, and EUR payouts. Additionally, Ripple CEO Brad Garlinghouse has been vocal about the approval of multiple altcoin exchange-traded funds (ETFs), advocating for broader cryptocurrency investment options during his appearance on Fox Business.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |