OKX Wallet Transactions Trigger Chaos, Costing Millions in Bitcoin Fees!

Key Points:

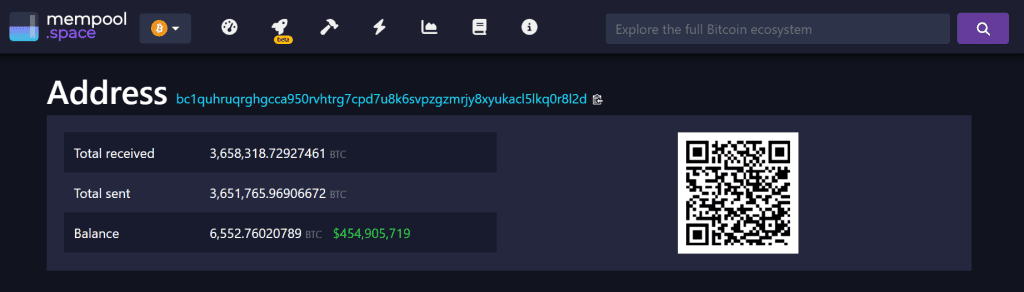

- OKX initiated wallet transactions from block 846,867, processing 2,380+ transactions, costing 254.28 BTC (about $17.6 million).

- Allegations suggest OKX’s system led to internal bidding wars between its own transactions, exacerbating fees and user frustrations.

- The incident underscores concerns about OKX’s infrastructure reliability and broader systemic risks within the cryptocurrency ecosystem.

OKX wallet transaction has come under fire for its handling of wallet transactions, with allegations of an ineffective automated system causing transaction fees to spiral out of control.

According to mononaut, the founder of mempool, a blockchain analysis platform, OKX wallet transaction initiated wallet transactions from block 846,867 onwards, processing over 2,380 transactions at a staggering cost of 254.28 BTC, equivalent to approximately $17.6 million.

The revelations shed light on what appears to be a botched implementation of an automated system by OKX, resulting in internal bidding wars between its own transactions. This internal friction within the exchange’s system has exacerbated transaction fees, posing challenges for users and fueling criticism of OKX’s operational practices.

OKX’s Infrastructure Reliability Questioned Amidst Escalating Fees

The escalation of fees raises concerns about the efficiency and reliability of OKX wallet transaction‘s infrastructure, prompting questions about its ability to handle transaction volumes effectively. The incident underscores the importance of robust systems and protocols within cryptocurrency exchanges, particularly as the industry continues to grapple with scalability and usability issues.

Critics argue that OKX wallet transaction’s mismanagement of wallet transactions not only undermines user experience but also highlights broader systemic risks within the cryptocurrency ecosystem. As the sector attracts increasing scrutiny from regulators and investors, incidents like these underscore the need for greater transparency and accountability from cryptocurrency exchanges.

OKX has yet to issue a formal statement addressing the allegations. However, the incident serves as a cautionary tale for both industry participants and regulators, emphasizing the importance of vigilance in safeguarding against potential vulnerabilities and ensuring the integrity of cryptocurrency markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |