US CPI Data Falls Unexpectedly in May, Signals Potential Market Upside!

Key Points:

- In May, the US CPI data annual rate fell to 3.3%, below the anticipated 3.4%. Core CPI, excluding volatile food and energy prices, also decreased to 3.4%, surprising markets with a drop from the previous 3.6%.

- The unexpected CPI decline is attributed to a drop in gasoline prices. This has prompted market speculation on future Federal Reserve actions, with expectations now leaning towards a 25 basis point interest rate cut in November.

The US CPI data annual rate in May was 3.3%, slightly below the expected 3.4% and down from the previous value of 3.4%.

The unadjusted core CPI annual rate, which excludes volatile food and energy prices, came in at 3.4%, also lower than the anticipated 3.5% and down from the previous 3.6%. This core US CPI data rate is the lowest recorded since April 2021, indicating a potential easing of inflationary pressures.

The unexpected drop in May’s CPI is primarily attributed to a decrease in gasoline prices. This reduction in consumer costs has fueled speculation about future Federal Reserve actions. The market now fully expects a 25 basis point interest rate cut by the Fed in November. However, a rate cut in September remains uncertain as analysts weigh the Fed’s response to the evolving economic landscape.

US CPI Activity Points to Potential Upside in the Crypto Market

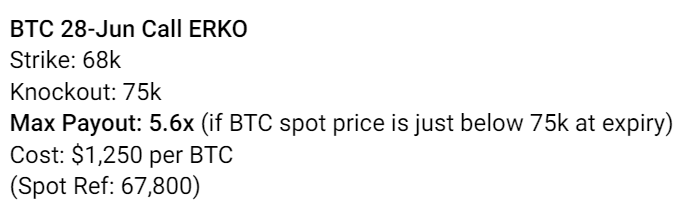

QCP Capital noted significant market activity in response to the US CPI data. “We saw aggressive buying of 13-Jun calls today, coupled with a substantial increase in the funding rate, indicating the market is positioning for an upside surprise,” a QCP spokesperson stated. They suggested an inline CPI print and a neutral Federal Open Market Committee (FOMC) outcome could drive the crypto market to retest its previous highs.

This scenario underscores the delicate balance the Fed must maintain between controlling inflation and supporting economic growth. As gasoline prices decline, consumers may experience relief, but the broader economic implications remain. The anticipation of rate cuts reflects market optimism about easing financial conditions, which could further stimulate economic activity and impact various asset classes, including cryptocurrencies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |