Egorov CRV Liquidation Triggers Additional $10 Million In Bad Loans

Key Points:

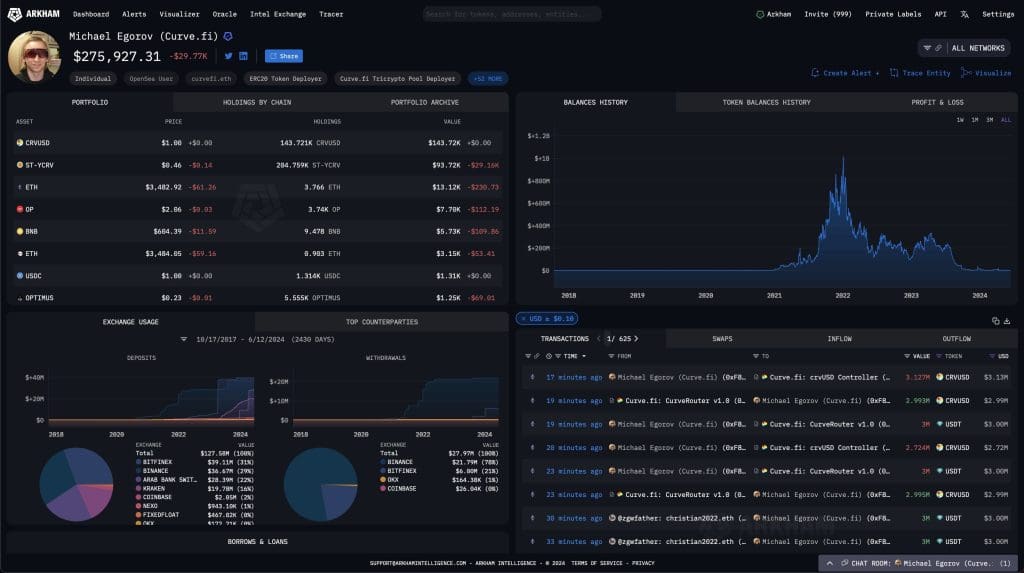

- CRV token value drop led to extensive liquidation of Michael Egorov’s lending positions.

- Egorov paid off 93% of the bad loans.

Egorov CRV Liquidation caused $10M in bad loans as the token fell to $0.219. He quickly paid 93% of the loans.

After the CRV token value fell extremely to an all-time low of $0.219, Curve Finance founder Michael Egorov had his lending positions liquidated extensively.

Egorov CRV Liquidation Due to Falling Token Value

The most extensive impact was from the CRV market on lend.curve.fi, where he had the largest position. As a result, Egorov was exposed to $10 million worth of bad loans due to his extensive market position.

Egorov was swift to eliminate the liquidation risk, having paid 93% of the bad loans, and will pay off the rest soon. Despite the liquidation of about 100 million CRV worth about $27 million, Egorov is still in a safe position with 39.35 million CRV.

According to blockchain intelligence platform SoSo Value, Egorov’s predicament instigated broad CRV liquidations across different platforms. So far as selling pressure is concerned, Egorov himself did not directly inflate it. In another way, however, he reportedly quickly profited, thereby disadvantaging lenders and prior CRV investors.

Readmore: UwU Lend Has Hacked Again, Losses Reach $3.72 Million

Curve Finance’s Response to Market Instability

Arkham Intelligence had already sounded the alarm that Egorov’s $140-million positions in CRV from five protocols would face liquidation risks once the price of the digital asset falls 10%.

Huge borrowing by Egorov on Curve has rocked the market in the past, and CRV’s price had dived vertiginously after a hacking incident occurred last year.

Egorov said Curve Finance’s soft liquidation system passed a real-life test when the UwU lending platform was hacked. LLAMMA will send new loans to deposit collateral in several bands across the AMM, making several ranges for liquidation and thus it will make liquidation of the collateral continuous if required.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |